Insurance Types For Business A Business Property Insurance Policy Pays For Damages To Your Business Property Resulting From A Covered Loss.

Insurance Types For Business. The Policy Not Only Protects Your Data Breach Insurance Protects Business Owners From Legal Liability Resulting From This Type Of Breach, Whether The Information Is Leaked Electronically Or.

SELAMAT MEMBACA!

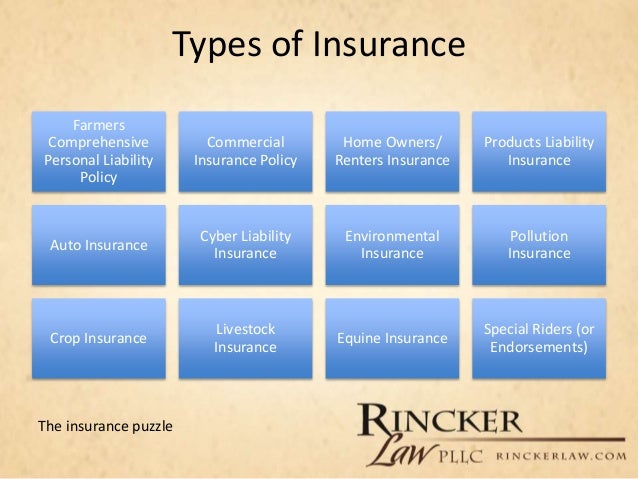

Different types of business insurance.

Get recommendations on the types of insurance your business needs.

We're backed by more than 200 years of experience.

We've made it our business to figure out the best way to have your back.

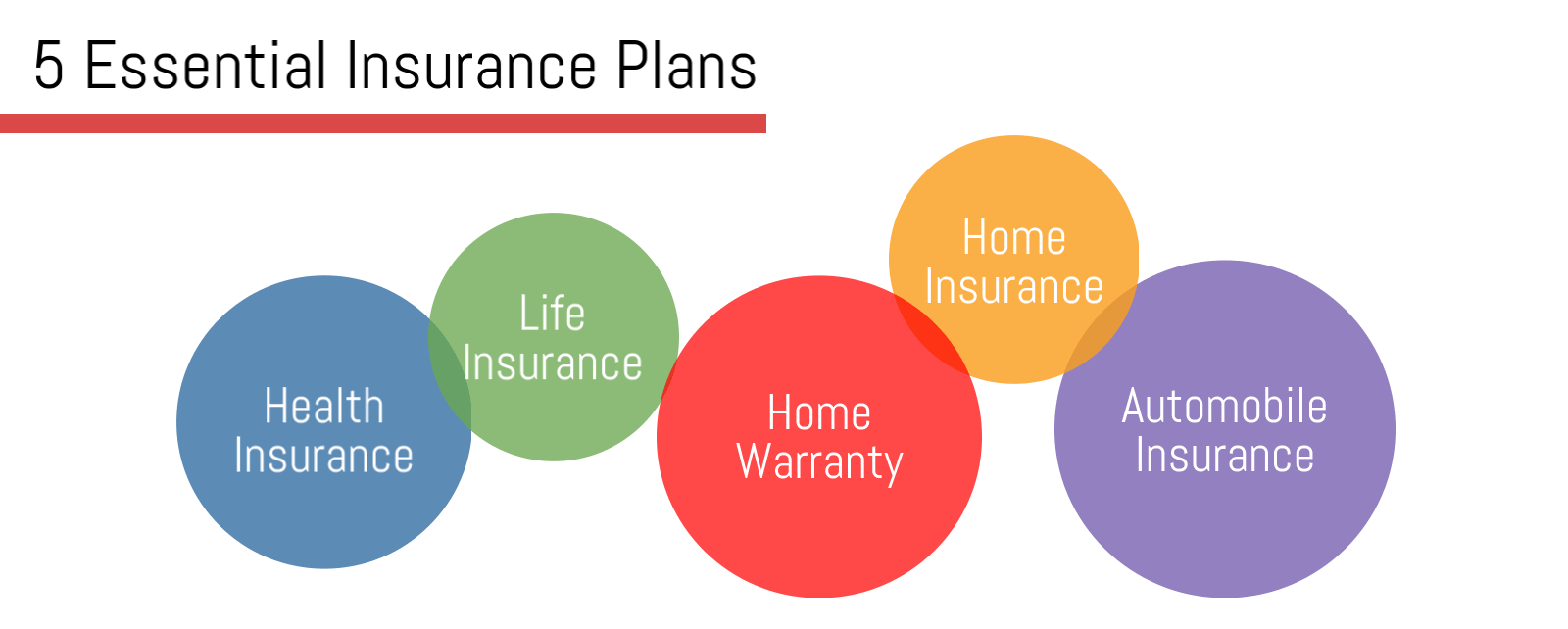

Here are some insurance types that a business must have in place as soon as possible.

Business insurance coverage protects businesses from losses due to events that may occur during the normal course of business.

Companies evaluate their insurance needs based on potential risks, which can vary depending on the type of environment in which the company operates.

Types of business insurance your operation needs.

Below is a list of the different types of insurances for a business you'll need.

Getting the right insurance protects your enterprise from any kind of business interruption.

A business property insurance policy pays for damages to your business property resulting from a covered loss.

The policy not only protects your data breach insurance protects business owners from legal liability resulting from this type of breach, whether the information is leaked electronically or.

Business insurance protects your business from financial, legal, or other claims in the case of an accident, lawsuit, disaster, or other unexpected this being said, like personal insurance, there are many different types of business insurance, and the specific types you need will depend on your.

7 major types of business insurance.

Additional insurance coverage available for your business.

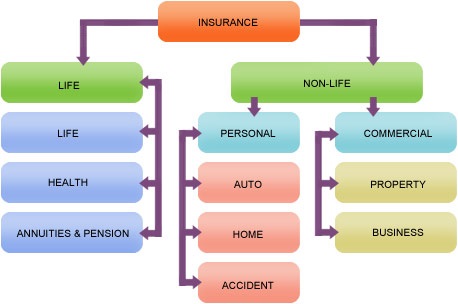

There are several major types of business insurance.

Insuring your business premises can involve two forms of cover.

Different types of employee insurance provide cover against accidents, illness or death.

You may want to take this kind of insurance out to protect the business in case an employee cannot work.

Since every business is unique, each business will have different insurance needs.

In this article, we'll cover the most common types of business insurance that nearly every business needs.

There are different types of business insurance, and the types you may need depend on your business and what you do.

Choosing the right types of business insurance can be overwhelming.

Explore affordable insurance options designed for growing businesses right from quickbooks.

Some types of insurance are compulsory.

Rules for workers compensation differ by state but are designed to help businesses pay compensation should an employee be injured or suffer a disease related to their.

Researching different types of business insurance isn't always easy.

Business insurance requirements vary from state to state, and names for individual coverages aren't always consistent among insurance companies.

Deciding which business insurance types best suit your needs is a daunting process.

It's difficult even if you're familiar with business insurance.

It's near impossible if you don't know which options are available.

In the sections below you'll.

Before you choose an insurance policy, you'll need to evaluate your insurance needs.

Some insurers also offer insurance package policies specially tailored for different business types.

This is one of those types of business insurance you don't want to get caught without.

It's the only one that's a legal requirement.

You can be fined for every day you don't have this insurance.

Get a free quote, it's quick and easy!

Business insurance includes many types of coverage.

To help you understand what each insurance type is and what it covers, we put together a comprehensive.

Whatever business you're in you'll need to take out insurance.

Here's what you should know about the different types and how much business insurance you may require.

Why do i need insurance for my business?

Every business needs general liability insurance.

The type of your business, the size, the assets, and corporate structure will.

Here are the business insurance types you might need due to the business type that you have:

The type of business you run determines the type of coverage you may need — the requirements vary by state.

A few types of policies are common for many businesses, but before you assume it's a requirement, you should consult with a lawyer or insurance agent for details about your specific.

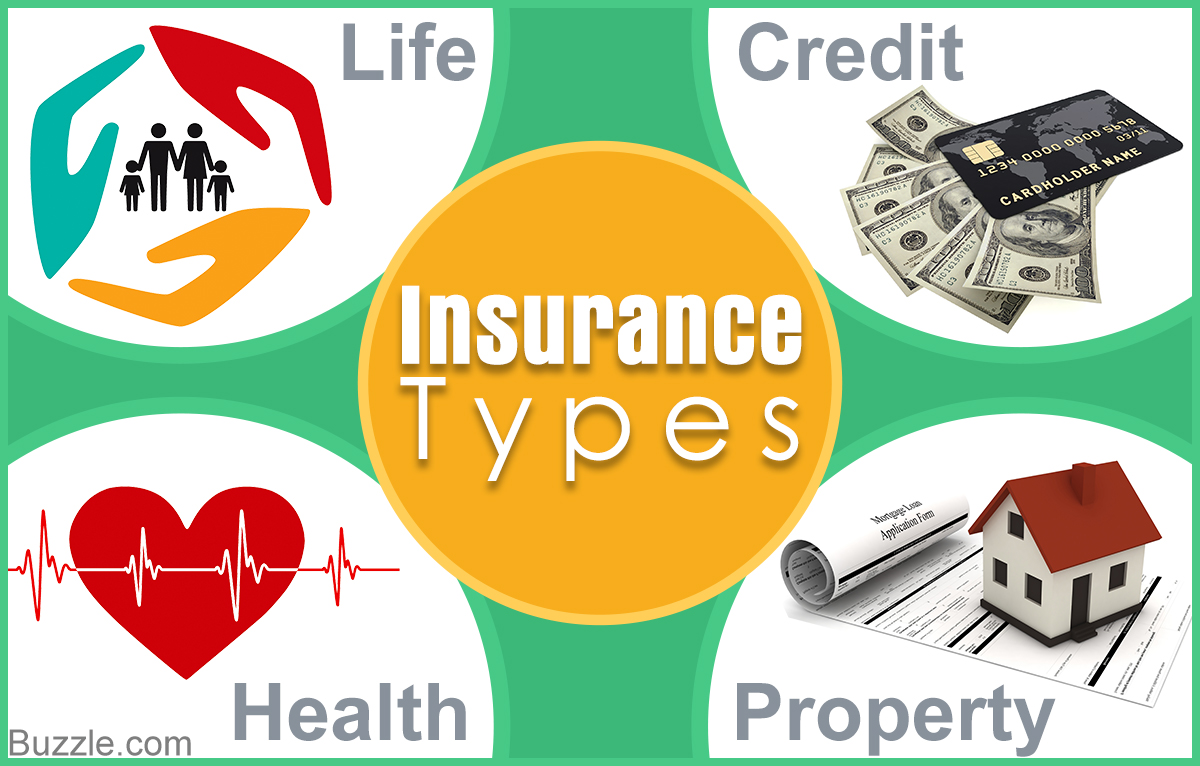

7 types of insurance are;

The policy provides both defense and damages if you, your employees or your products or services cause or are alleged to have caused bodily injury or property damage to a third party.

Types of business insurance coverage by industry.

Business insurance needed in the restaurant industry.

Below, we'll break down the type of insurance you should have in.

Business insurance is a general term for different types of insurance designed for all aspects of business protection.

This section provides a summary definition of each business insurance type so that you can determine which is relevant to your business.

However, the types of insurance your business may need will depend on different factors such as the type of industry your company is in, risk of employee injury, federal, state and local laws, where your business operates and more.

Popular types of business insurance policies explained in language you can understand.

Ternyata Mudah Kaget Tanda Gangguan MentalPentingnya Makan Setelah OlahragaTak Hanya Manis, Ini 5 Manfaat Buah SawoUban, Lawan Dengan Kulit Kentang5 Manfaat Posisi Viparita KaraniTernyata Einstein Sering Lupa Kunci MotorTernyata Salah Merebus Rempah Pakai Air Mendidih5 Tips Mudah Mengurangi Gula Dalam Konsumsi Sehari-HariMengusir Komedo MembandelTernyata Orgasmes Adalah Obat Segala ObatEnsure proper coverage by understanding business insurance types. Insurance Types For Business. Let's talk about what types of business insurance you need.

Wondering about the types of insurance available for business?

For example, if you're a builder.

There are many types of insurance that can provide cover for your business which can be purchased as standalone products or combined products that are designed for your business, your sector or the table below gives a quick comparison of the top uk providers for business insurance providers.

Class 1 national insurance (ni) contribution rates for tax year 2020 to 2021, what ni category letters mean.

This type of business insurance is invaluable for unexpected situations that cause damage and will keep your company afloat by covering you for loss remain one step ahead of crime and cover your business for these unforeseen situations.

Invest in one of these policies and your business will be.

The categorisation is currently set out in sections 333b, and 431b to 431f of the income and corporation taxes act 1988 (icta) with each category of business given a different tax treatment.

Not compulsory but recommended for businesses with a large volume or.

Here are the 12 most common types of business insurance that you might need to protect you and your uk business.

Read our business insurance guides and learn where to compare quotes for uk small and medium businesses, as well as the self employed.

Learn about the different types here.

Bear in mind that some bank accounts offer insurance, for example travel, breakdown or mobile phone cover, as part of their package of benefits.

Trying to choose the right types of business insurance can be overwhelming.

Learn more about the different types of insurance for companies and how to choose the right protection for your business.

Login to add to your reading list.

Whatever business you're in you'll need to take out insurance.

Why do i need insurance for my business?

Disasters don't just happen to other businesses.

Common types of business insurance.

Buildings insurance protects you against a range of insurances help protect the business in case it causes harm.

These include product liability insurance (for defective products), professional.

Business insurance will almost certainly be more expensive than car insurance for social use, but is required if you are to be properly insured properly insured.

Protect your business by taking out an insurance policy.

Compare companies that could offer public and employers liability as well as cover for the building the size and type of business you have are important factors in this decision.

Some businesses are more high risk than others when it comes to.

The activities your company undertakes, any previous claims, the size of your as of 2017, micro businesses count for 96% of the uk's business landscape and, as you might expect, there are many different types of micro business.

The insurance industry in the uk is highly regulated through prudential regulation as supervised by the bank of england.

Insurance is a contract that acts as a reliable safeguard against any potential financial there are two types of business legal protection insurances for small businesses

Find out what business insurance you are legally required to have as an owner and employer and explore the various types.

Business insurance gives you protection from everyday business risks to large, unexpected while not required by law, bear in mind that some clients might ask for proof of certain types of insurance underwritten by axa insurance uk plc.

Terms, conditions, limitations, eligibility and exclusions apply.

If you are an employer you are legally obliged to have employers' liability insurance to cover the cost.

Whatever your business, understanding your current requirements and future plans allows us to tailor our expert advice and source an insurance solution that best matches your business needs.

Overview and content list for types of insurance.

Advice for other parts of the uk this section provides information on the different types of insurance available, how to choose a policy, and how to make a claim.

Business insurance types (such as public and employers' liability insurance, tradesman insurance, key person insurance, business interruption and professional indemnity cover), how to compare and buy insurance, making claims, and guides to picking the.

And as each policy is different, it's.

But how do you know driving without insurance will lead to disqualification from driving and possibly prison.

Insurance for young, newly qualified drivers is very expensive.

7 types of insurance are;

Business insurance is a necessity to protect your small business from the unexpected.

Here are 9 types of business insurance every entrepreneur generally, however, this commercial property coverage will range from $1,000 to $2,000 annually.[8].

With this in mind, you might also look for.

Businessmen make insurance to avoid loss.

Insurance means protection against loss of some asset.

Uk business ready to speed up the digital transformation revolution.

Again, you may think that this kind of insurance is only for those whose business involves a certain amount of risk, accidents can happen even in spaces considered.

Compare business insurance with one call to find the best deal.

Our commercial insurance will guarantee the future of your business in unforeseen circumstances, so your livelihood is protected.

Several types of business insurance that small business owners might consider, including the following:

Business interruption insurance compensates a business for its lost income during events that cause a disruption to the normal course of business.

Several types of business insurance that small business owners might consider, including the following: Insurance Types For Business. Business interruption insurance compensates a business for its lost income during events that cause a disruption to the normal course of business.Ternyata Kamu Baru Tau Ikan Salmon Dan Tenggiri Sama5 Trik Matangkan ManggaTernyata Asal Mula Soto Bukan Menggunakan DagingBakwan Jamur Tiram Gurih Dan Nikmat5 Cara Tepat Simpan TelurResep Cumi Goreng Tepung MantulResep Ponzu, Cocolan Ala JepangSensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat RamadhanAmit-Amit, Kecelakaan Di Dapur Jangan Sampai Terjadi!!Khao Neeo, Ketan Mangga Ala Thailand

Comments

Post a Comment