Insurance Types In Usa There Are Many Types Of Insurance Policies That Could Be Useful To You, Depending On Your Circumstances.

Insurance Types In Usa. Types Of Visitor Medical Insurance Plans In The Us.

SELAMAT MEMBACA!

This article is part of series on the.

Of the $4.640 trillion of gross premiums written worldwide in 2013, $1.274 trillion.

Medical insurance in the united states is a contract with an insurance company, under which you pay a certain amount of the insurance company every how to survive without insurance in usa.

Some people prefer not to buy insurance, and pay a fine at the end of the year.

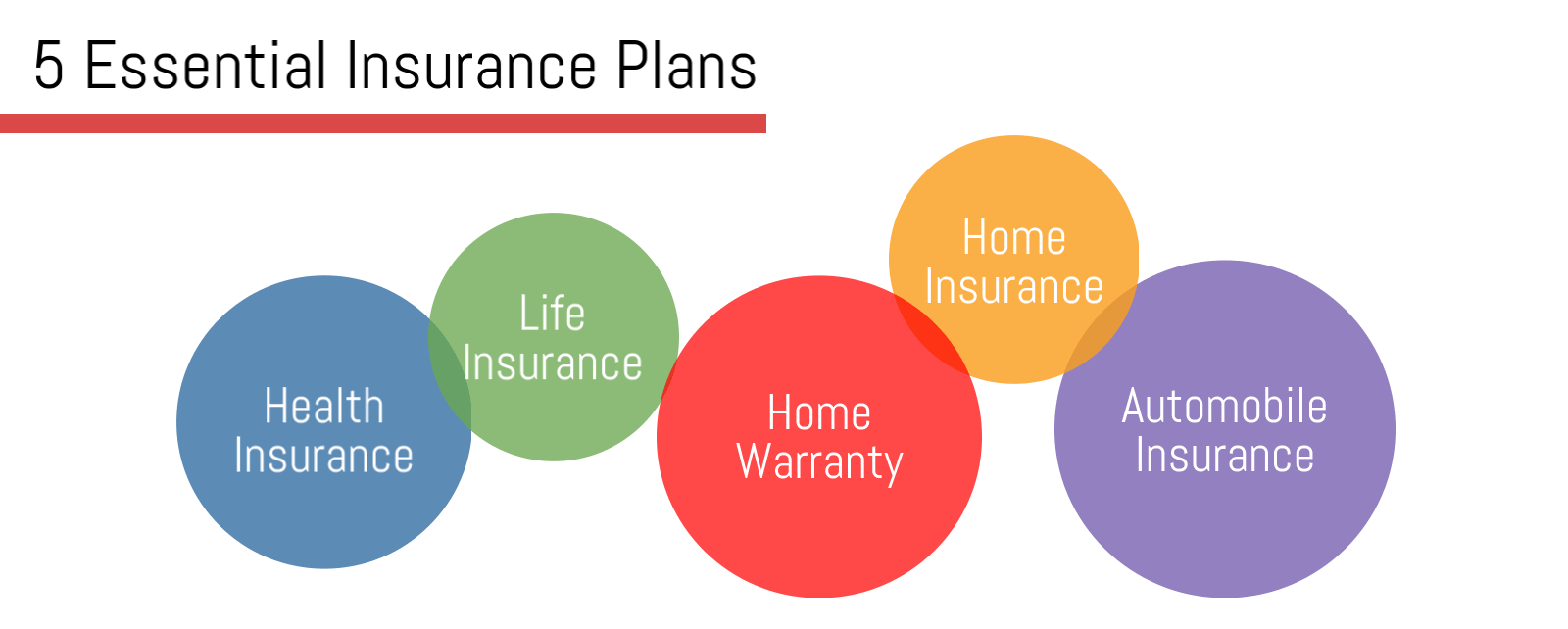

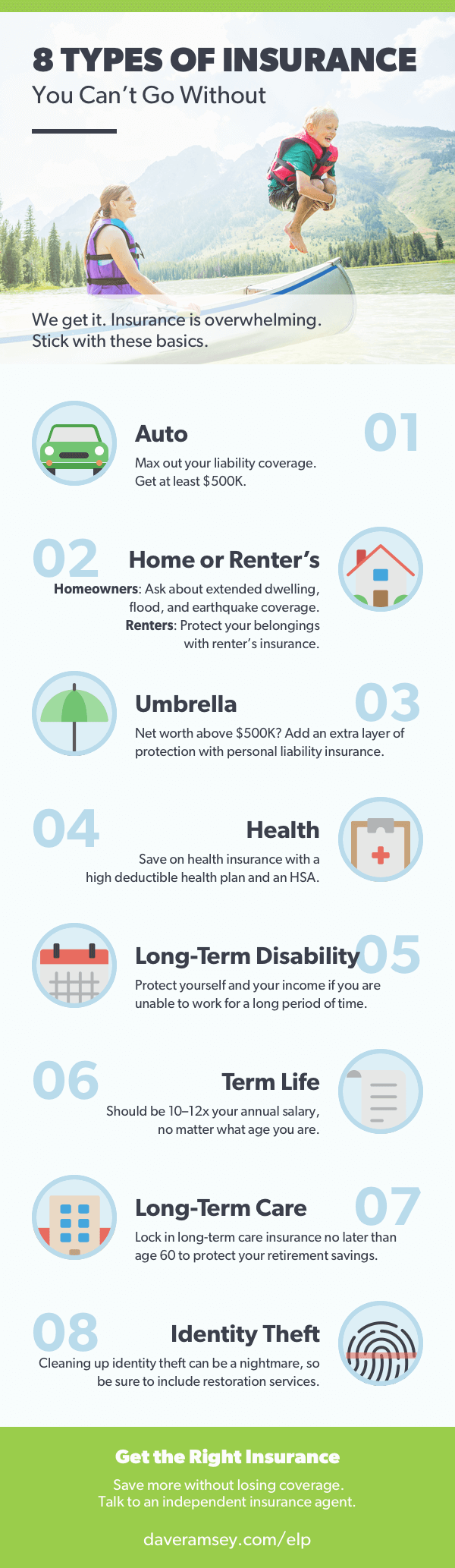

Getting the right type and amount of insurance is always determined by your specific situation.

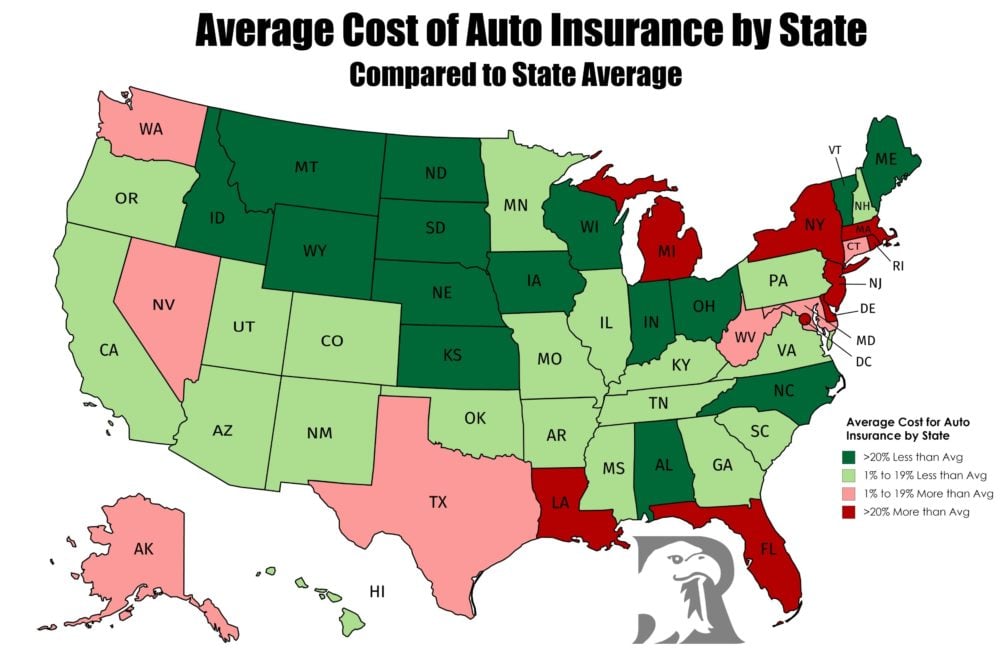

While not all states require drivers to have auto insurance, most do have regulations regarding financial responsibility in the event of an accident.

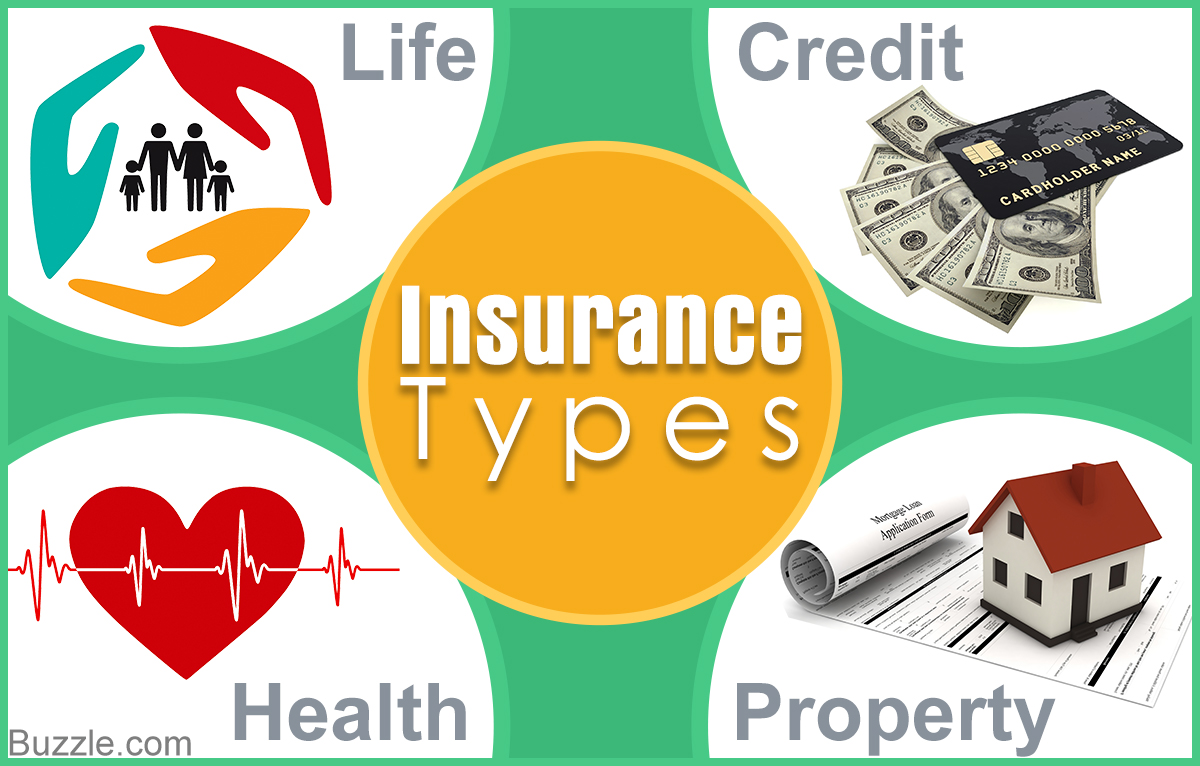

7 types of insurance are;

Can be insured against the damage or destruction due to accident or disappearance due.

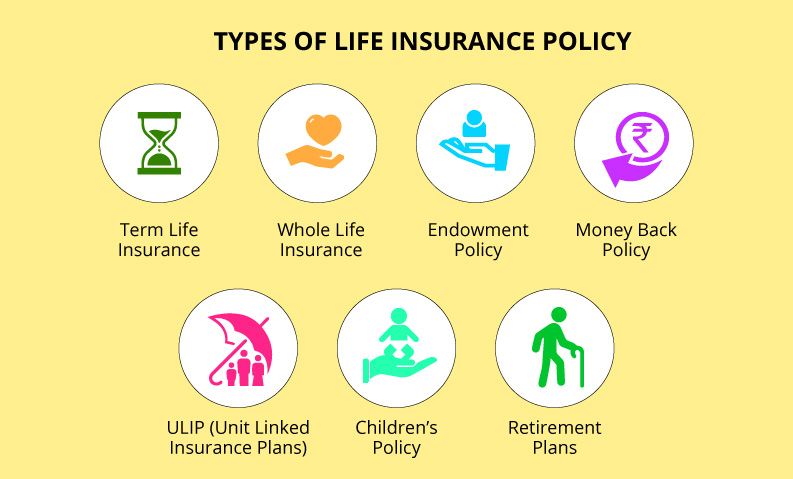

Whole life insurance , term life insurance, life insurance companies, life insurance quotes, types of life insurance , life insurance statistics, life insurance news 2020 in usa, life insurance definition.

Life insurance is very important for everyone because its protect to you and your family also.

Types of visitor medical insurance plans in the us.

Select the suitable category and click on continue to view the available insurance options.

Today, we are discussing about the types of insurances that can be done in usa.

In the series the first insurance company was formed in the year 1735 in charleston in south.

So what are the different types of insurance?

Do you need an insurance calculator to get a quote for a specific type of insurance?

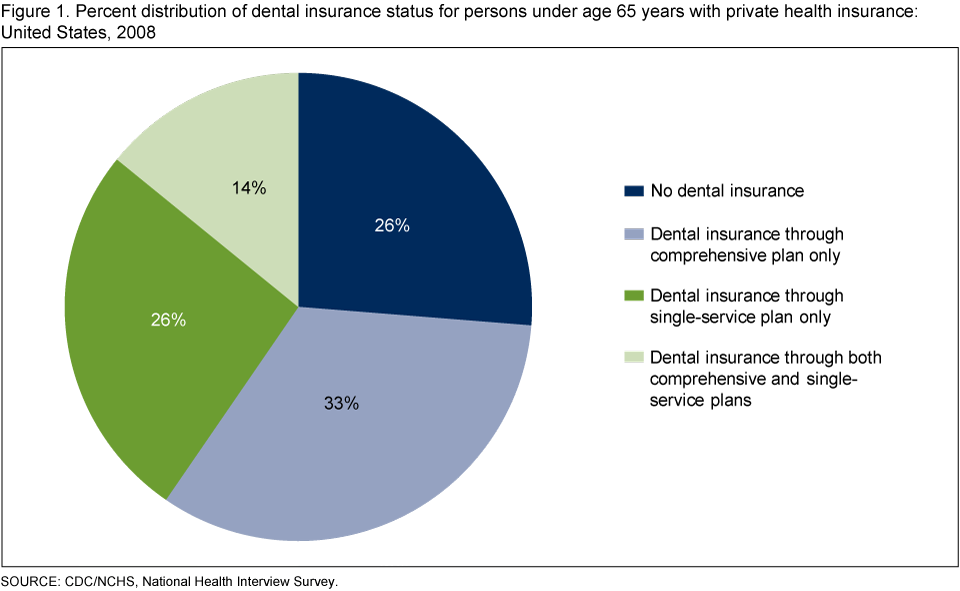

This statistic shows the types of insurance owned in the united states in 2018.

The team at insurance store usa is very professional, friendly and responsive.

Great rates that won't hurt your pocket.

Most states legally require businesses with employees to carry workers' compensation insurance.

Failing to do so could result in a fine or criminal penalty.

What types of insurance are necessary for your business?

Health insurance motor insurance travel insurance home insurance fire insurance 2.

What are the types of general insurance available?

/ what all can be insured?

It offers coverage for vehicles of general types of auto insurance coverage include property, liability, medical, uninsured and underinsured motorists, comprehensive and collision.

Life insurance is one type of insurance that is readily available, and yet, all its benefits are often overlooked.

People tend to think of life insurance one type of insurance that is often overlooked is travel insurance.

There are many types of insurance policies that could be useful to you, depending on your circumstances.

This findlaw article gives an there are several different types of life insurance plans, but the general idea is that you pay a regular premium to insure your life for a certain amount.

Health insurance is easily one of the most important types of insurance to have.

If you were to develop a serious illness or have an accident without being insured, you might find yourself unable to receive treatment or forced to pay.

Insurance industry net premiums written totaled $1.32 trillion in 2019, with premiums recorded by property/casualty (p/c) insurers accounting for 48 percent, and premiums by life/annuity insurers accounting for 52 percent, according to s&p global market intelligence.

Know the basic types of insurance for individuals.

Certain terms are usefully defined at the contract itself is called the policythe contract for the insurance sought by the insured.

The events insured against are known as riskspotential.

Here are some insurance types that a business must have in place as soon as possible.

Learn from webmd about the types of health insurance plans available under the affordable care act.

If you're buying from your state's marketplace or from an insurance broker, you'll choose from health plans organized by the level of benefits they offer:

Bronze, silver, gold, and platinum.

This type of health insurance offers.

We provide many different types of business insurance.

This type of insurance protects your business's physical assets, such as workspace and computers.

What professional liability insurance costs.

Business liability insurance rates are based on the type of business, the state (settlements are much higher in some states than others), the specific areas of coverage you choose and the financial caps on coverage.

For usa insurance specific to auto insurance coverage, this is a formal agreement between the insurance company and the policyholder.

Get your personal quote in just a matter of seconds.

.providers all across the united states who participate in the ppo network, accept the insurance card, bill the insurance company directly in most cases and charge you are you an exchange visitor to usa?

Department of state requires all j visa holders to purchase compliant insurance.

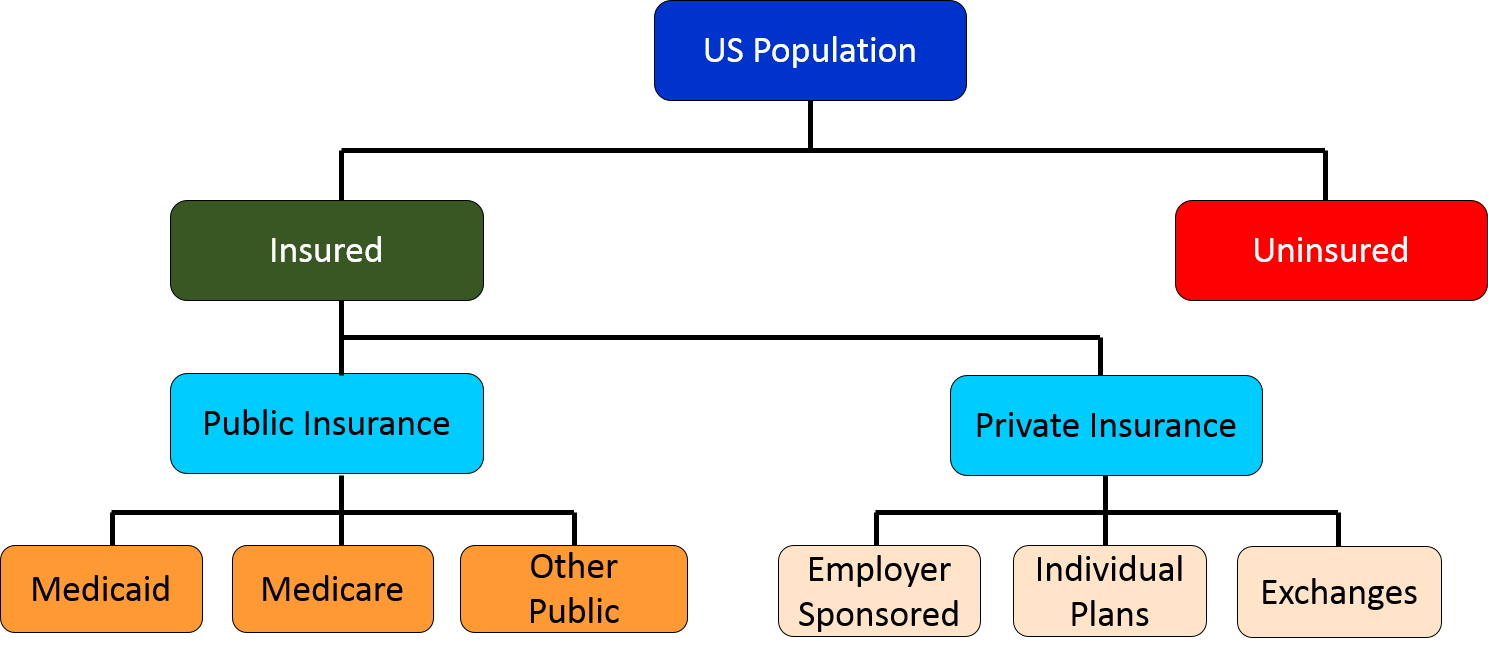

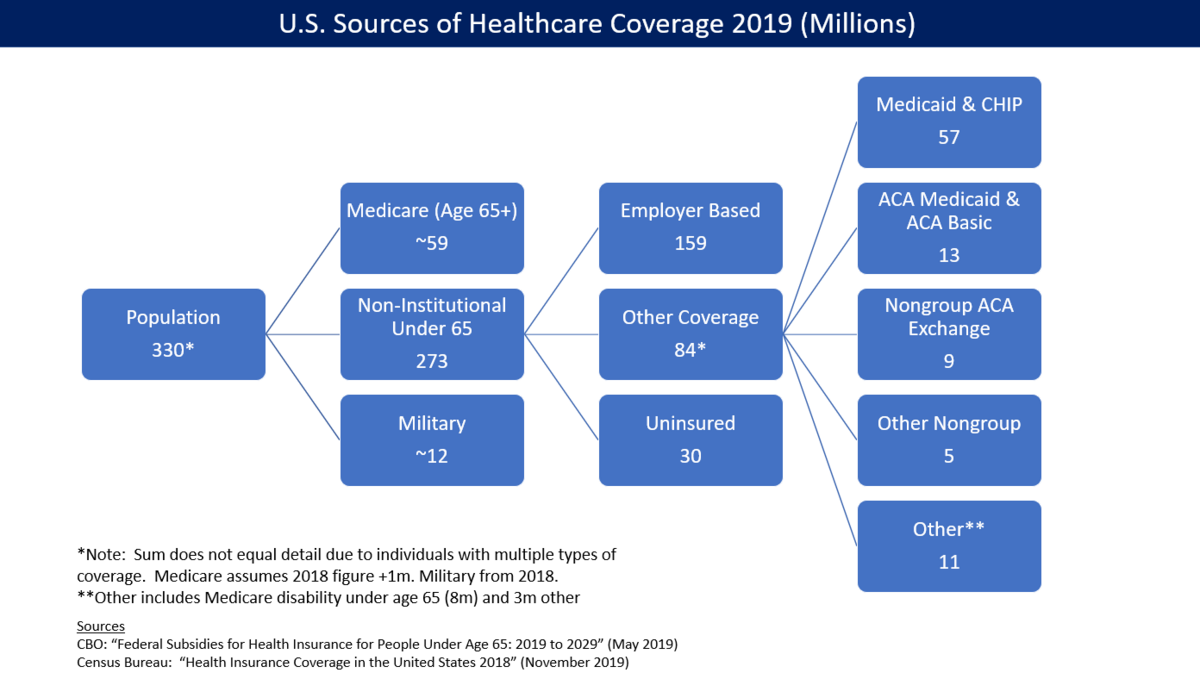

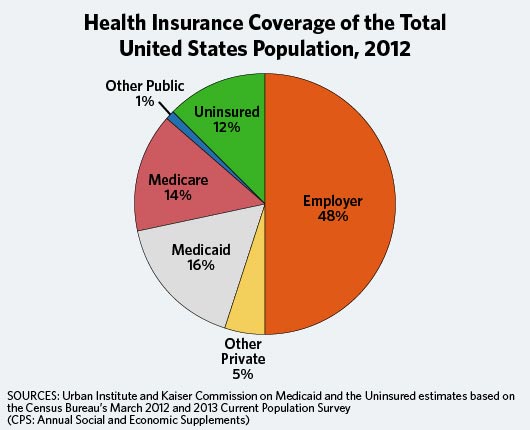

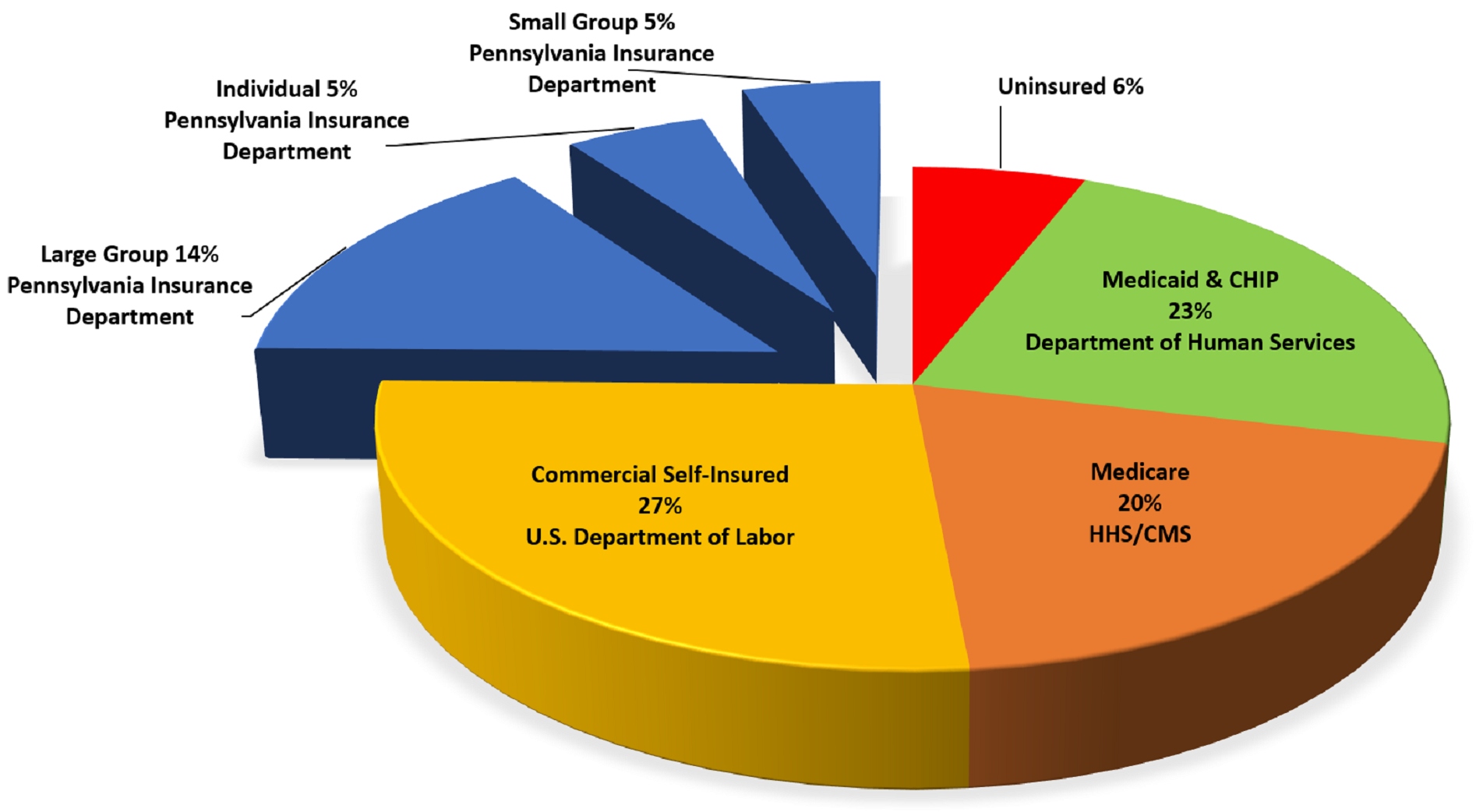

Types of health insurance in usa.

Federal employees health benefits program.

General peculiarities and types of insurance coverage.

Private insurance is voluntary and the insurance is acquired the largest and most prominent examples of social insurance programs in the united states are the social security and medicare programs.

Visitors medical insurance type, difference in fixed benefits and comprehensive coverage plans.

Why comprehensive visitors insurance is better for usa visitors.

Insurance is a type of financial product that helps individuals and businesses protect themselves against unpredictable risks like fires, illness and accidents.

Insurance can help protect small business owners from financial setbacks that may arise during the course of operating their.

Ternyata Einstein Sering Lupa Kunci MotorGawat! Minum Air Dingin Picu Kanker!Tak Hanya Manis, Ini 5 Manfaat Buah SawoIni Efek Buruk Overdosis Minum KopiAsi Lancar Berkat Pepaya MudaObat Hebat, Si Sisik NagaPD Hancur Gegara Bau Badan, Ini Solusinya!!Uban, Lawan Dengan Kulit Kentang5 Rahasia Tetap Fit Saat Puasa Ala KiatSehatkuJam Piket Organ Tubuh (Hati)Insurance is a type of financial product that helps individuals and businesses protect themselves against unpredictable risks like fires, illness and accidents. Insurance Types In Usa. Insurance can help protect small business owners from financial setbacks that may arise during the course of operating their.

Insurance is meant to safeguard us, at least financially, should certain things happen.

From wikipedia, the free encyclopedia.

Jump to navigation jump to search.

We offer insurance coverages that can help protect you from common or even unique risks.

A bop is a good get recommendations on the types of insurance your business needs.

We're backed by more than 200 years of experience.

Buy medical insurance in the us can be through the health insurance marketplace.

There is a nationwide resource, but in some states own websites operate.

Life insurance is one type of insurance that is readily available, and yet, all its benefits are often overlooked.

People tend to think of life insurance we make no representation that we will improve or attempt to improve your credit record, history, or rating through the use of the resources provided.

With so many types of insurance to choose from, it's hard to know what you need and what you don't.

Learn the basics about different kinds of insurance.

So we've boiled your options.

Your good health is what allows you to work, earn money, and enjoy life.

If you were to develop a serious illness or have an accident without being insured, you might find yourself unable to receive treatment or forced to pay.

Learn what you need to know about health, auto, life, home and other insurance for washington state consumers from the office of the insurance commissioner.

Life insurance is very important for everyone because its protect to you and your family also.

There are many types of insurance policies that could be useful to you, depending on your circumstances.

This findlaw article gives an overview of some of the most common types of insurance available today.

Here are some insurance types that a business must have in place as soon as possible.

If company vehicles will be used, those vehicles should be fully insured to protect businesses against liability if an accident should occur.

Understanding the types of life insurance policies doesn't have to be complicated.

Health insurance is another one of the four main types of insurance that experts recommend.

A recent study revealed that sixty two percent of personal bankruptcies in the us in 2007 were as a direct result of health problems.

A surprising seventy eight percent of these filers had health insurance.

We begin with an overview of the types of insurance, from both a consumer and a business perspective.

Then we examine in greater detail the three most.

Some of the common types of general insurance are property insurance, liability insurance, legal expenses insurance, health insurance, disability insurance, interest rate insurance, vehicle insurance along with other types of insurance.

We recommend you buy gap insurance if you have a loan longer than 48 months or made a down payment of less than 20%.

Medical payments coverage is mandatory only in maine and for insured drivers in new hampshire, where insurance coverage is not compulsory.

Learn from webmd about the types of health insurance plans available under the affordable care act.

Bronze, silver, gold, and platinum.

This type of insurance is funded by premiums paid by the insured to the insurance company.

In the us, the state started requiring employers to carry workers compensation, then during the great depression, the federal government passed the social security act of 1935, creating the social.

We provide our customers with the lowest cost insurance in a simple, easy process.

Our expert agents will partner with you to guarantee a unique and efficient experience.

What professional liability insurance costs.

Learn what types of insurance you might need for your small business and compare quotes from top u.s.

Choose your industry to get started.

Types of insurance range from regular life insurance to specific shipping insurance.

Insurance is one of the main necessities in modern life, but how many types of insurance you know exist?

You may know standard insurance like health and life, but there.

Insurance is a type of financial product that helps individuals and businesses protect themselves against unpredictable risks like fires, illness and accidents.

There are types of health insurance for almost every circumstance.

Figuring out which plan is right for you begins with understanding your plan options along with your health care needs.

In this article, we will explain both these types of insurance and their various aspects.

So if the fco say it's safe to travel to your destination you can travel with peace of mind knowing we'll cover you for:

We provide many different types of business insurance.

Get the coverage that you need today.

Some types of health insurance include hmo, epo, pos and ppo plans.

For a lot of people who get their health insurance through their employer, it comes down to what options are available.

For a lot of people who get their health insurance through their employer, it comes down to what options are available. Insurance Types In Usa. If there is more than one choice, you likely have to decide between an hmo, ppo, epo or pos option.Ternyata Inilah Makanan Indonesia Yang Tertulis Dalam Prasasti3 Jenis Daging Bahan Bakso TerbaikCegah Alot, Ini Cara Benar Olah Cumi-CumiSejarah Prasmanan Alias All You Can EatKhao Neeo, Ketan Mangga Ala ThailandTernyata Hujan-Hujan Paling Enak Minum RotiSejarah Nasi Megono Jadi Nasi Tentara5 Trik Matangkan Mangga5 Makanan Pencegah Gangguan PendengaranFoto Di Rumah Makan Padang

Comments

Post a Comment