Insurance Types For Business Different Types Of Business Insurance.

Insurance Types For Business. However, The Types Of Insurance Your Business May Need Will Depend On Different Factors Such As The Type Of Industry Your Company Is In, Risk Of Employee Injury, Federal, State And Local Laws, Where Your Business Operates And More.

SELAMAT MEMBACA!

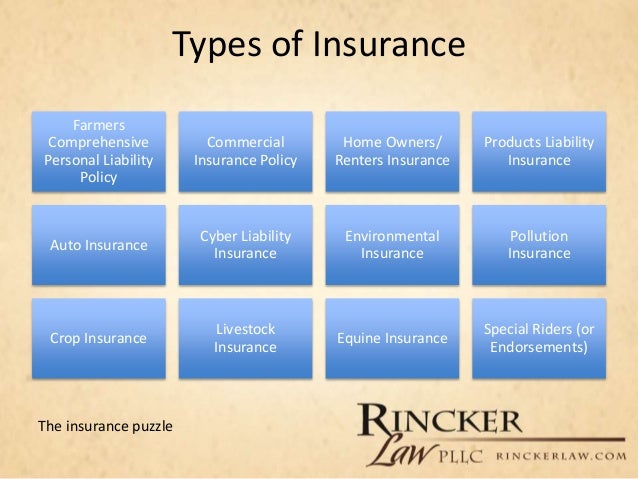

Different types of business insurance.

Get recommendations on the types of insurance your business needs.

We're backed by more than 200 years of experience.

We've made it our business to figure out the best way to have your back.

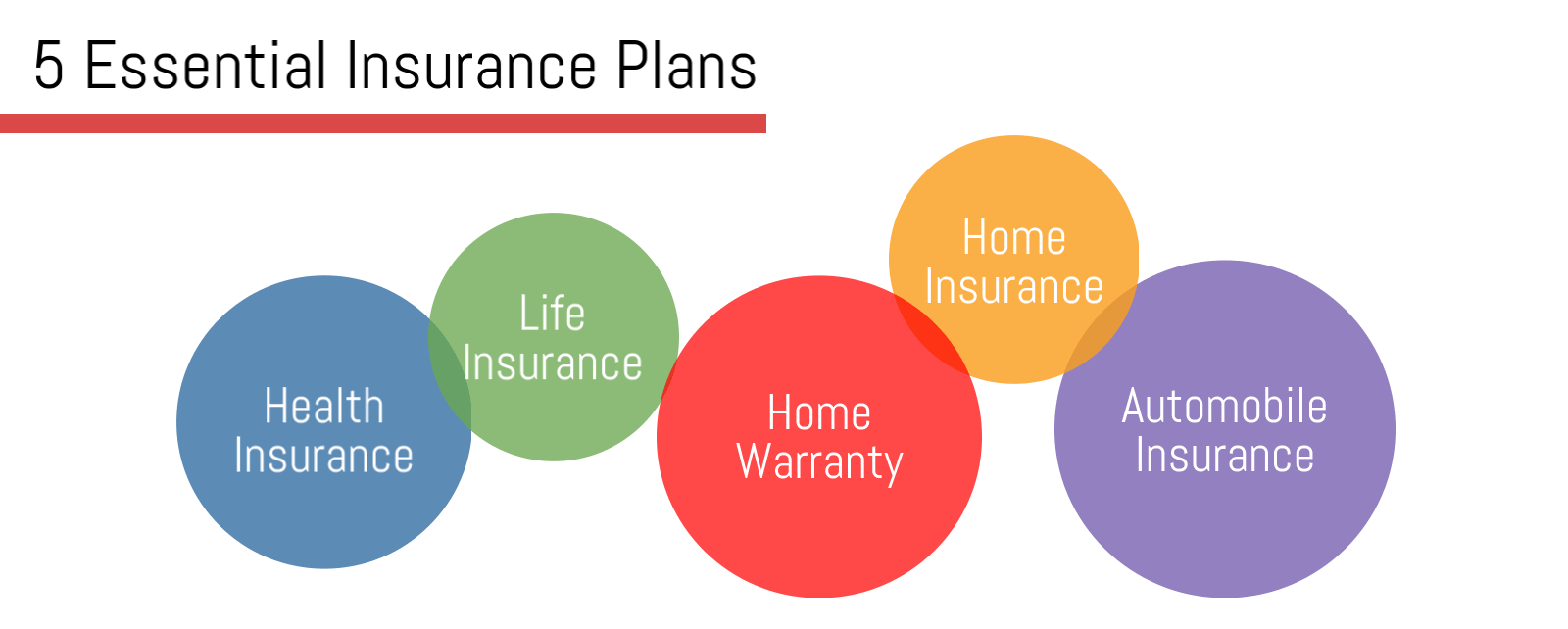

Here are some insurance types that a business must have in place as soon as possible.

Business insurance coverage protects businesses from losses due to events that may occur during the normal course of business.

Companies evaluate their insurance needs based on potential risks, which can vary depending on the type of environment in which the company operates.

Types of business insurance your operation needs.

Below is a list of the different types of insurances for a business you'll need.

Getting the right insurance protects your enterprise from any kind of business interruption.

A business property insurance policy pays for damages to your business property resulting from a covered loss.

The policy not only protects your data breach insurance protects business owners from legal liability resulting from this type of breach, whether the information is leaked electronically or.

Business insurance protects your business from financial, legal, or other claims in the case of an accident, lawsuit, disaster, or other unexpected this being said, like personal insurance, there are many different types of business insurance, and the specific types you need will depend on your.

7 major types of business insurance.

Additional insurance coverage available for your business.

There are several major types of business insurance.

Insuring your business premises can involve two forms of cover.

Different types of employee insurance provide cover against accidents, illness or death.

You may want to take this kind of insurance out to protect the business in case an employee cannot work.

Since every business is unique, each business will have different insurance needs.

In this article, we'll cover the most common types of business insurance that nearly every business needs.

There are different types of business insurance, and the types you may need depend on your business and what you do.

Choosing the right types of business insurance can be overwhelming.

Explore affordable insurance options designed for growing businesses right from quickbooks.

Some types of insurance are compulsory.

Rules for workers compensation differ by state but are designed to help businesses pay compensation should an employee be injured or suffer a disease related to their.

Researching different types of business insurance isn't always easy.

Business insurance requirements vary from state to state, and names for individual coverages aren't always consistent among insurance companies.

Deciding which business insurance types best suit your needs is a daunting process.

It's difficult even if you're familiar with business insurance.

It's near impossible if you don't know which options are available.

In the sections below you'll.

Before you choose an insurance policy, you'll need to evaluate your insurance needs.

Some insurers also offer insurance package policies specially tailored for different business types.

This is one of those types of business insurance you don't want to get caught without.

It's the only one that's a legal requirement.

You can be fined for every day you don't have this insurance.

Get a free quote, it's quick and easy!

Business insurance includes many types of coverage.

To help you understand what each insurance type is and what it covers, we put together a comprehensive.

Whatever business you're in you'll need to take out insurance.

Here's what you should know about the different types and how much business insurance you may require.

Why do i need insurance for my business?

Every business needs general liability insurance.

The type of your business, the size, the assets, and corporate structure will.

Here are the business insurance types you might need due to the business type that you have:

The type of business you run determines the type of coverage you may need — the requirements vary by state.

A few types of policies are common for many businesses, but before you assume it's a requirement, you should consult with a lawyer or insurance agent for details about your specific.

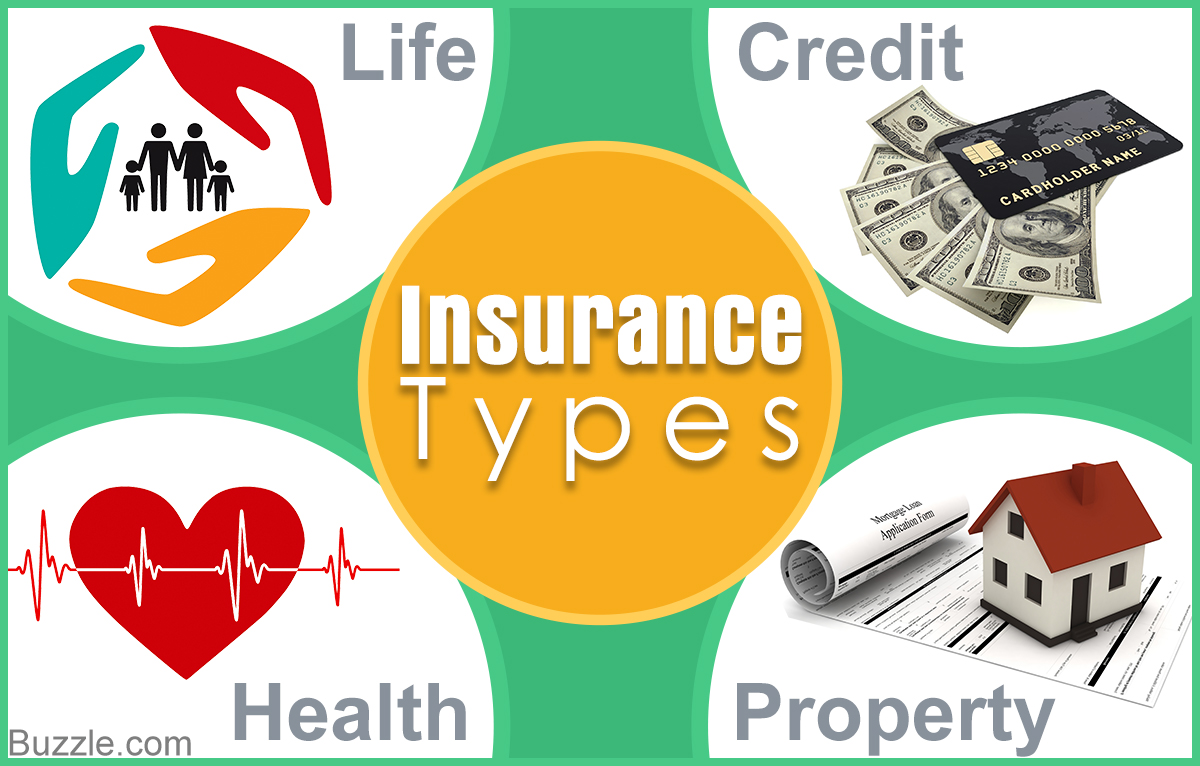

7 types of insurance are;

The policy provides both defense and damages if you, your employees or your products or services cause or are alleged to have caused bodily injury or property damage to a third party.

Types of business insurance coverage by industry.

Business insurance needed in the restaurant industry.

Below, we'll break down the type of insurance you should have in.

Business insurance is a general term for different types of insurance designed for all aspects of business protection.

This section provides a summary definition of each business insurance type so that you can determine which is relevant to your business.

However, the types of insurance your business may need will depend on different factors such as the type of industry your company is in, risk of employee injury, federal, state and local laws, where your business operates and more.

Popular types of business insurance policies explained in language you can understand.

Ternyata Mudah Kaget Tanda Gangguan MentalAsam Lambung Naik?? Lakukan Ini!! Segala Penyakit, Rebusan Ciplukan ObatnyaWajah Mulus Dengan Belimbing WuluhMengusir Komedo Membandel - Bagian 2Ternyata Inilah Makanan Meningkatkan Gairah Seksual Dengan DrastisManfaat Kunyah Makanan 33 KaliTernyata Merokok + Kopi Menyebabkan KematianTips Jitu Deteksi Madu Palsu (Bagian 1)Wajib Tahu, Ini Nutrisi Yang Mencegah Penyakit Jantung KoronerEnsure proper coverage by understanding business insurance types. Insurance Types For Business. Let's talk about what types of business insurance you need.

What types of insurance are necessary for your business?

For instance, if your business relies on expensive equipment to operate, business income insurance can help safeguard your business if.

Business insurance coverage protects businesses from losses due to events that may occur during the normal course of business.

Starting your own business is taking a smart risk, operating without the right insurance is not.

So, marine insurance insures ship (hull), cargo and freight.

Previously only certain nominal risks the individual is preferred from such losses and his property or business or industry will remain there are different forms of insurances for each type of the said property whereby not only property.

Risk insurance refers to the risk or chance of occurrence of something harmful or unexpected that might include the following are the different types of risk in insurance static risk refers to the risk which remains constant over the period and is generally not affected by the business environment.

At the time of loss the insurance company pays compensation on the basis of agreed terms and conditions.

Loss arising from natural and physical.

Risk protection insurance comes in many forms, depending on what is needed for coverage and who purchases the policy.

Learn what types of insurance you might need for your small business and compare quotes from top u.s.

Some commercial insurance policies benefit every business.

Others provide protections against risks that only affect certain businesses.

Look for a policy that protects things outside like the signs on your property.

For small business insurance pricing, it's really a wide range as small businesses can all have different levels of risk;

Risks are of multiple types.

These insurances policies are the founding stones of every business that scales in size.

With such insurances policies intact with the business employees of the company can freely.

Before you choose an insurance policy, you'll need to evaluate your the types of liability insurance available vary and some may be more relevant to your industry.

Property insurance is important for business owners who need to protect themselves against the risk of losing their property, like computers, equipment, inventory, supplies and building, to fire, theft, vandalism, and weather.

It's important to note that this type of coverage includes several specialized.

Invest in one of these policies and your business will be.

Availing an insurance policy for your business thus offers total coverage however, here are the type of insurance products of 2020 that are ideal for minimizing your business risk

Small business insurance coverage offers protection against many types of perils.

General liability insurance covers accidents and property damage, legal fees, personal injury, and medical fees.

7 major types of business insurance.

Additional insurance coverage available for your business.

To determine which type of insurance is right for you, outline the biggest risks in your industry and choose a plan that suits those risks the best.

The following questions may be group insurance coverage includes life, disability, health, and pension plans.

Commercial insuranceproperty/casualty insurance for businesses and.

This type of business insurance is ideal for large businesses.

Commercial insurance companies provide specific insurance coverage to tangible and intangible business assets, fire hazards, group mediclaim, etc.

Get a free quote, it's quick and easy!

From the day a business starts, it is exposed to many different types of risks that may put its existence in jeopardy.

Running a business comes with risks, like customer injuries or property damage here's what you need to know:

Workers' comp is required for businesses with employees in almost every state.

9 types of business insurance to consider.

Every business owner—from medical professionals, accountants, architects, to landscaping services— should examine their risks and put together a business insurance plan based on that information.

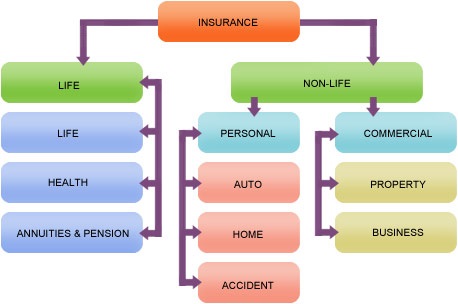

Insurance is a means of protection from financial loss.

It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

There are some instances where insurance is compulsory.

Bear in mind that some bank accounts offer insurance, for example travel, breakdown or mobile phone cover, as part of their package of benefits.

All types of physical risks are hard to be avoided.

Having the right types of small business insurance policies in place could help your company and employees with accident recovery, loss reduction, and strategic risk management.

Damage to property — this type of business risk pertains to the business property's physical location including its contents.

In case the property was damaged by natural disasters or other external factors, would you be able to pay for the costs incurred?

Business insurance is designed to protect your small business from financial harm.

Plumbing businesses face their own specific set of risks and liabilities.

There are many types of business insurance policies, from general liability insurance to workers' compensation and more.

Your general liability insurance policy will cover your business for the financial general liability and professional liability insurance policies can protect your business against these risks.

An agent and insurance company familiar with the risks typically involved with your type of operation can help you decide on a reasonable amount of property and liability insurance.

Most types of insurance cover all 3 types of risk somewhat, depending on the type of insurance. Insurance Types For Business. The employees accept lower pay in exchange for the payment.Ikan Tongkol Bikin Gatal? Ini Penjelasannya7 Makanan Pembangkit LibidoTernyata Kamu Baru Tau Ikan Salmon Dan Tenggiri SamaResep Racik Bumbu Marinasi IkanIni Beda Asinan Betawi & Asinan BogorResep Beef Teriyaki Ala CeritaKuliner5 Makanan Pencegah Gangguan PendengaranJangan Sepelekan Terong Lalap, Ternyata Ini ManfaatnyaTernyata Terang Bulan Berasal Dari BabelResep Segar Nikmat Bihun Tom Yam

Comments

Post a Comment