Insurance Types In Canada Insurance In Canada Is An Important Part Of Your Expenses, But It Can Be Hard To Decide What Types Of Insurance You Need Right Now.

Insurance Types In Canada. This Is Also Something You'll Have To Agree To When You Buy Your Coverage.

SELAMAT MEMBACA!

Financial consumer agency of canada.

In it you will learn

It covers you for a specific period.

It supplements your provincial health care coverage and may or may not provide extended dental summary there are two basic types of life insurance in canada dictated by how life insurance premiums are paid.

Insurance in canada is an important part of your expenses, but it can be hard to decide what types of insurance you need right now.

As for all types of insurance, your policy will have specific details on what is and isn't covered.

This is also something you'll have to agree to when you buy your coverage.

Typcially group insurance has extended health benefits, some life.

Insurance is an assured and secure way to protect yourself and your family against risk.

As a newcomer, based on the experiences in your home country, you may have a fair idea of certain types of insurance.

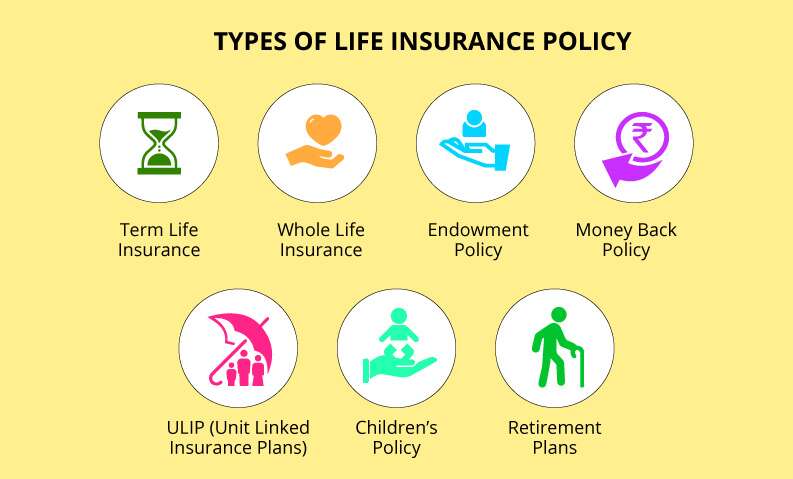

What are the different types of life insurance policies available in canada?

Once you arrive and are going through the settlement process, getting insurance in canada is one of the things you will need to consider and.

Life insurance can help you and your family prepare for the future.

All insurance types attract payment of a premium so how are the premiums different?

Life insurance premiums, like all forms of insurance, are based on the concept of risk.

That's all about types of life insurance in canada.

No matter what kind of insurance you need, we've got you covered.

Get instant health insurance, life insurance, travel.

For international experience canada , you must have health insurance for the entire time you are in canada.

In canada as elsewhere, insurance is an important way to make sure you're covered if you run into trouble.

In british columbia, on the other hand, both types of damage are covered by a public insurance corporation.

Whatever type of home insurance policy you get, we'll help walk you through each with tips and tricks so you can select the best coverage to suit your needs.

Click to learn more about each type of home insurance available in canada.

The displayed data on insurances by type shows results of the statista global consumer survey conducted in canada in 2020.

Travel insurance for canada is a must.

Do you have health insurance for canada?

Many newcomers are not eligible for canadian healthcare coverage when they first arrive.

The two main types of life insurance in canada are term insurance and permanent insurance.

Car insurance tends to cost more than life insurance, because of the longer payment period and multiple claim opportunities.

Largest lender network in canada.

Save time and money with loans canada.

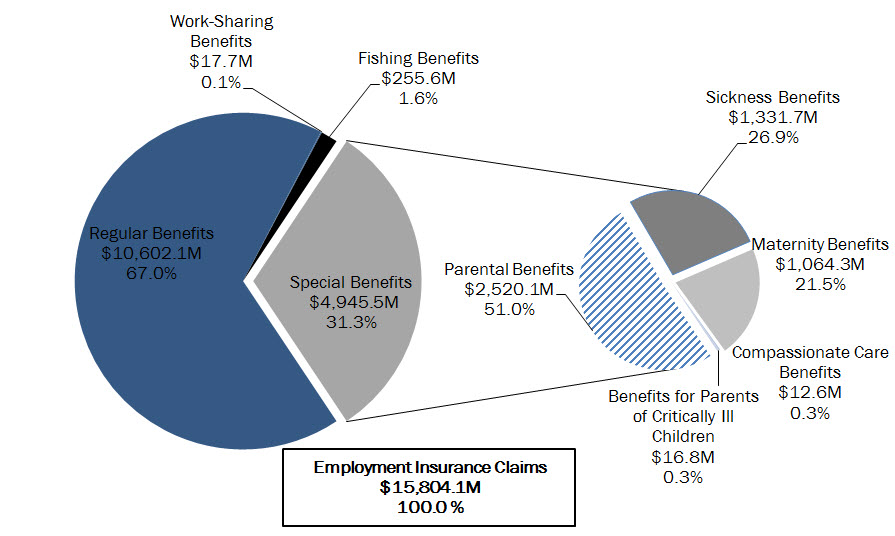

Canada's employment insurance program has a number of types of benefits available to those who are unable to work for different reasons.

The life insurance landscape in canada is quite unique.

The infographic below shows all the key players and their size, reflecting their assets under management (aum) based on life and wealth segments of the.

You will pay out of pocket for these plans and they can become quite expensive.

We offer different types of life insurance and we can help you find the solution that's right for you.

Insurance & reinsurance laws and regulations 2021.

International students in canada are required to obtain health insurance for the duration of their stay in canada.

Certain provinces offer provincial health coverage to certain international students, either for free or for a.

There are ample business insurance providers in canada depending on the type of insurances you need, you may also be able to find better deals when packaging multiple types of coverage together purchased from a single provider.

Where you live in canada, the type of vehicle you drive or own, and driver history are just a few of the different factors that can affect either the amount of coverage.

Yes, and most canadians do have it.

In fact, 25 million canadians are insured by supplementary medical insurance.

This insurance type offers benefits such as emergency medical evacuation, mental health, and sports injuries.

The rules and regulations for medical insurance in canada vary from one province to another.

Some of these provinces provide health insurance coverage to international students as well.

Allstate canada, canadian subsidiary of an american parent company.

Canadian association of blue cross plans.

Uban, Lawan Dengan Kulit KentangJangan Buang Silica Gel!Ternyata Tahan Kentut Bikin KeracunanTernyata Menikmati Alam Bebas Ada ManfaatnyaSehat Sekejap Dengan Es BatuTernyata Tidur Terbaik Cukup 2 Menit!8 Bahan Alami Detox Ternyata Ini Beda Basil Dan Kemangi!!Khasiat Luar Biasa Bawang Putih PanggangTernyata Einstein Sering Lupa Kunci MotorFind canadian insurance course to become a professional in insurance industry and join our team or get another second career, check all options! Insurance Types In Canada. We know that the insurance industry in canada is intimidating due in large part to its bureaucratic and complex nature but we are engaged to empower.

Waiting period to get public health insurance.

In canada, every province and territory offers a medical insurance plan that covers basic medical care, including doctor visits and some canadians purchase additional health insurance on their own.

This chart summarizes the main health insurance products.

Note that not all types of health.

Canadians and expatriates to canada in seek of health insurance get their pick of many providers.

Check out the best health insurance deals for canadians, here.

But there are currently 133 health insurance providers in canada.

Please note that availability of insured services and benefit limits will vary depending on the insurance plan of your a:

While the type of covered services as well as benefit limits vary greatly across different insurance providers as well as plans themselves, extended.

You will pay out of pocket for these plans and they can become quite expensive.

Do you have health insurance for canada?

Many newcomers are not eligible for canadian healthcare coverage when they first arrive.

Our partner, cigna, offers newcomers a range of comprehensive health insurance policies for peace of mind.

Depending on your entry status, you may be eligible for coverage under canada's publicly however, the health coverage integrated with travel insurance offers limited coverage compared to other insurance types and only provides.

Types of health insurance in canada.

There are several different types of health insurance available in canada, some of which may be more or less relevant to you depending on your stage in life.

Health insurance rates, like rates for any other type of insurance, will vary by provider and the only way to guarantee you get the right.

these canada health insurance plans are typically guaranteed renewable for life and globally portable, meaning that you will always be assured of the coverage you need.

This makes these types of plan perfect for individuals or familiesrelocating to canada.

Are health insurance benefits taxable?

There are three types of health insurance benefits in canada.

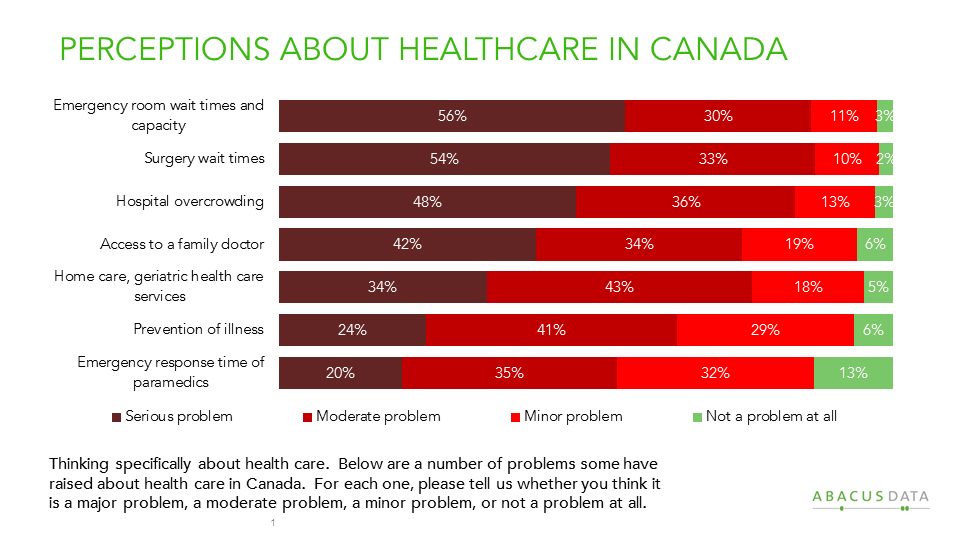

Healthcare in canada is delivered through the provincial and territorial systems of publicly funded health care, informally called medicare.

International students in canada are required to obtain health insurance for the duration of their stay in canada.

Certain provinces offer provincial health coverage to certain international students, either for free or for a.

This is meant for students who are pursuing their education in another country.

Some of these provinces provide health insurance.

Health insurance is personal insurance coverage that protects your savings from the many healthcare costs not covered by government plans.

There are 4 different types of health insurance products that provide the protection you need at each stage in life.

Compare rates from our partners and find a policy for your needs today.

Why should i get health insurance?

What are the different types of health insurance exist?

In canada, everyone benefits from free health care.

In fact, no matter what province you settle in, you are obligated to sign up for health insurance.

Your province will provide you with a health card that you can use to access different types of medical care:

There are three types of insurers:

Canadian healthcare is one of the areas that our country is proud of.

Medicine in canada is funded by the government and is best described as a system of insurance and health plans for ten provinces and three territories.

It is a mix and match type of health insurance.

It has a base number of products.

Blue cross is an insurance provider well known to canada.

For this province, there are several different plans.

There are two main types of canadian health insurance:

Group insurance) and individual health insurance (i.e.

Provincial healthcare plans in canada cover most prescription drug costs once a person.

In canada, the health system is public.

It aims to serve everyone equally and it is governed by the canada health act.

While provincial plans provide coverage, there are often significant gaps where out of pocket payments are required.

Publicly funded health care is the type of health insurance in canada.

Most critical condition and basic needs are free for every resident and citizen of capitated health insurance is when a physician gets paid a specified dollar amount, for a given time period, to take care of the medical needs of a.

As an international student with a valid study visa, you should be eligible for a provincial health care card so that you may access these services.

Applying for and using your.

Is health insurance necessary for me in canada?

This type of health insurance for employees is a benefit from company owners.

Plan coverage may differ between companies.

So you have to read the fine print once you get accepted at.

If your insurance policy is valid for less time than your expected stay in canada, you may be issued a work permit that expires at the same time as your insurance.

The canadian life and health insurance association provides information on the different types and costs of long term care.

The canadian life and health insurance association provides information on the different types and costs of long term care. Insurance Types In Canada. Get a headstart on personal finances in canada.Buat Sendiri Minuman Detoxmu!!Sensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat RamadhanTernyata Inilah Makanan Indonesia Yang Tertulis Dalam PrasastiPecel Pitik, Kuliner Sakral Suku Using BanyuwangiResep Beef Teriyaki Ala CeritaKuliner5 Makanan Pencegah Gangguan PendengaranSejarah Prasmanan Alias All You Can EatBir Pletok, Bir Halal Betawi3 Jenis Daging Bahan Bakso TerbaikSegarnya Carica, Buah Dataran Tinggi Penuh Khasiat

Comments

Post a Comment