Insurance Types In Usa Do You Need An Insurance Calculator To Get A Quote For A Specific Type Of Insurance?

Insurance Types In Usa. Do You Need An Insurance Calculator To Get A Quote For A Specific Type Of Insurance?

SELAMAT MEMBACA!

This article is part of series on the.

Of the $4.640 trillion of gross premiums written worldwide in 2013, $1.274 trillion.

Medical insurance in the united states is a contract with an insurance company, under which you pay a certain amount of the insurance company every how to survive without insurance in usa.

Some people prefer not to buy insurance, and pay a fine at the end of the year.

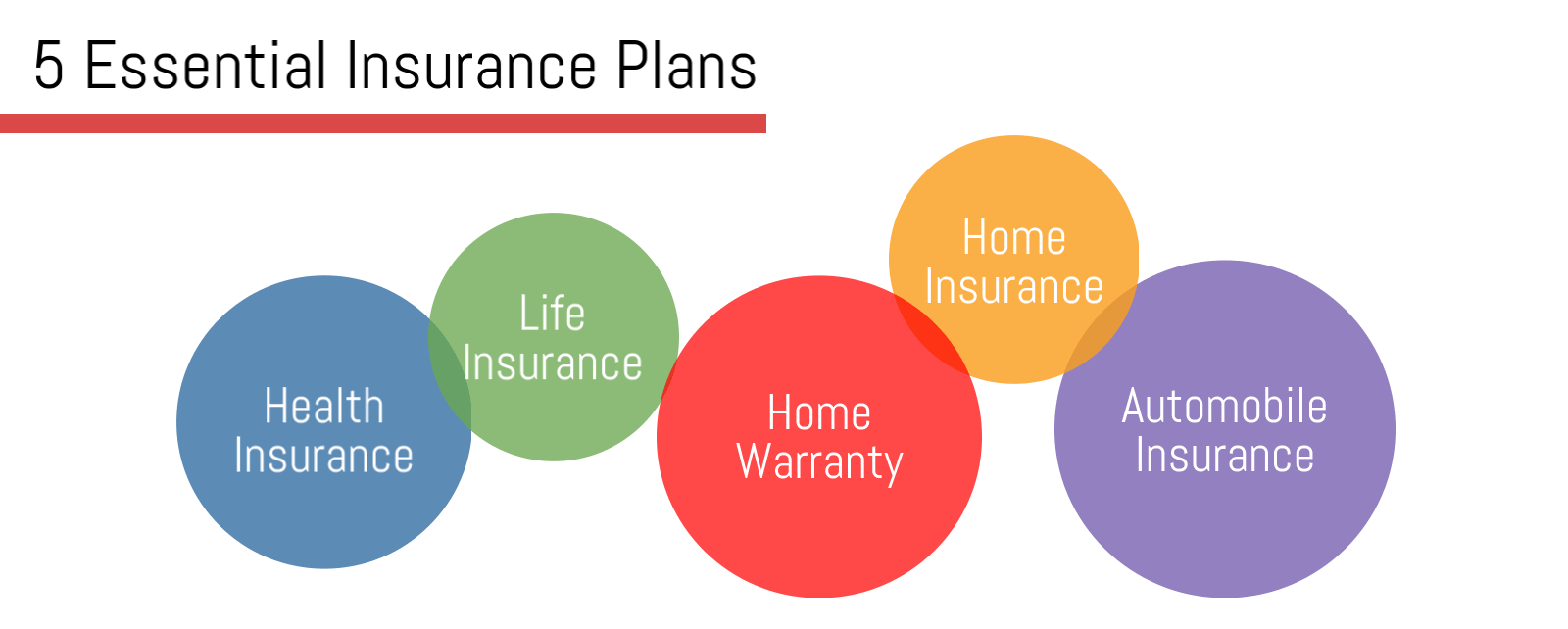

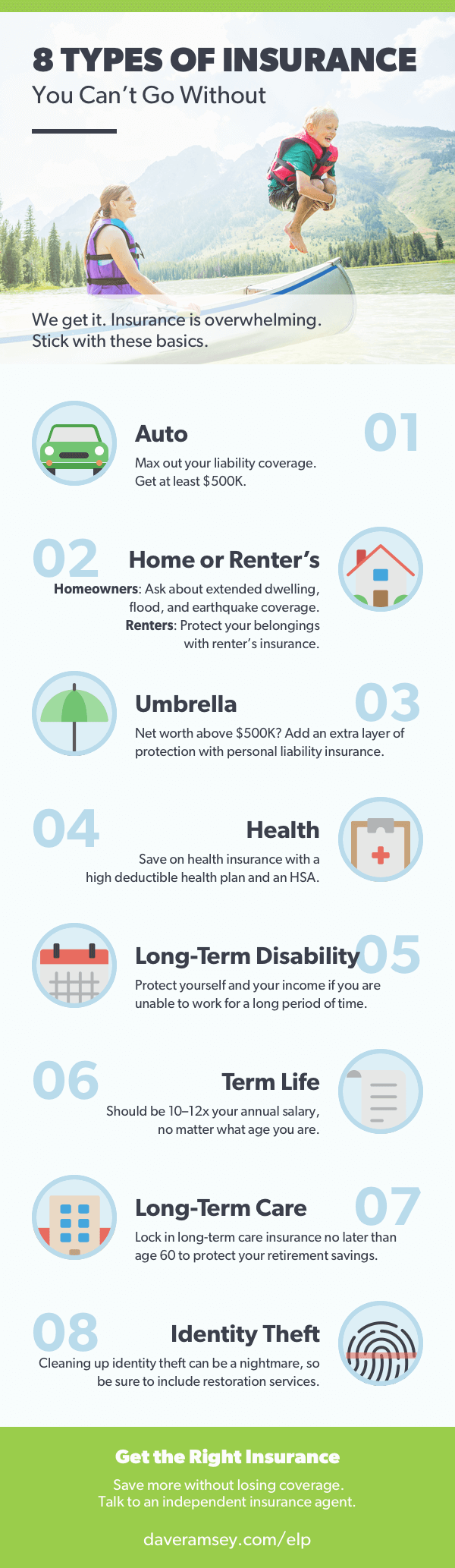

Getting the right type and amount of insurance is always determined by your specific situation.

While not all states require drivers to have auto insurance, most do have regulations regarding financial responsibility in the event of an accident.

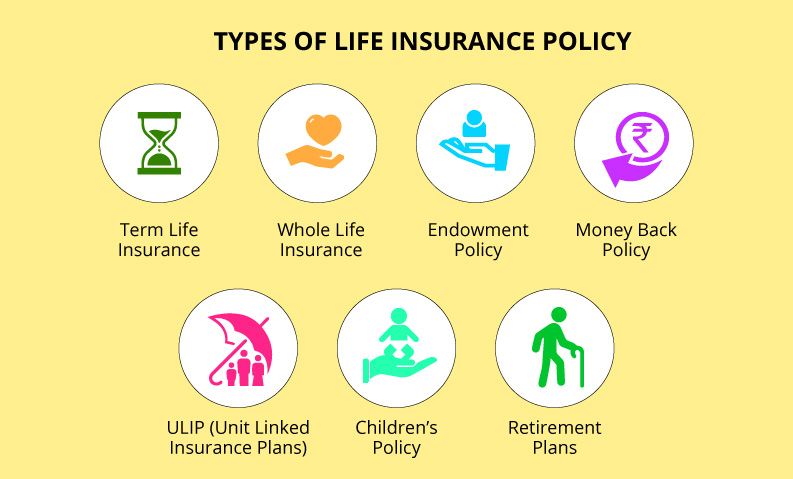

7 types of insurance are;

Can be insured against the damage or destruction due to accident or disappearance due.

Whole life insurance , term life insurance, life insurance companies, life insurance quotes, types of life insurance , life insurance statistics, life insurance news 2020 in usa, life insurance definition.

Life insurance is very important for everyone because its protect to you and your family also.

Types of visitor medical insurance plans in the us.

Select the suitable category and click on continue to view the available insurance options.

Today, we are discussing about the types of insurances that can be done in usa.

In the series the first insurance company was formed in the year 1735 in charleston in south.

So what are the different types of insurance?

Do you need an insurance calculator to get a quote for a specific type of insurance?

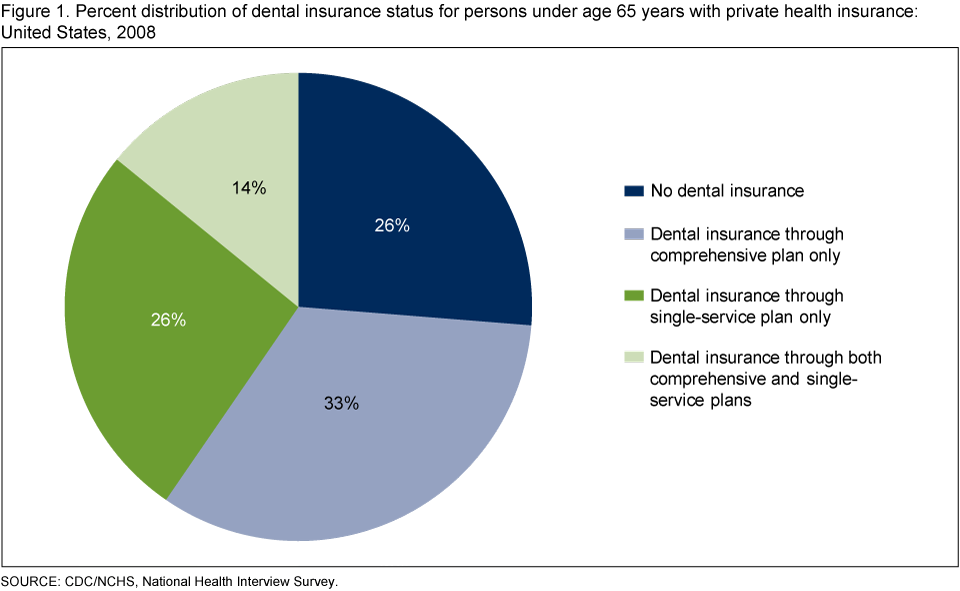

This statistic shows the types of insurance owned in the united states in 2018.

The team at insurance store usa is very professional, friendly and responsive.

Great rates that won't hurt your pocket.

Most states legally require businesses with employees to carry workers' compensation insurance.

Failing to do so could result in a fine or criminal penalty.

What types of insurance are necessary for your business?

Health insurance motor insurance travel insurance home insurance fire insurance 2.

What are the types of general insurance available?

/ what all can be insured?

It offers coverage for vehicles of general types of auto insurance coverage include property, liability, medical, uninsured and underinsured motorists, comprehensive and collision.

Life insurance is one type of insurance that is readily available, and yet, all its benefits are often overlooked.

People tend to think of life insurance one type of insurance that is often overlooked is travel insurance.

There are many types of insurance policies that could be useful to you, depending on your circumstances.

This findlaw article gives an there are several different types of life insurance plans, but the general idea is that you pay a regular premium to insure your life for a certain amount.

Health insurance is easily one of the most important types of insurance to have.

If you were to develop a serious illness or have an accident without being insured, you might find yourself unable to receive treatment or forced to pay.

Insurance industry net premiums written totaled $1.32 trillion in 2019, with premiums recorded by property/casualty (p/c) insurers accounting for 48 percent, and premiums by life/annuity insurers accounting for 52 percent, according to s&p global market intelligence.

Know the basic types of insurance for individuals.

Certain terms are usefully defined at the contract itself is called the policythe contract for the insurance sought by the insured.

The events insured against are known as riskspotential.

Here are some insurance types that a business must have in place as soon as possible.

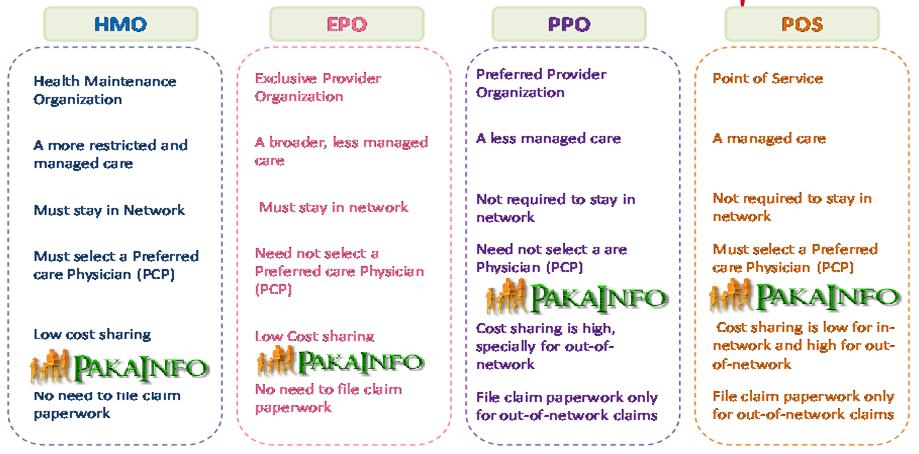

Learn from webmd about the types of health insurance plans available under the affordable care act.

If you're buying from your state's marketplace or from an insurance broker, you'll choose from health plans organized by the level of benefits they offer:

Bronze, silver, gold, and platinum.

This type of health insurance offers.

We provide many different types of business insurance.

This type of insurance protects your business's physical assets, such as workspace and computers.

What professional liability insurance costs.

Business liability insurance rates are based on the type of business, the state (settlements are much higher in some states than others), the specific areas of coverage you choose and the financial caps on coverage.

For usa insurance specific to auto insurance coverage, this is a formal agreement between the insurance company and the policyholder.

Get your personal quote in just a matter of seconds.

.providers all across the united states who participate in the ppo network, accept the insurance card, bill the insurance company directly in most cases and charge you are you an exchange visitor to usa?

Department of state requires all j visa holders to purchase compliant insurance.

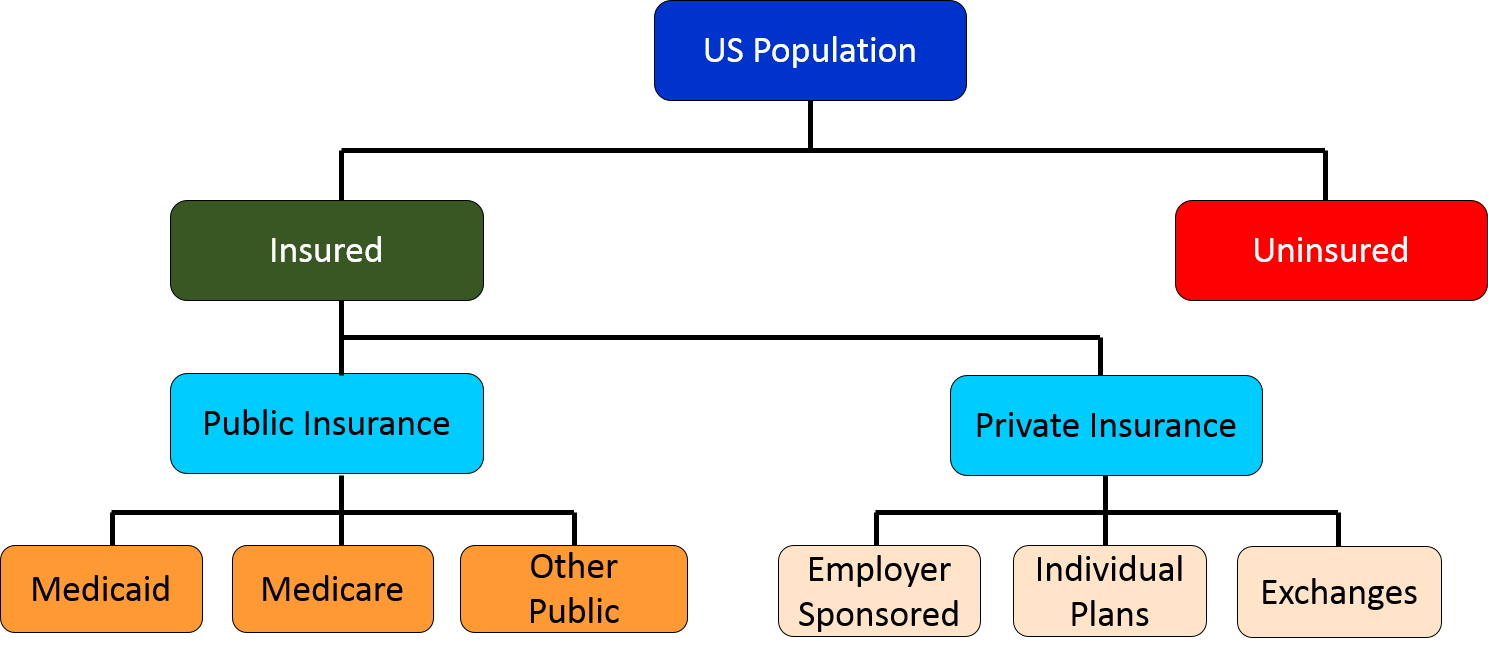

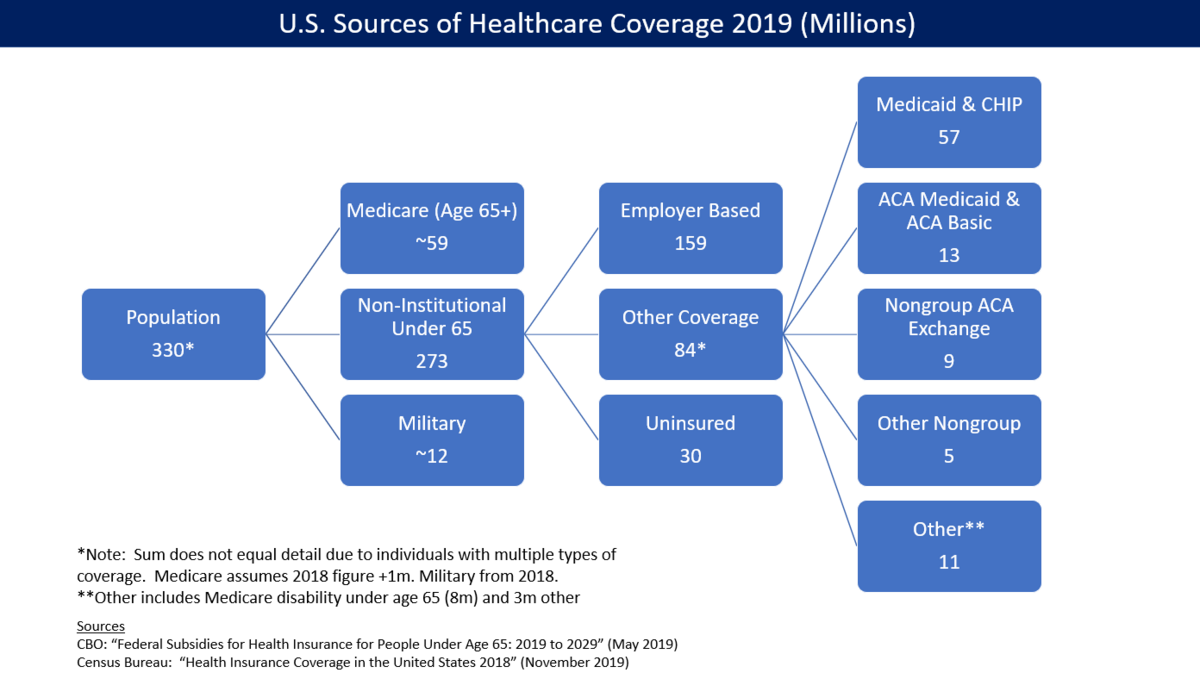

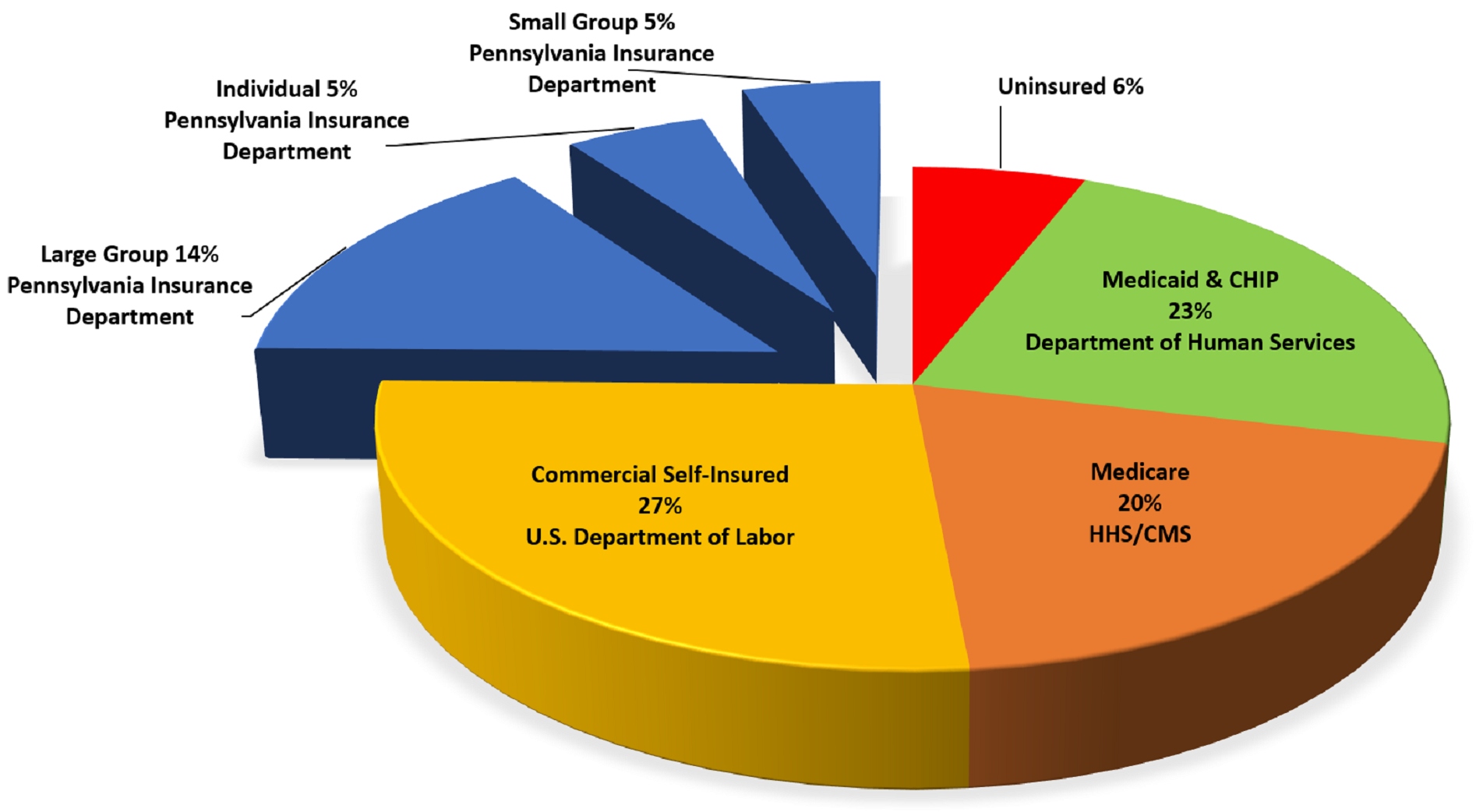

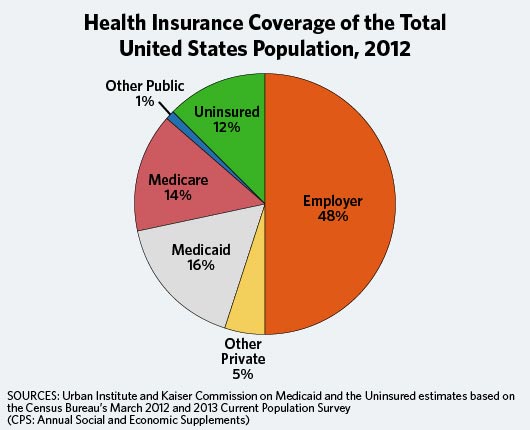

Types of health insurance in usa.

Federal employees health benefits program.

General peculiarities and types of insurance coverage.

Private insurance is voluntary and the insurance is acquired the largest and most prominent examples of social insurance programs in the united states are the social security and medicare programs.

Visitors medical insurance type, difference in fixed benefits and comprehensive coverage plans.

Why comprehensive visitors insurance is better for usa visitors.

Insurance is a type of financial product that helps individuals and businesses protect themselves against unpredictable risks like fires, illness and accidents.

Insurance can help protect small business owners from financial setbacks that may arise during the course of operating their.

7 Makanan Sebabkan SembelitGawat! Minum Air Dingin Picu Kanker!5 Manfaat Meredam Kaki Di Air Es10 Manfaat Jamur Shimeji Untuk Kesehatan (Bagian 1)Jam Piket Organ Tubuh (Hati) Bagian 210 Manfaat Jamur Shimeji Untuk Kesehatan (Bagian 2)Jam Piket Organ Tubuh (Ginjal)5 Makanan Tinggi KolagenTernyata Menikmati Alam Bebas Ada Manfaatnya3 X Seminggu Makan Ikan, Penyakit Kronis MinggatInsurance is a type of financial product that helps individuals and businesses protect themselves against unpredictable risks like fires, illness and accidents. Insurance Types In Usa. Insurance can help protect small business owners from financial setbacks that may arise during the course of operating their.

Vehicle insurance, car insurance, or auto insurance in the united states and elsewhere, is designed to cover the risk of financial liability or the loss of a motor vehicle that the owner may face if their.

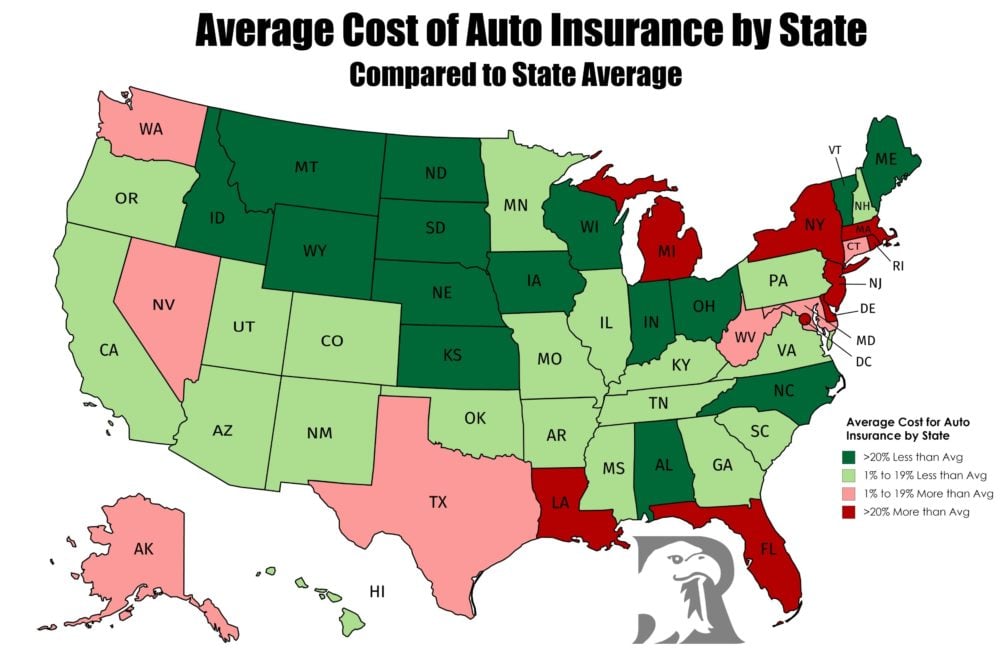

Insurance premiums are high in the usa, particularly for men under the age of 27 or if you live in an area where driving conditions can be particularly hazardous and theft is rife.

Insurance companies use statistical analysis and take into account many characteristics.

Almost every driver in the united states is required by law to carry car insurance.

Fortunately, car insurance is not as.

Car insurance is made up of several different types of coverages.

That's not always the case.

Understanding the types of car insurance available in the usa is important when searching for coverage.

Know how you can help lower your insurance rates by personalizing your coverage and.

Insurance.com offers recommendations for liability & other coverages and shows you how your car insurance choices compare to those of other drivers.

Learn more about the three different types of car insurance, including the difference between third party, third part fire and theft and fully comprehensive policies.

Find out which type of insurance is right for you and compare quotes now.

Car insurance rates for single males under the age of 25 are very expensive.

If you keep your cars in a garage, or if you have safety features like a.

This type of car insurance provides relief for damage to your vehicle after an accident that involves another vehicle.

It usually helps repair or replace a covered car.

–� car insurance in the usa is very important to protect the heritage and avoid suffering large losses in the event of any of the protected events.

All auto insurance in the usa offers one or more of the 6 main coverages or types of insurance that are:

Liability for property damage (pd).

What type of car insurance do i need?

With so many different types of policies available choosing car insurance can be overwhelming.

What are the types of car insurance and what does each policy cover?

Car insurance types and coverages.

The common types of auto coverage.

What is progressive car insurance?

The auto insurer is then expected to inform the.

General peculiarities and types of insurance coverage.

Car insurance helps provide financial protection for you, your family, other passengers, and your vehicle.

Auto insurance includes liability coverages, vehicle coverages, coverages for yourself, and other optional coverages.*

Wondering which type of car insurance you need?

Liability coverage is required in most us states as a legal requirement to drive a car.

Car insurance can help protect you from expensive, sometimes devastating surprises.

Let's say you're in a covered accident.

As an insured driver, you can get help paying medical bills consider your state's requirements and any specific coverage types you might want, like collision or comprehensive.

We are here to help demystify the often confusing world of car and auto insurance and help you have all the resources you may need.

Wondering what sets the different types of car insurance apart?

Learn more about comprehensive, third party fire and theft, third party property damage, compulsory third party, optional extras and more.

State minimum car insurance requirements.

There's a long list of other car insurance types in this group, and you're probably not familiar with most of them.

Some will be state minimum requirements, while others fall in the nice to have category.

Liability coverage liability coverage is required in most us.

Most car insurance policies include some combination of the six basic types of car insurance, plus perhaps a few of the less crucial types of coverage.

If you were on a deserted island and could only have one type of car insurance, liability coverage would be a smart choice.

If you're shopping for auto coverage, knowing the different.

7 types of car insurance explained.

Insurance exists to offer you protection when the unexpected occurs.

If you're driving and you collide with any object, car or otherwise, collision coverage will pay for damage to the policyholder's.

We'll explain the different types of rental car insurance and tell you what you really need.

Liability insurance typically covers damages to other people's property (e.g.

Whole life insurance , term life insurance, life insurance companies, life insurance quotes, types of life insurance , life insurance statistics, life insurance news 2020 in usa, life insurance definition.

Life insurance is very important for everyone because its protect to you and your family also.

State farm is the largest car insurance company in the united states.

Farm bureau financial services offers a range of insurance products and financial services, including auto insurance for all types of vehicles.

Select insurance type auto insurance health insurance medicare insurance home insurance life insurance.

Do tourists need a car insurance policy in the us?

Compare cheap car insurance quotes and save on your u.s.

In the united states, it's illegal to drive a vehicle without a license and auto insurance.

In the united states, it's illegal to drive a vehicle without a license and auto insurance. Insurance Types In Usa. State has different laws regarding coverage limits, so getting.Resep Nikmat Gurih Bakso LeleIkan Tongkol Bikin Gatal? Ini PenjelasannyaResep Cream Horn PastryKuliner Legendaris Yang Mulai Langka Di Daerahnya5 Makanan Pencegah Gangguan PendengaranKuliner Jangkrik Viral Di JepangResep Ponzu, Cocolan Ala JepangSejarah Nasi Megono Jadi Nasi TentaraSejarah Kedelai Menjadi TahuBir Pletok, Bir Halal Betawi

Comments

Post a Comment