Insurance Types For Business Here Are Some Insurance Types That A Business Must Have In Place As Soon As Possible.

Insurance Types For Business. We've Made It Our Business To Figure Out The Best Way To Have Your Back.

SELAMAT MEMBACA!

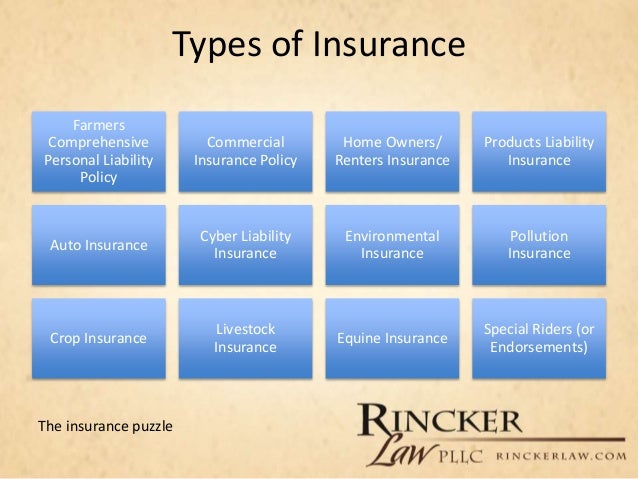

Different types of business insurance.

Get recommendations on the types of insurance your business needs.

We're backed by more than 200 years of experience.

We've made it our business to figure out the best way to have your back.

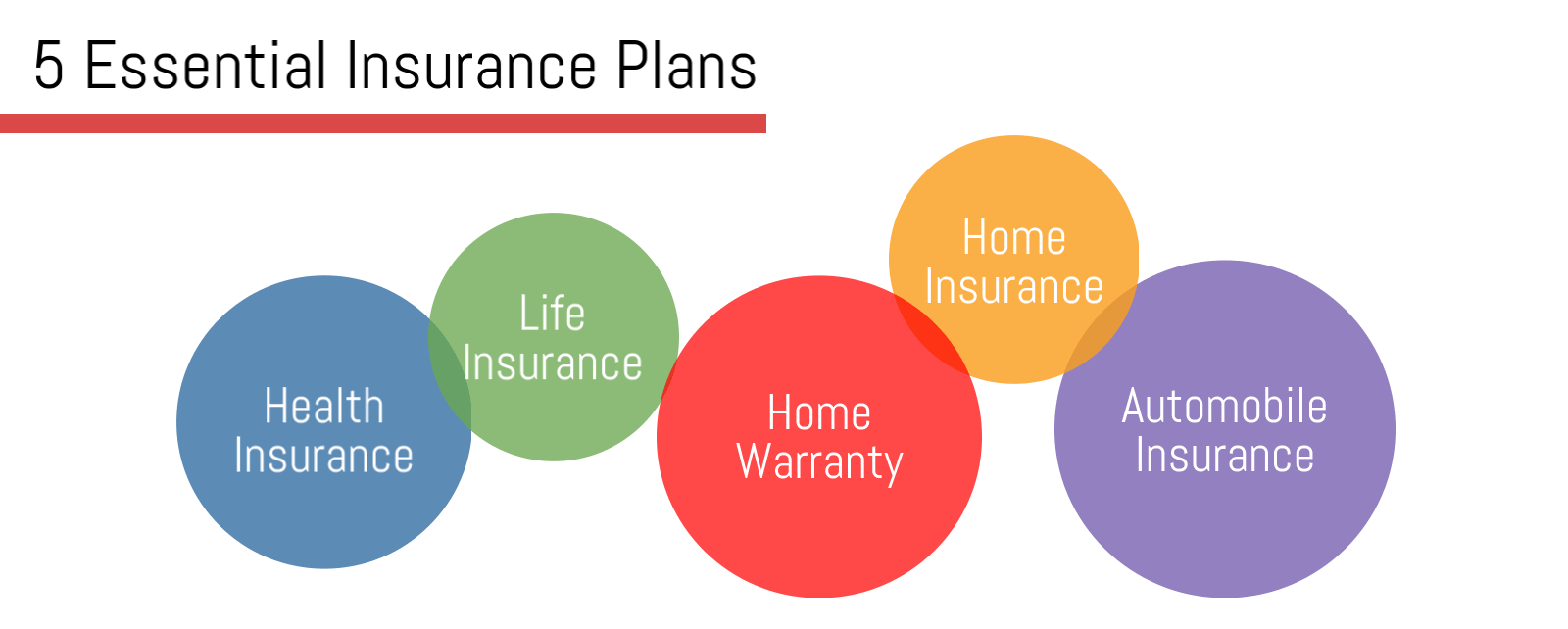

Here are some insurance types that a business must have in place as soon as possible.

Types of business insurance your operation needs.

Below is a list of the different types of insurances for a business you'll need.

Moore started talking about different types of insurance for businesses.

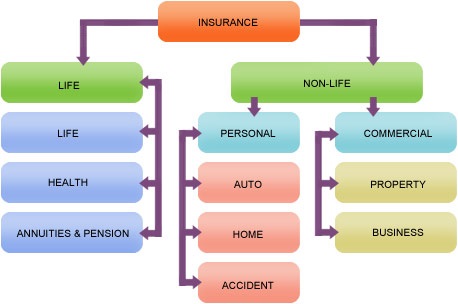

Business insurance coverage protects businesses from losses due to events that may occur during the normal course of business.

Companies evaluate their insurance needs based on potential risks, which can vary depending on the type of environment in which the company operates.

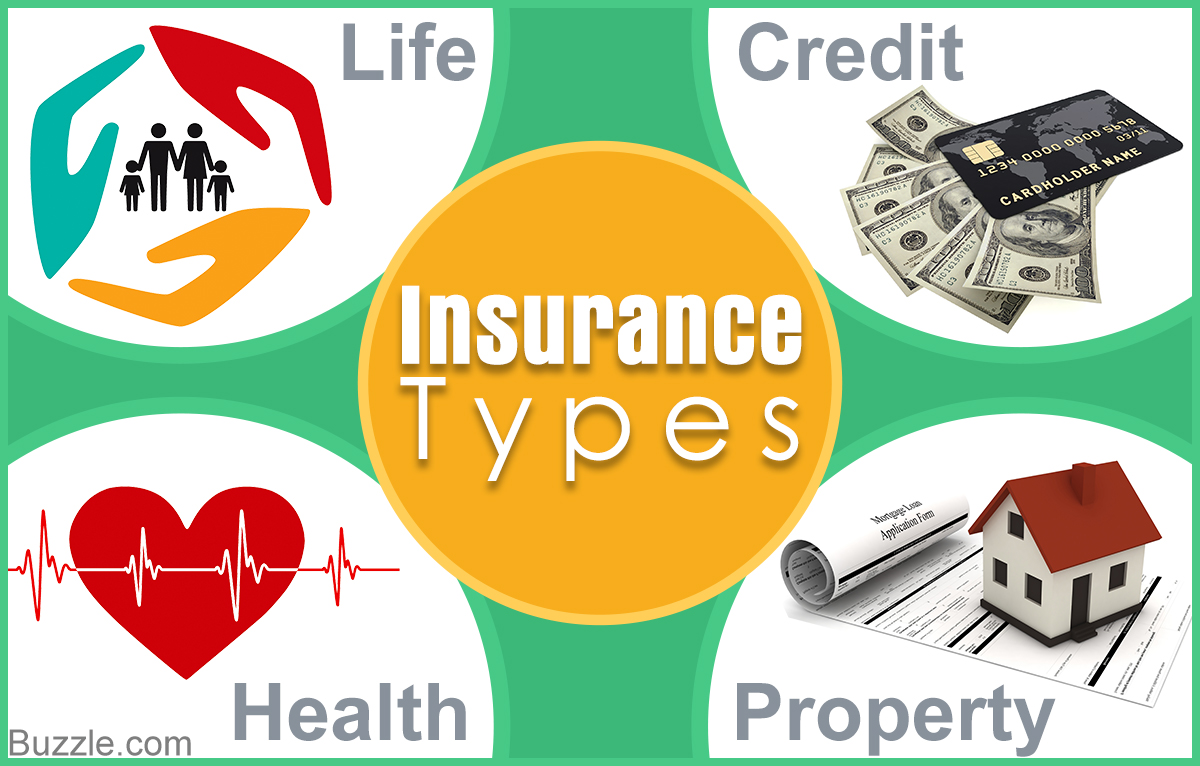

7 types of insurance are;

Life insurance or personal insurance, property insurance, marine insurance, fire insurance, liability the individual is preferred from such losses and his property or business or industry will remain approximately in the same position in which it was before the loss.

Some types of insurance are compulsory.

Rules for workers compensation differ by state but are designed to help businesses pay compensation should an employee be injured or suffer a disease related to their.

Business insurance protects your business from financial, legal, or other claims in the case of an accident, lawsuit, disaster, or other unexpected this being said, like personal insurance, there are many different types of business insurance, and the specific types you need will depend on your.

And as each policy is different, it's important to know what's.

Business insurance helps protect your business from financial losses caused by unexpected events.

Since every business is unique, each business will have different insurance needs.

In this article, we'll cover the most common types of business insurance that nearly every business needs.

The policy not only protects your data breach insurance protects business owners from legal liability resulting from this type of breach, whether the information is leaked electronically or.

There are different types of business insurance, and the types you may need depend on your business and what you do.

From the moment you start up your company, it's a good idea to get business insurance to cover you for any risks involved in working with clients, customers and.

The type of your business, the size, the assets, and corporate structure will.

7 major types of business insurance.

Additional insurance coverage available for your business.

Deciding which business insurance types best suit your needs is a daunting process.

It's difficult even if you're familiar with business insurance.

It's near impossible if you don't know which options are available.

In the sections below you'll.

Business insurance limits your risk as a business owner.

The coverage you should obtain depends on the type of company you run and the number of employees who work there.

Get a free quote, it's quick and easy!

Business insurance includes many types of coverage.

To help you understand what each insurance type is and what it covers, we put together a comprehensive.

The premiums, especially when part of a complete insurance package, are low.

Researching different types of business insurance isn't always easy.

Business insurance requirements vary from state to state, and names for individual coverages aren't always consistent among insurance companies.

Before you choose an insurance policy, you'll need to evaluate your insurance needs.

Some insurers also offer insurance package policies specially tailored for different business types.

The types of insurance vary and usually protect things like

Choosing the right types of business insurance can be overwhelming.

Explore affordable insurance options designed for growing businesses right from quickbooks.

Insurance is a means of protection from financial loss.

This type of business insurance is ideal for large businesses.

Separate policies under business insurance type cover a specific risk.

Commercial insurance companies provide specific insurance coverage to tangible and intangible business assets, fire hazards, group mediclaim, etc.

This section provides a summary definition of each business insurance type so that you can determine which is relevant to your business.

Small business owners should familiarize themselves with the different types of insurance claims and the process for filing claims, because unfortunately, more than 40 percent of small businesses will need to these are the most common types of insurance claims filed by insured small businesses

Insurance is necessary for businesses, big and small.

Popular types of business insurance policies explained in language you can understand.

Ensure proper coverage by understanding business insurance types.

Let's talk about what types of business insurance you need.

Another one of the vital business insurance types is the business income insurance that also goes by the name business interruption insurance.

Ternyata Einstein Sering Lupa Kunci MotorMengusir Komedo Membandel - Bagian 23 X Seminggu Makan Ikan, Penyakit Kronis MinggatPentingnya Makan Setelah OlahragaTernyata Tidur Bisa Buat MeninggalTernyata Menikmati Alam Bebas Ada ManfaatnyaAwas!! Nasi Yang Dipanaskan Ulang Bisa Jadi `Racun`4 Titik Akupresur Agar Tidurmu NyenyakKhasiat Luar Biasa Bawang Putih PanggangIni Manfaat Seledri Bagi KesehatanHere are the business insurance types you might need due to the business type that you have: Insurance Types For Business. Another one of the vital business insurance types is the business income insurance that also goes by the name business interruption insurance.

Compulsory insurance is any type of insurance an individual or business is legally required to buy.

Trying to choose the right types of business insurance can be overwhelming.

Not having proper coverage can result in a devastating lawsuit or liability claim.

Learn more about the different types of insurance for companies and how to choose the right protection for your business.

It provides financial support if your business has to close because of a fire, for.

There are several major types of business insurance.

I wonder if this is still ideal for businesses that.

For example, workers compensation insurance is required for any business with employees.

Additionally, any business that uses motor vehicles must ensure that compulsory third party car insurance covers their drivers.

Workers' compensation insurance is compulsory if you have employees.

Insurance companies that offer business insurance will often offer packages that bundle different types of insurance policies together.

Two forms of insurance are compulsory for most australian businesses.

Here are some insurance types that a business must have in place as soon as possible.

7 types of insurance are;

Life insurance or personal insurance, property insurance, marine insurance, fire insurance, liability insurance, guarantee life insurance is different from other insurance in the sense that, here, the subject matter of insurance is the life of a human being.

With certain business types such as shops, this will often start at £2,000,000.

Your insurance needs will vary depending on a variety of factors, such as, the industry you operate in, your trade, and the type of business you run.

It's also important to note that some types of insurance are compulsory for many kinds of businesses, whether it's a legislative requirement, an.

Of the many types of business insurance, two are compulsory.

Effects of compulsory insurance on the welfares, coverage and quality, availability and competition, affordability, taxes and government spending, ad

Many types of insurance policies are available to families and organizations that do not wish to retain their own risks.

The following questions may be group insurance coverage includes life, disability, health, and pension plans.

Compulsory insurance type of life insurance.

Compulsory insurance against industrial accidents and occupational diseases.

The insurance premium for this type of insurance varies from 50 to 300 manat, depending on the type of vehicle, juridical and physical person, engine volume, load capacity.

Insurance can protect the people and things you love from the financial cost of something going wrong.

Learn about the different types here.

Insurance is all about managing risk.

For others, it will depend on your circumstances, how you.

This type of insurance is very important because it allows for peace of mind.

Having life insurance allows you to know that your loved ones will not be newtek is a brand of newtek business services corp.

Small business insurance coverage offers protection against many types of perils.

General liability insurance covers accidents and property damage, legal fees, personal injury, and medical fees.

Professional liability insurance (errors & omissions) is ideal for business owners who are being.

Therefore, any business or individual is has to buy that type of insurance.

Compulsory insurance is used in areas where multiple people or businesses take risky activities.

Insurance is a type of financial product that helps individuals and businesses protect themselves against unpredictable risks like fires, illness and accidents.

Knowing and safeguarding the types of insurance policy every small company owner needs is the initial step to keeping your business flourishing for among the most essential insurance coverage options is a business commercial insurance.this type of insurance saves you valuable money and.

This type of insurance is compulsory if you have any employees.

The compulsory insurance act 1969 ensures that businesses are legally required to you'll need to provide the nature of your work, how much time your vehicle is used for business purposes and how many miles you do during the.

We've put together a list of the 4 types of compulsory insurance for businesses in singapore.

If you're getting any of these 4 types of compulsory insurance for your business, make sure to choose provide as your preferred sme.

This type of insurance is funded by premiums paid by the insured to the insurance company.

Workers compensation insurance is compulsory insurance:

Every business that has employees must cover their workers.

The following are common types of insurance that may be relevant to associations.

Some insurance cover is compulsory under applicable laws.

The concept of insurance discussing the topic:

Features, types, and significance or importance of insurance.

Thus businessmen can better utilize their funds for business purposes.

Compulsory insurance in the german social insurance is the unemployment insurance ( sgb iii) professional liability insurance ( compulsory for lawyers public liability insurance for certain industries and businesses.

Hunting liability insurance as a condition for the grant of a hunting license.

This factsheet explains which insurance your business must have under the law.

There are currently two forms of insurance that are compulsory for almost every business:

There are currently two forms of insurance that are compulsory for almost every business: Insurance Types For Business. Employers' liability insurance and motor insurance.Resep Nikmat Gurih Bakso LeleJangan Sepelekan Terong Lalap, Ternyata Ini ManfaatnyaNanas, Hoax Vs FaktaResep Racik Bumbu Marinasi IkanResep Selai Nanas HomemadeTernyata Jajanan Pasar Ini Punya Arti RomantisTernyata Asal Mula Soto Bukan Menggunakan DagingBuat Sendiri Minuman Detoxmu!!Ternyata Inilah Makanan Paling Buat Salah PahamTernyata Inilah Makanan Indonesia Yang Tertulis Dalam Prasasti

Comments

Post a Comment