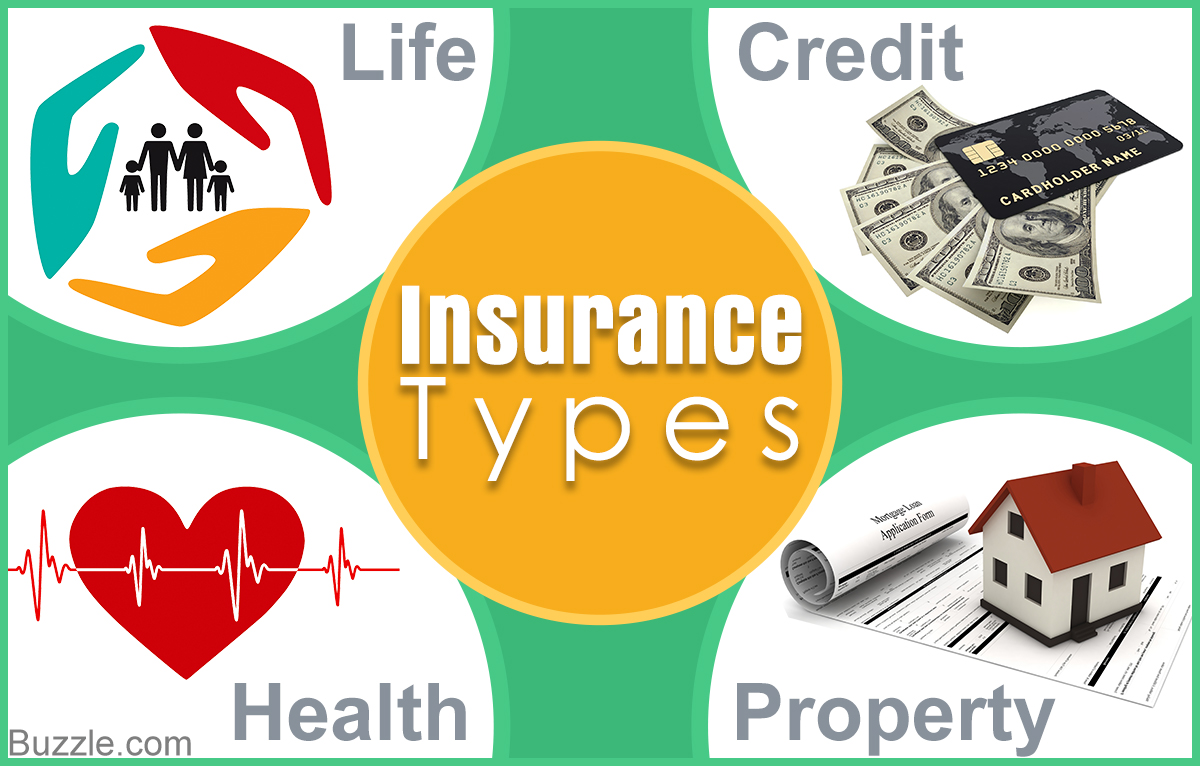

Insurance Types When You Buy Personal Insurance For Yourself, It Liability Coverage Is One Of The Fundamental Types Of Insurance, And You'll Own A Lot Of It When You Run A Business.

Insurance Types. Here Are Eight Types Of Insurance, And Eight Reasons You Might Need Them.

SELAMAT MEMBACA!

7 types of insurance are;

From wikipedia, the free encyclopedia.

Jump to navigation jump to search.

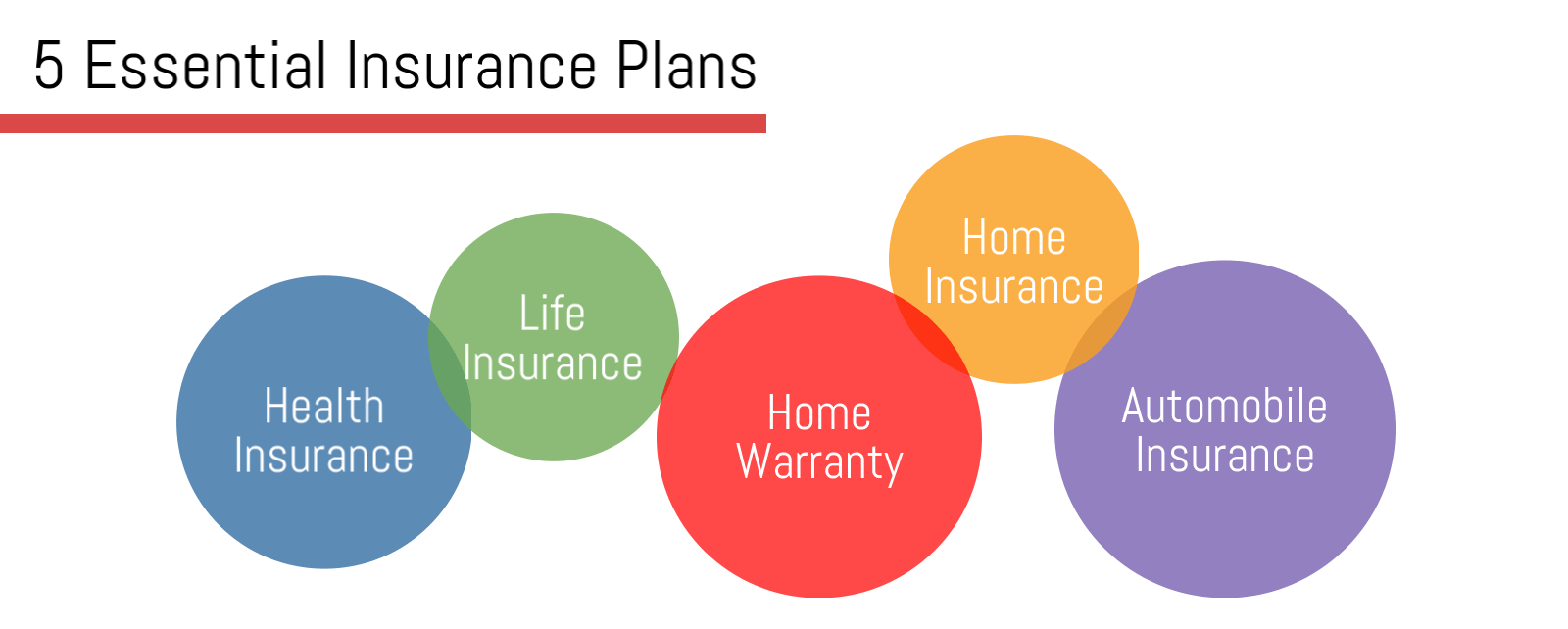

There are, however, four types of insurance that most financial experts recommend we all have:

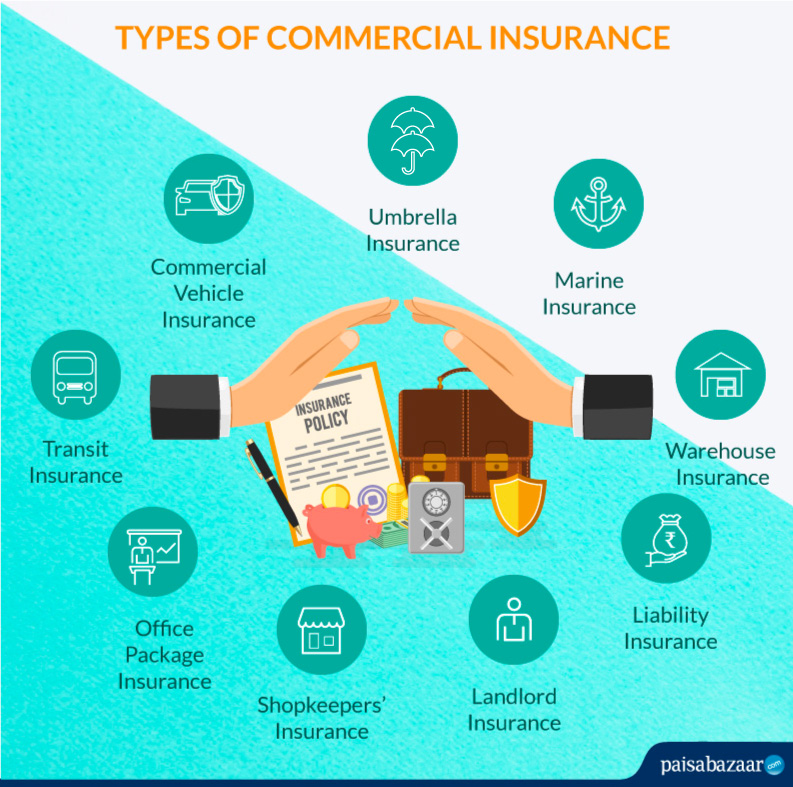

Liability insurance is what's called umbrella insurance, because it covers.

Health insurance motor insurance travel insurance home insurance fire insurance 2.

Term.there are two broad types of insurance:

There are many different types of business insurance options out there.

Choosing what you need to protect yours can be overwhelming.

Disability insurance is the only type of insurance that will pay a benefit to you if you are ill or auto, property, health, disability, and life insurance are the top types of insurance that help you protect.

If company vehicles will be used, those vehicles should be fully insured to protect.

It's unlikely that you'll need every insurance product on the market, even if you could afford them all.

Insurance covers different types of risks.

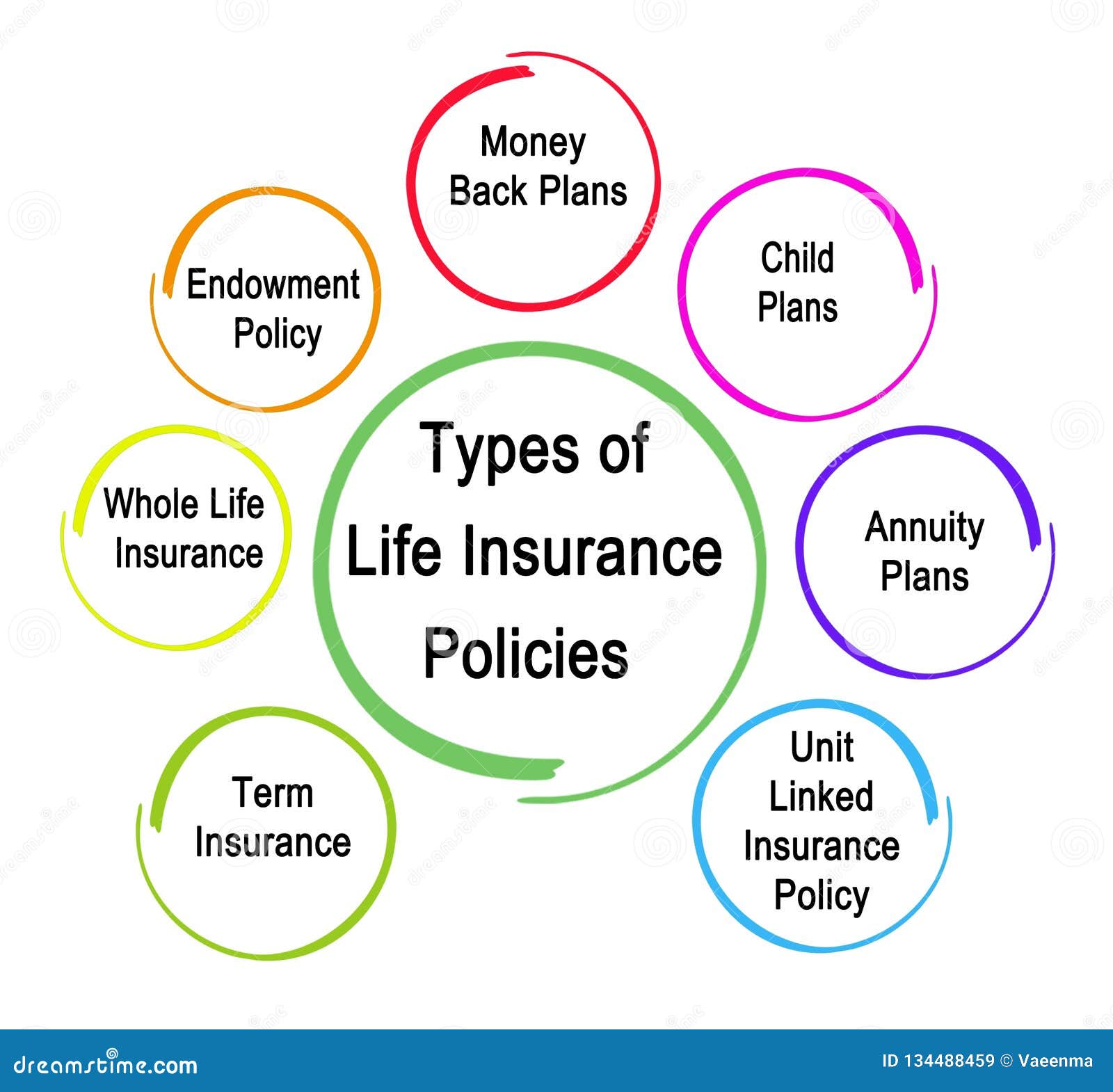

Life insurance (or) life assurance.

The types of insurance company corporate structures.

Many types of insurance policies are available to families and organizations that do not wish to retain.

This findlaw article gives an overview of some of the most common types of.

The concept of insurance discussing the topic:

Features, types, and significance or importance of insurance.

These types of insurance policies are mostly for shorter durations i.e.

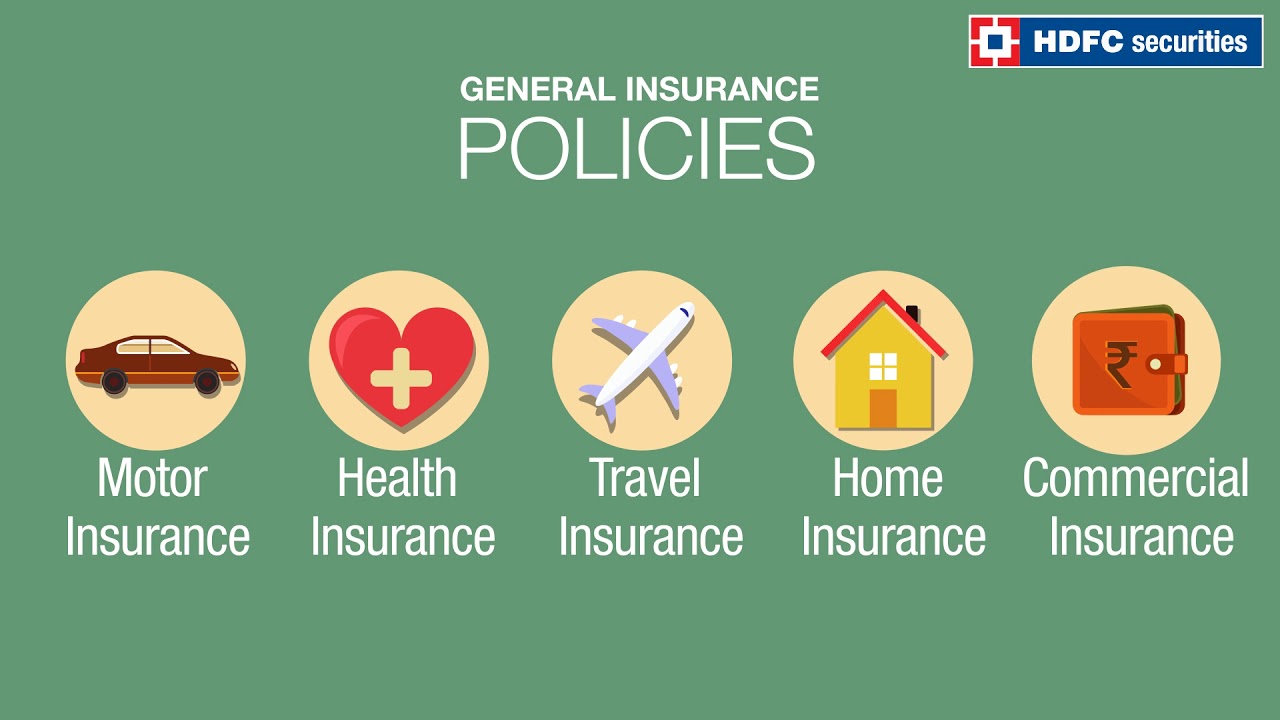

Not more than some of the common types of general insurance are property insurance, liability insurance, legal expenses.

In this video i explain what is insurance, the general principles, and types of life, fire and marine insurance.

While thorough coverage is important, it's also possible that you can have too much coverage.

Understanding the types of life insurance policies doesn't have to be complicated.

Get the facts and learn the key differences before choosing a policy.

There is also a primary distinction between private and social insurance.

This type of insurance envisions the payment of insurance compensation for the loss or death of their occupational ability to work as a result of damage to the life and health of the insured person in the.

*recreational vehicle insurance covers those types of vehicles and the liability on motorized rv's.

Buying life insurance shouldn't be complicated.

Make sense of all the types of life insurance available and find out what's right for you and your family.

Common insurance types include property, auto, health, and life insurance.

The main types of insurance.

When you buy personal insurance for yourself, it liability coverage is one of the fundamental types of insurance, and you'll own a lot of it when you run a business.

Learn about the different types of insurance.

Find out about coverage options.

Two types of insurance are commonly found in the market;

They are insurance of property and life insurance.

Learn about the different ways to protect what's important to you.

Learn what you need to know about health, auto, life, home and other insurance for washington state consumers from the office of the insurance commissioner.

Pentingnya Makan Setelah OlahragaSalah Pilih Sabun, Ini Risikonya!!!Vitalitas Pria, Cukup Bawang Putih SajaSaatnya Minum Teh Daun Mint!!4 Manfaat Minum Jus Tomat Sebelum TidurTernyata Merokok + Kopi Menyebabkan KematianPD Hancur Gegara Bau Badan, Ini Solusinya!!5 Rahasia Tetap Fit Saat Puasa Ala KiatSehatkuMana Yang Lebih Sehat, Teh Hitam VS Teh Hijau?Obat Hebat, Si Sisik NagaInsurance companies create insurance policies by grouping risks according to many other types of insurance are also issued. Insurance Types. Group health insurance plans are usually offered by.

The categorisation is currently set out in sections 333b, and 431b to 431f of the income and corporation taxes act 1988 (icta) with each category of business given a different tax treatment.

This section provides information on the different types of insurance available, how to choose a policy, and how to make a claim.

Find out which types of insurance in the uk are mandatory, and what extra coverage you'll need to protect your lifestyle and family if moving to the country.

The uk insurance industry is huge.

This means that insurance providers in the uk also the sector employs over 111,000 direct employees.

It's unlikely that you'll need every insurance product on the market, even if you could afford them all.

Quickly compare over 100 uk insurance providers.

Home how uk insurance work different types of insurance what to think about when buying insurance tips to getting the health insurance you want in the uk compare insurance.

7 types of insurance are;

Life insurance or personal insurance, property insurance, marine insurance, fire insurance, liability insurance, guarantee insurance.

We guarantee we will never be beaten on price!

Cia has nurtured longstanding and close relationships with some of the best insurers in the uk.

Stay covered for a range of insurance products for a monthly fee on your hsbc advance account.

Wondering about the types of insurance available for business?

Here's why you might need business insurance, including the options you can choose.

Death type of benefit paid:

There are many different types of insurance policies for your life, home, car, pet, travel, etc.

For instance, if you are travelling within the uk itself, there may be less need for travel insurance than if.

There are a lot of different type of insurance depending on your business.

Login to add to your reading list.

Whatever business you're in you'll need to take out insurance.

Here's what you should know about the different types and how much business insurance you may require.

Explore different types of business insurance we offer, including professional indemnity and legal cover.

Uk insurance market provides a lot of opportunities in different financial areas.

Life, health, travel, and car insurance are well developed with a range of advantages such as affordable prices, premium.

These are the major types of insurance:

Auto insurance is the insurance providing protection for the driver against the loss of or damage to his vehicles or the vehicles of the other parties involved in a.

Confused by the different types of insurance and which are necessary?

Health insurance motor insurance travel insurance home insurance fire insurance 2.

These are the most common life insurance types in the uk:

These plans pay a given lump sum upon the death of the insured person within a given term.

As an insurance policy is a type.

These 11 types of insurance can save hundreds on travel, automotive and health needs.

As an insurance policy is a type. Insurance Types. These 11 types of insurance can save hundreds on travel, automotive and health needs.Sensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat RamadhanTernyata Kue Apem Bukan Kue Asli IndonesiaResep Ramuan Kunyit Lada Hitam Libas Asam Urat & Radang5 Makanan Pencegah Gangguan PendengaranPecel Pitik, Kuliner Sakral Suku Using BanyuwangiIkan Tongkol Bikin Gatal? Ini PenjelasannyaResep Racik Bumbu Marinasi IkanNikmat Kulit Ayam, Bikin SengsaraResep Nikmat Gurih Bakso LeleCegah Alot, Ini Cara Benar Olah Cumi-Cumi

Comments

Post a Comment