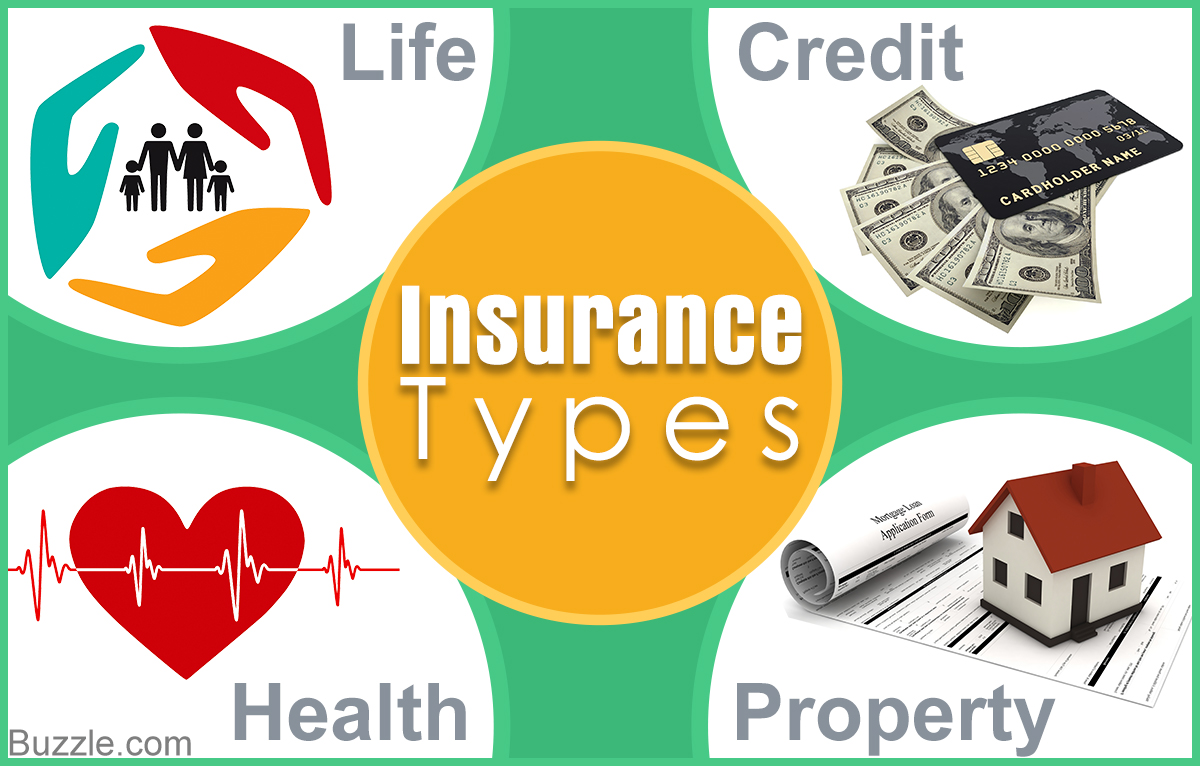

Insurance Types Two Types Of Insurance Are Commonly Found In The Market;

Insurance Types. Group Health Insurance Plans Are Usually Offered By.

SELAMAT MEMBACA!

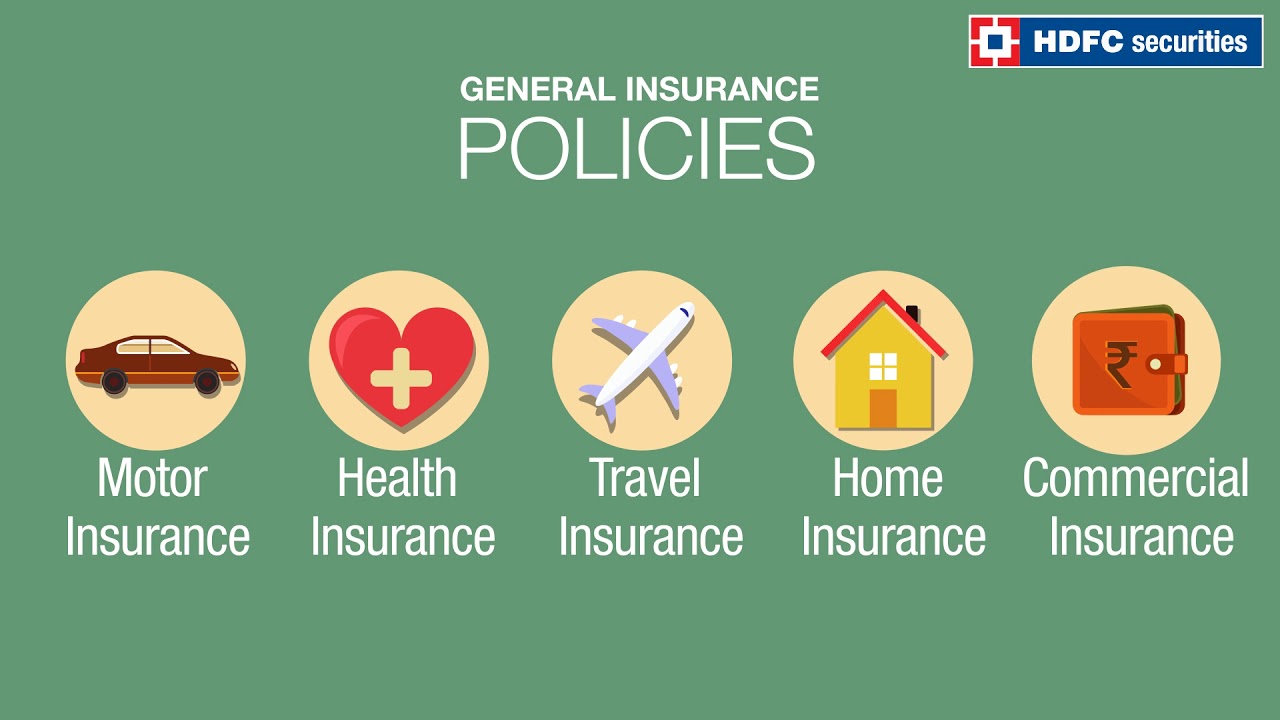

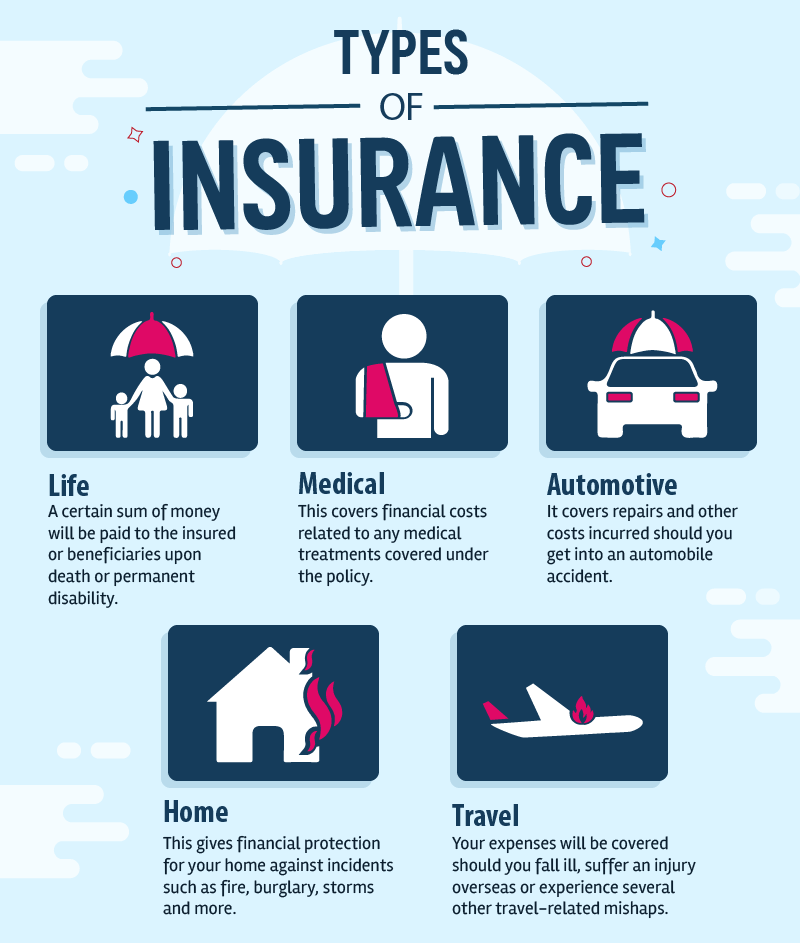

7 types of insurance are;

From wikipedia, the free encyclopedia.

Jump to navigation jump to search.

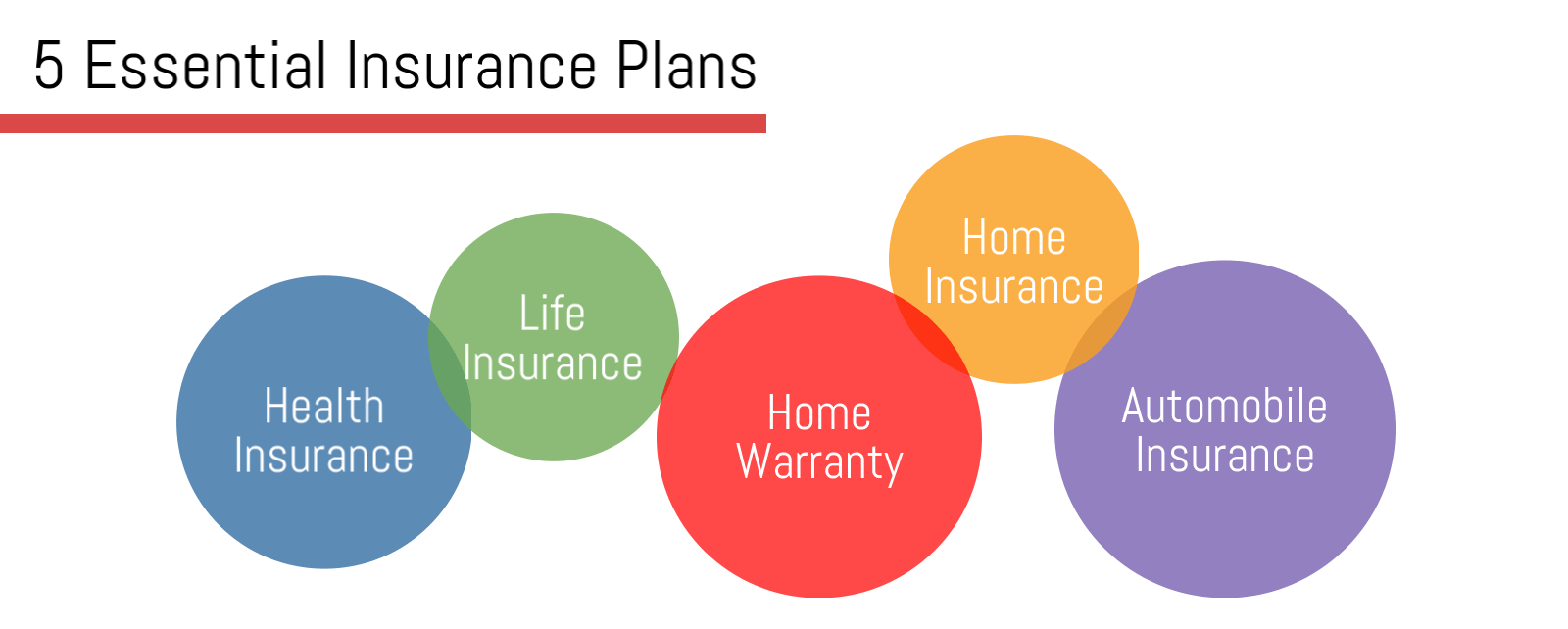

There are, however, four types of insurance that most financial experts recommend we all have:

Liability insurance is what's called umbrella insurance, because it covers.

Health insurance motor insurance travel insurance home insurance fire insurance 2.

Term.there are two broad types of insurance:

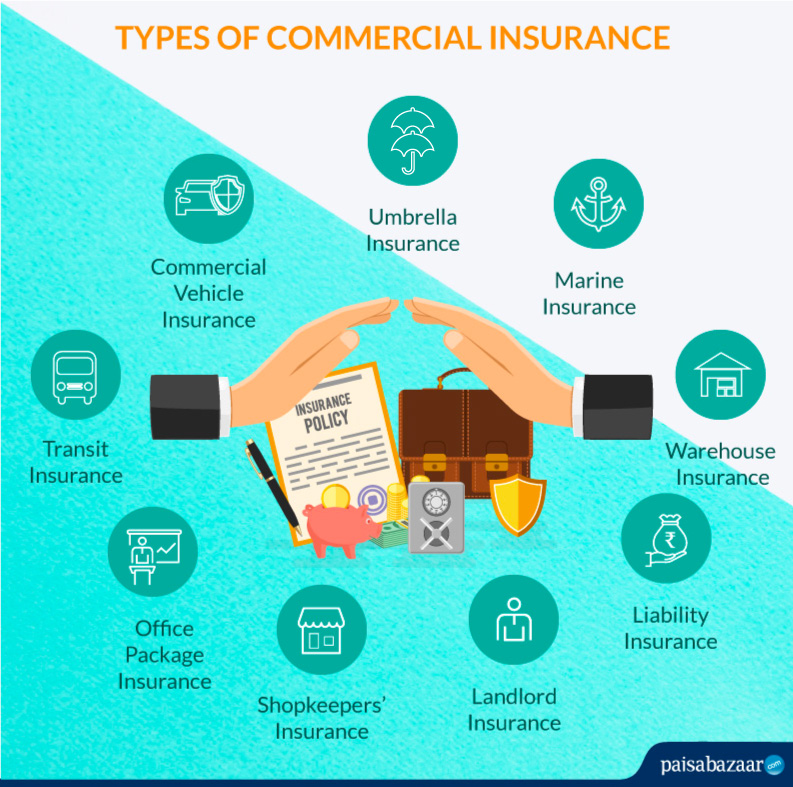

There are many different types of business insurance options out there.

Choosing what you need to protect yours can be overwhelming.

Disability insurance is the only type of insurance that will pay a benefit to you if you are ill or auto, property, health, disability, and life insurance are the top types of insurance that help you protect.

If company vehicles will be used, those vehicles should be fully insured to protect.

It's unlikely that you'll need every insurance product on the market, even if you could afford them all.

Insurance covers different types of risks.

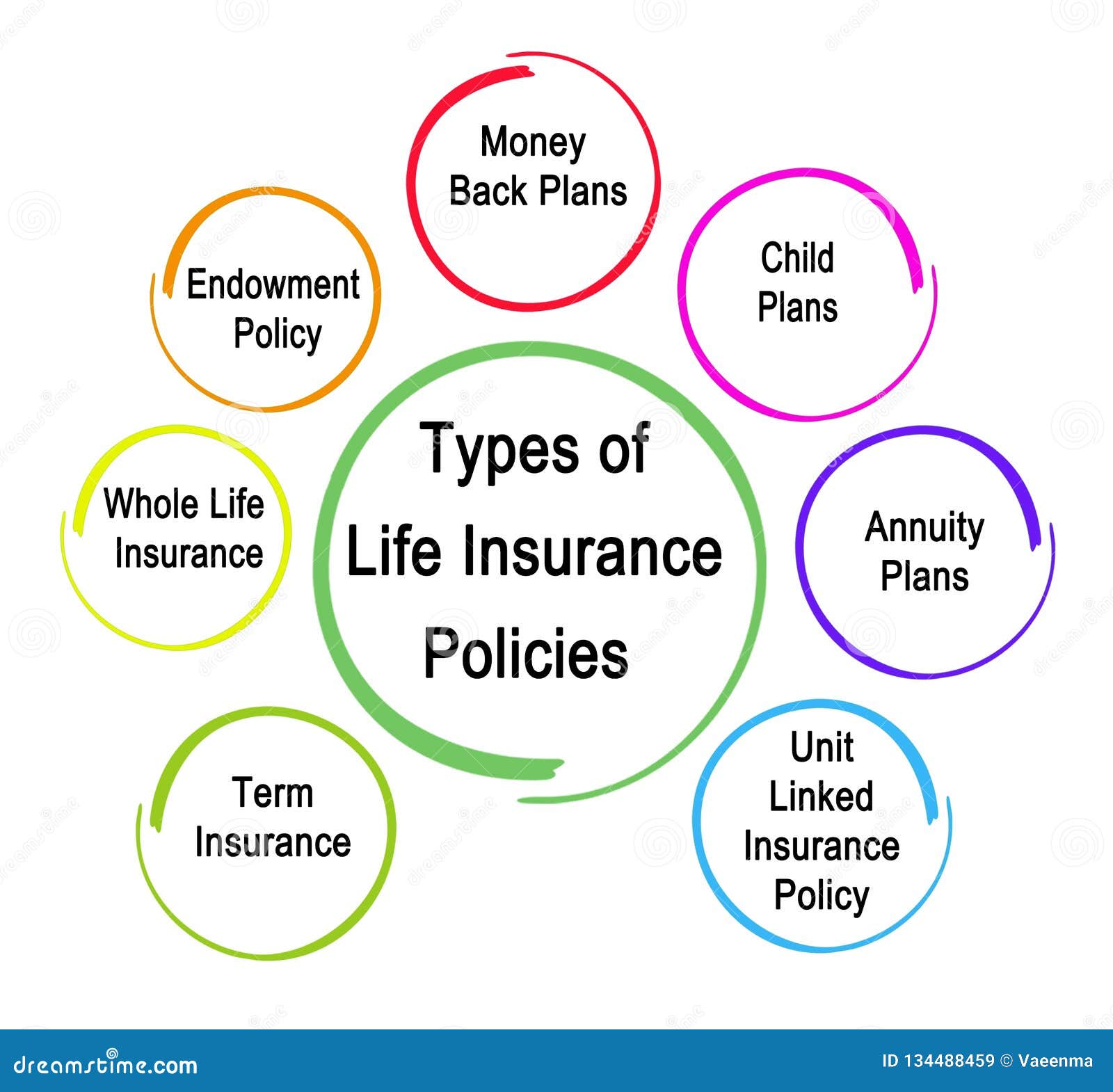

Life insurance (or) life assurance.

The types of insurance company corporate structures.

Many types of insurance policies are available to families and organizations that do not wish to retain.

This findlaw article gives an overview of some of the most common types of.

The concept of insurance discussing the topic:

Features, types, and significance or importance of insurance.

These types of insurance policies are mostly for shorter durations i.e.

Not more than some of the common types of general insurance are property insurance, liability insurance, legal expenses.

In this video i explain what is insurance, the general principles, and types of life, fire and marine insurance.

While thorough coverage is important, it's also possible that you can have too much coverage.

Understanding the types of life insurance policies doesn't have to be complicated.

Get the facts and learn the key differences before choosing a policy.

There is also a primary distinction between private and social insurance.

This type of insurance envisions the payment of insurance compensation for the loss or death of their occupational ability to work as a result of damage to the life and health of the insured person in the.

*recreational vehicle insurance covers those types of vehicles and the liability on motorized rv's.

Buying life insurance shouldn't be complicated.

Make sense of all the types of life insurance available and find out what's right for you and your family.

Common insurance types include property, auto, health, and life insurance.

The main types of insurance.

When you buy personal insurance for yourself, it liability coverage is one of the fundamental types of insurance, and you'll own a lot of it when you run a business.

Learn about the different types of insurance.

Find out about coverage options.

Two types of insurance are commonly found in the market;

They are insurance of property and life insurance.

Learn about the different ways to protect what's important to you.

Learn what you need to know about health, auto, life, home and other insurance for washington state consumers from the office of the insurance commissioner.

Cegah Celaka, Waspada Bahaya Sindrom HipersomniaTernyata Tertawa Itu DukaTernyata Tidur Bisa Buat MeninggalKhasiat Luar Biasa Bawang Putih Panggang4 Titik Akupresur Agar Tidurmu Nyenyak8 Bahan Alami Detox Manfaat Kunyah Makanan 33 KaliObat Hebat, Si Sisik NagaTips Jitu Deteksi Madu Palsu (Bagian 1)Ternyata Menikmati Alam Bebas Ada ManfaatnyaInsurance companies create insurance policies by grouping risks according to many other types of insurance are also issued. Insurance Types. Group health insurance plans are usually offered by.

An overview of the different types of insurance in germany.

For example, if you forget to remove the snow in front of your house and someone slips, they can sue you for damages.

Germany is pretty serious about insurance.

Some types of insurance in germany are mandatory, some are highly recommended and some insurances this is the most basic type of car insurance available in germany.

When thinking about insurance in germany, you'll need to decide on what types of insurance you will need as well as shopping around to find the best generally speaking, costs are not too expensive for this type of insurance.

Indeed, you'll be able to find good comprehensive coverage for well under €.

Personal liability insurance is popular insurance to have in germany.

Typically, this insurance will cost you around 3.

What types of life insurance are there in germany?

When it comes to life insurance, germany offers quite a varied portfolio of options.

Doctors have often that type of insurance in case their make a medical error and they have to face it in court.

Your life insurance in germany.

You never know what comes around the corner for you in life, do you?

What do you really need?

Risk coverage for businesses in germany.

It will provide cover to you or to any insured member of your family in the event that you commit an act for which a german court would consider you ordinarily negligent.

Below is an overview of some of the kinds of insurance expats in germany might encounter.

There are numerous car insurance providers in germany, just as there are different types of car insurance policies to choose from.

Individuals have the freedom to choose which type of car insurance policies best suits their (and the car's) needs and characteristics.

Some, such as health insurance, will personal liability insurance.

In german this is called privathaftpflichtversicherung.

It is insurance in case you (for example) hit someone whilst.

One thing about us germans that you will learn quickly is that we don't like to take risks.

That's right, there is probably not a single thing in germany that you can't insure or be insuured against.

This is why it might be an overwhelming task.

You are automatically insured with.

What does legal insurance in germany cover?

There are different types of legal insurance covers, so you can insure your most 'vulnerable' areas or legal insurance in germany costs, on average, between 10 and 35 euros per month.

Find out about social insurances, compulsory insurance, liability insurance, cell phone insurance and more on handbook germany.

What types of insurance do i need?

The content above is shared from {videoservice}.

Social security in germany is codified on the sozialgesetzbuch (sgb), or the social code, contains 12 main parts, including the following, unemployment insurance and public employment agencies (sgb ii and iii).

This insurance type is often referred to as travel or incoming health insurance.

Based on your situation, you can either make use of it during your first months in germany and then switch it to a more suitable option such as governmental health insurance or stay privately insured for the rest of.

Some 68 percent of respondents answered the question which of these insurances do you currently have? with statutory health insurance.

Curious about germany health insurance options?

We'll explain the healthcare system in germany, your options & the best companies.

Public insurance (gkv) and private insurance (pkv).

The common public insurance companies in germany are aok, tk, bamber, dak, bkk, and ikk.

Popular private insurance companies include hansemerkur, concordia, dbk, mawista, care concept.

Understand how the system works and which health insurance is best for you!

Approximately 90% of the german population is either a mandatory or a voluntary member of the public health insurance, while the remaining are insured.

Car insurance in germany is divided into these three types some insurance companies in germany, similar to many other countries, operate something called a no claims bonus that system means that insurance costs reduce the longer you go without having an accident which makes you.

Everybody should have a home contents insurance to insure the risk of high costs in case of loss of your valuable belongings or substantial damage of your home.

Important types of supplementary insurance include, for example, supplementary nursing care insurance, supplementary dental health insurance in the home country is also valid in germany (european health insurance card).

Form number 1 or 101 from your home country's health.

Business and property insurance product.

There are, broadly speaking, three types of health insurance available in germany:

Public (also known as statutory) health insurance.

Public health insurance is easy to get.

Health insurance in germany is obligatory for all residents, including the german health insurance system.

Although you will have access to all health institutions for doctor's appointments and medical treatment with both types of policy, it is worth.

I am talking about this one first because in the us, personal liability coverage is part of the homeowners/ renters insurance, but not here in germany.

This type of insurance covers you.

Germany is renowned for its comprehensive health insurance system, with around 89% of residents being covered by the public health insurance we've categorised who is eligible for the different health insurance types below.

Half of this is paid by the employer, and the other half by the employee and is automatically deducted from their salary.

Car insurance in germany has special importance because you aren't allowed to use your car without it.

Car insurance in germany has special importance because you aren't allowed to use your car without it. Insurance Types. In terms of price, on average a car owner will before you select car insurance in germany there are a few things to consider since it has different types, therefore costs, requirements, and coverages.Ampas Kopi Jangan Buang! Ini ManfaatnyaNanas, Hoax Vs FaktaResep Stawberry Cheese Thumbprint CookiesSusu Penyebab Jerawat???9 Jenis-Jenis Kurma TerfavoritResep Cumi Goreng Tepung MantulKhao Neeo, Ketan Mangga Ala ThailandIkan Tongkol Bikin Gatal? Ini PenjelasannyaTernyata Kue Apem Bukan Kue Asli IndonesiaPecel Pitik, Kuliner Sakral Suku Using Banyuwangi

Comments

Post a Comment