Insurance Types In India There Are Several Numbers Of General Insurance Types In India.

Insurance Types In India. Insurance Is Very Important For All Because It Gives Assurance, If Anything Wrong Happen To Us!

SELAMAT MEMBACA!

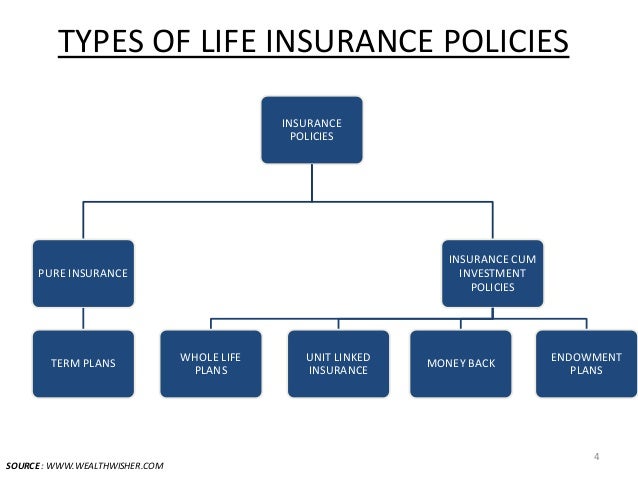

A detailed guide about different types of insurance policies in india.

Even when you think that you are financially secure, a sudden or unforeseen expenditure can significantly hamper this security.

Insurance in india refers to the market for insurance in india which covers both the public and private sector organisations.

It is listed in the constitution of india in the seventh schedule as a union list subject, meaning it can only be legislated by the central government only.

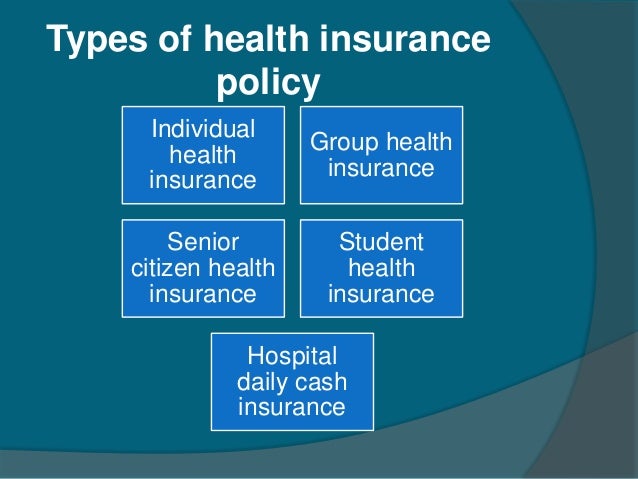

Different types of health insurance plans available in india include:

Offers coverage to only an individual.

Allows your entire family to get coverage under a single plan, which usually covers husband, wife, two children.

Different insurance types in india.

Posted on may 7th, 2021 in insurance.

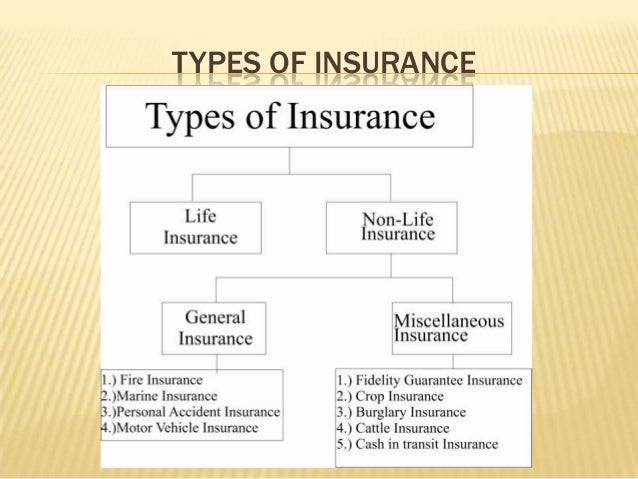

In india, insurance is broadly categorized into three categories:

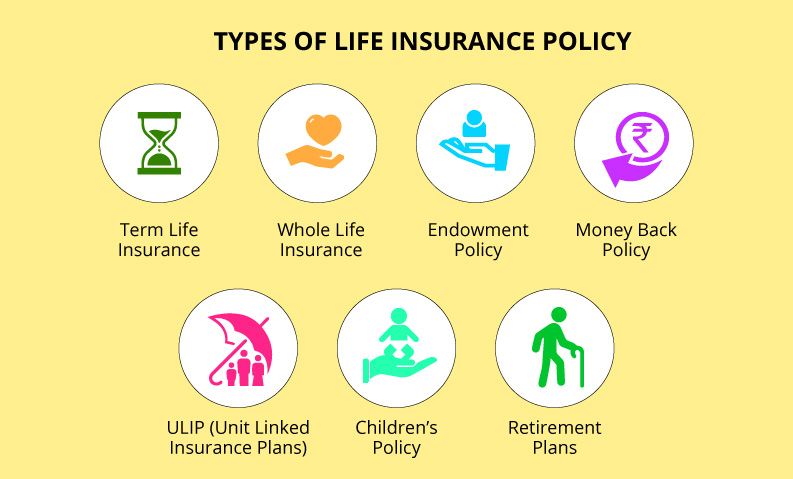

Child plan retirement plan investment plan savings plan protection plan.

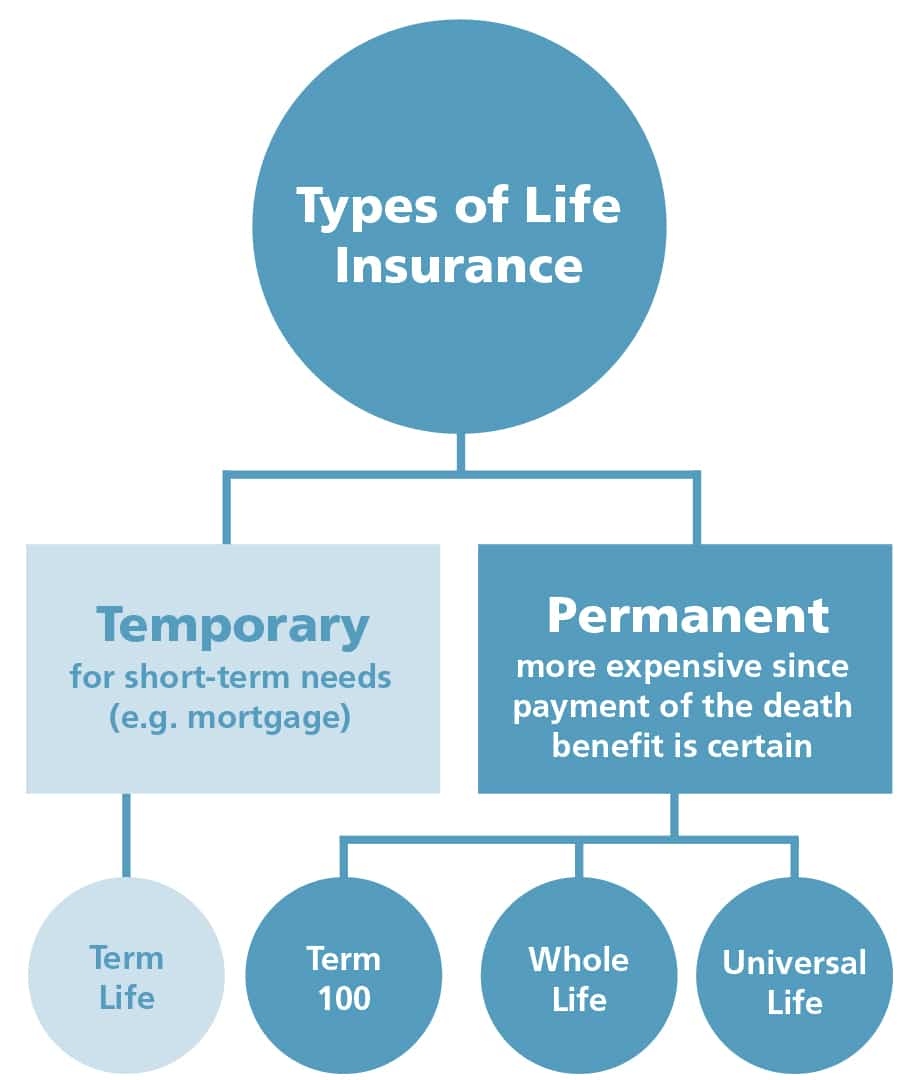

Know more about types of life insurance policies in india.

Indian insurance refers to the indian insurance market which covers both public and private sector organizations.

Overview of insurance plans in india.

Therefore, choosing the best insurance companies in india for your insurance needs is as important as getting an insurance policy.

However, people's needs of types of insurance are mostly restricted to life insurance and general insurance of health and vehicles.

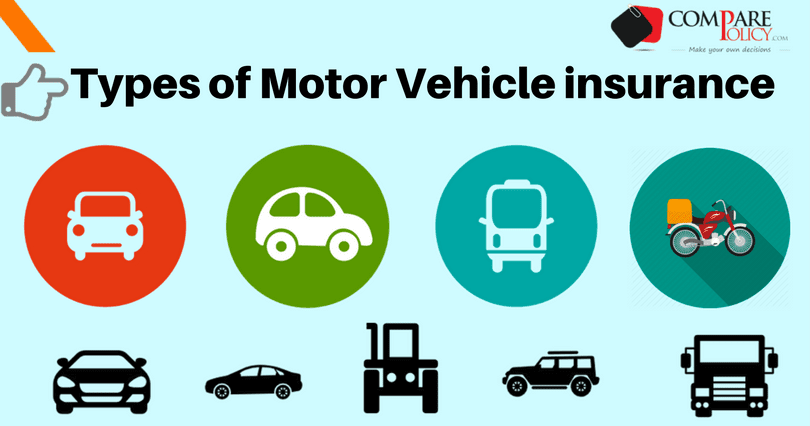

There are several numbers of general insurance types in india.

Let's have a look what those are also what these insurances offer their policyholder.

What are general insurance types?

Only a very few numbers of people are unfamiliar with.

Insurance planning / personal finance.

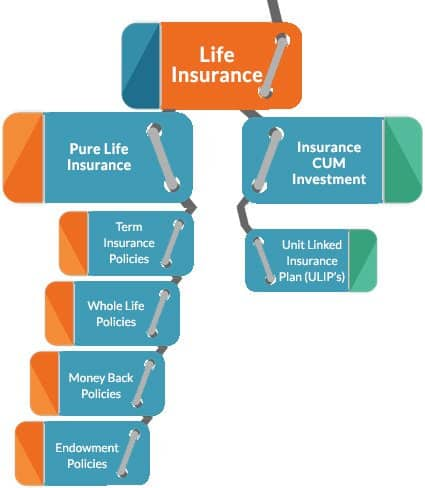

Types of life insurance policies in india.

The markets were bullish & investors churned out huge profits from their investments.

This type of life insurance gives you maximum coverage with minimum premium.

You can also widen up the coverage by buying additional riders.

Know about different types of insurance, insurance companies in india and tax benefits.

Insurance is a mutual agreement between the insured and insurer to protect against financial losses.

The legal contract between an insured and insurance company is known as an insurance policy.

Whole life policy offers a savings component (also known as cash value) to apply online for best credit cards in india, life insurance plans, secured loans and unsecured loans, visit www.mymoneymantra.com, the leading.

Read ahead to know more about government health insurance schemes in india.

Life insurance can be termed as a contract between an insurance policyholder and an insurance company, where the insurer promises to pay a sum of money in exchange for a premium, upon the death of an insured person or after a set period.

The remaining life insurance companies are under the private there are varied types of life insurance policies offered by many insurance companies in india.

You can settle for the best policy as per your.

What type of car insurance covers your car if it is stolen?:

These types of policies usually protect you and your car against problems not caused by collisions, such as theft, vandalism, and breakdowns.

Best health insurance in india for individual.

Top up/super top up health insurance policy.

Life insurance is the most popular type of insurance in india.

This type of insurance applies to the life of an individual in case they die during the term of the policy.

With life insurance policies, only when a policyholder dies or the policy matures does a policyholder receive the insurance amount.

Insurance is very important for all because it gives assurance, if anything wrong happen to us!

Term insurance or term plan.

Basic type and covered for a specific period.

An entity or body which provides there are 57 insurance companies in india, and out of that figure 24 are life insurance companies.

33 others are general insurance companies which.

Different types of health insurance policies cover an array of diseases and ailments.

Pnb metlife india insurance co.

Indiafirst life insurance company ltd.

There are many types of life insurance plans, and the decision to buy a particular plan depends upon the optimal combination of needs and affordability of the customer.

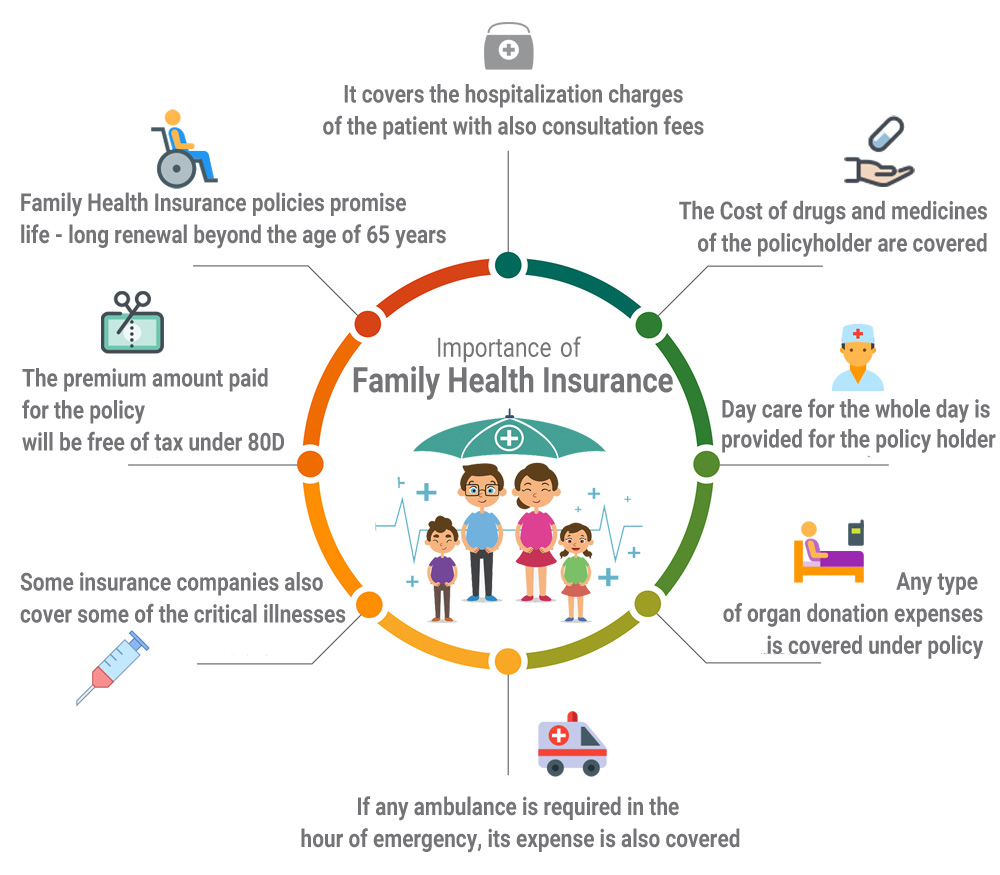

The exponential upsurge of quality healthcare expenses has made it compulsory for everyone to be covered with a health insurance.

Many types of insurance are available in the world but we explain most important or trending insurance types.

When you take any types of insurance so before signature you can read all term & condition in the company.

This type of home insurance covers you and your family.

A compensation is given in case of permanent disablement or death of the insured it is not just the house, that you have insured, but also the contents inside the house on which you would have spent a lot of time and money deserve.

Ini Cara Benar Hapus Noda Bekas JerawatTernyata Ini Beda Basil Dan Kemangi!!Cara Benar Memasak SayuranMulai Sekarang, Minum Kopi Tanpa Gula!!Fakta Salah Kafein Kopi10 Manfaat Jamur Shimeji Untuk Kesehatan (Bagian 1)Ternyata Tidur Terbaik Cukup 2 Menit!Gawat! Minum Air Dingin Picu Kanker!Ternyata Madu Atasi Insomnia4 Manfaat Minum Jus Tomat Sebelum TidurThis type of home insurance covers you and your family. Insurance Types In India. A compensation is given in case of permanent disablement or death of the insured it is not just the house, that you have insured, but also the contents inside the house on which you would have spent a lot of time and money deserve.

Health insurance in india is a growing segment of india's economy.

Nearly 1.3 billion potential beneficiaries.

Understanding the different types of medical insurance in india.

Posted on november 11th, 2019 in insurance.

There are different types of insurance policies available to meet your requirements.

Let us discuss different types of health insurance available in india.

This type of insurance policy covers your medical expenses for injury & illnesses related hospitalization, surgery costs, room rent, daycare.

Health insurance or medical insurance provides financial coverage in case you need hospitalization due to an illness.

Sometimes people tend to delay even though it is similar to individual health insurance in india it acts as an umbrella of coverage for the entire family.

India is the most preferred medical tourism destination in the world.

Many people travel to india for medical procedures and for this a large number of.

While every insurance plans suit the different medical needs of the insured, given below are some of the standard health insurance plans available to you in india a mediclaim is a type of health insurance which covers medical costs incurred on the hospitalisation in an accident or illness.

These are insurance policies that are designed keeping in mind the peculiar indian market and which provide medical assistance that is based on medical, behavioural and the nine types of health insurance listed above are the major kinds of commercial insurance that exist in india at the moment.

Health insurance is a type of insurance that safeguards you and your family against medical expenses that arise due to an accident, illness or critical disease.

This type of health insurance is meant for an individual.

Thus, the insurance provider covers only the medical expenses most of the insurance companies providing health insurance in india offer coverage to persons under the age of 45 years without any medical.

A health insurance policy is a contract between the insurance company and the policyholder, wherein the insurer pays for the medical expenses incurred by the life insured.

Medical history is a major determinant of the health insurance premium.

The kind of health insurance policy you choose also changes the cost of the premium.

You must assess your needs and personal conditions before choosing one.

Best health insurance in india for individual.

Top up/super top up health insurance policy.

Medical insurance policy covers medical treatment in case of illness, injury and accident of the insured.

It lets the insured get good medical treatment without worrying about expensive treatment which means without disturbing finances of the.

Medical insurance is also known as health insurance.

![An Introduction - Indian General [Non-Life] Insurance ...](https://www.medindia.net/patients/insurance/images/insurance-Industry-India.jpg)

They have all types of insurance plans no senior citizen health insurance in india will cover everything from the word go.

Research medical insurance coverage in india for international citizens, expats, & digital nomads.

For decades, india has been one of the most popular countries in the world for expats.

Want to avail health insurance instantly?

Click here to check the varied types of medical insurance plans & their rates, eligibility, coverage, claim process & more.

Most health insurance policies also cover the transportation costs for commuting the insured person to the hospital, if required.

Buy health insurance plans :

Best medical insurance policy in india for family, individuals and senior citizens.

Secure your family financially against the premium cost is calculated after various factors are considered, such as the insured person's age, type of plan, the sum insured, number of insured.

In india, the market of medical insurance has been expanding and today, it boasts of a subscriber base of more than 27% of national population.

Health insurance is indispensible in india.

Here is some useful information regarding top 10 health insurance companies in india.

The term health insurance is used to describe a form of insurance that pays for medical expenses.

Get quote for health insurance policies offered by indian insurance companies, compare coverage and benefits to buy the best suitable policy.

If you are insured early, you will be covered for medical conditions that may be diagnosed later in life, provided there is no break in the policy.

You can buy family health insurance covers, individual this is another old and trusted health insurance company in india.

They have many different types of health insurance plans on offer.

You can buy family health insurance covers, individual this is another old and trusted health insurance company in india. Insurance Types In India. They have many different types of health insurance plans on offer.Petis, Awalnya Adalah Upeti Untuk Raja9 Jenis-Jenis Kurma TerfavoritResep Yakitori, Sate Ayam Ala JepangTernyata Bayam Adalah Sahabat WanitaNikmat Kulit Ayam, Bikin SengsaraStop Merendam Teh Celup Terlalu Lama!Cegah Alot, Ini Cara Benar Olah Cumi-CumiKuliner Legendaris Yang Mulai Langka Di DaerahnyaKhao Neeo, Ketan Mangga Ala ThailandTips Memilih Beras Berkualitas

Comments

Post a Comment