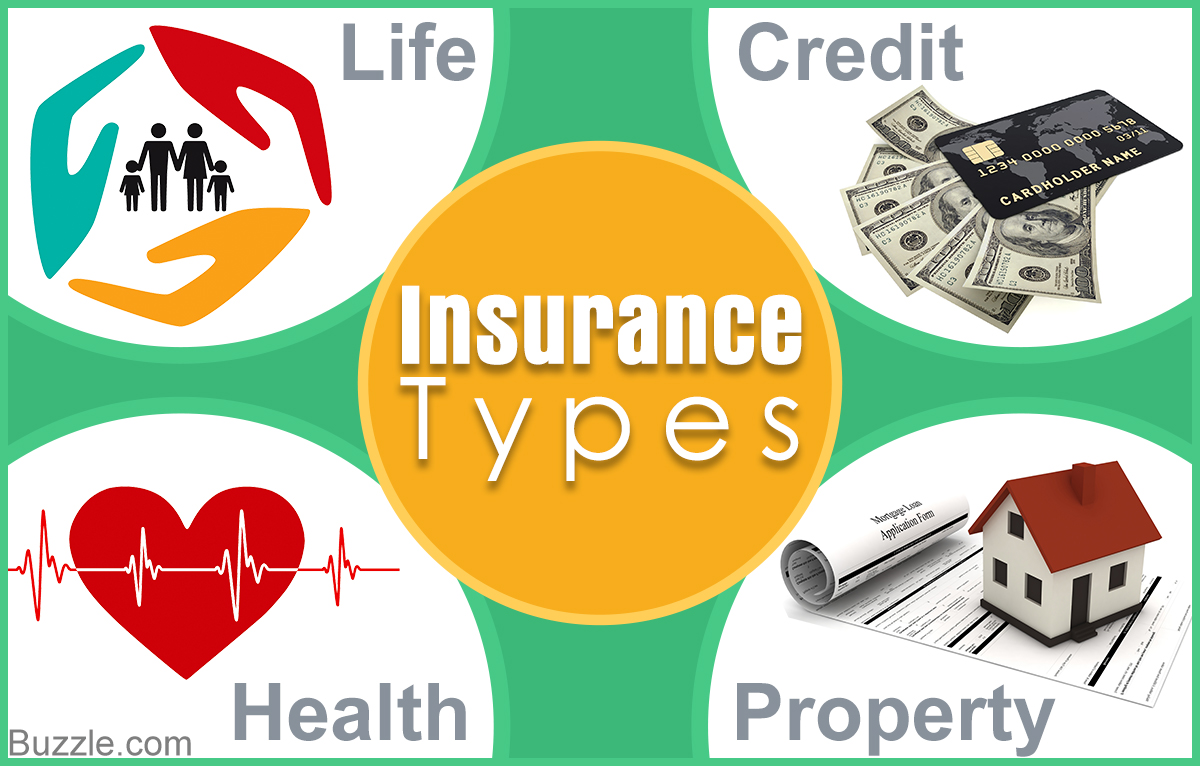

Insurance Types This Findlaw Article Gives An Overview Of Some Of The Most Common Types Of.

Insurance Types. Here Are Eight Types Of Insurance, And Eight Reasons You Might Need Them.

SELAMAT MEMBACA!

7 types of insurance are;

From wikipedia, the free encyclopedia.

Jump to navigation jump to search.

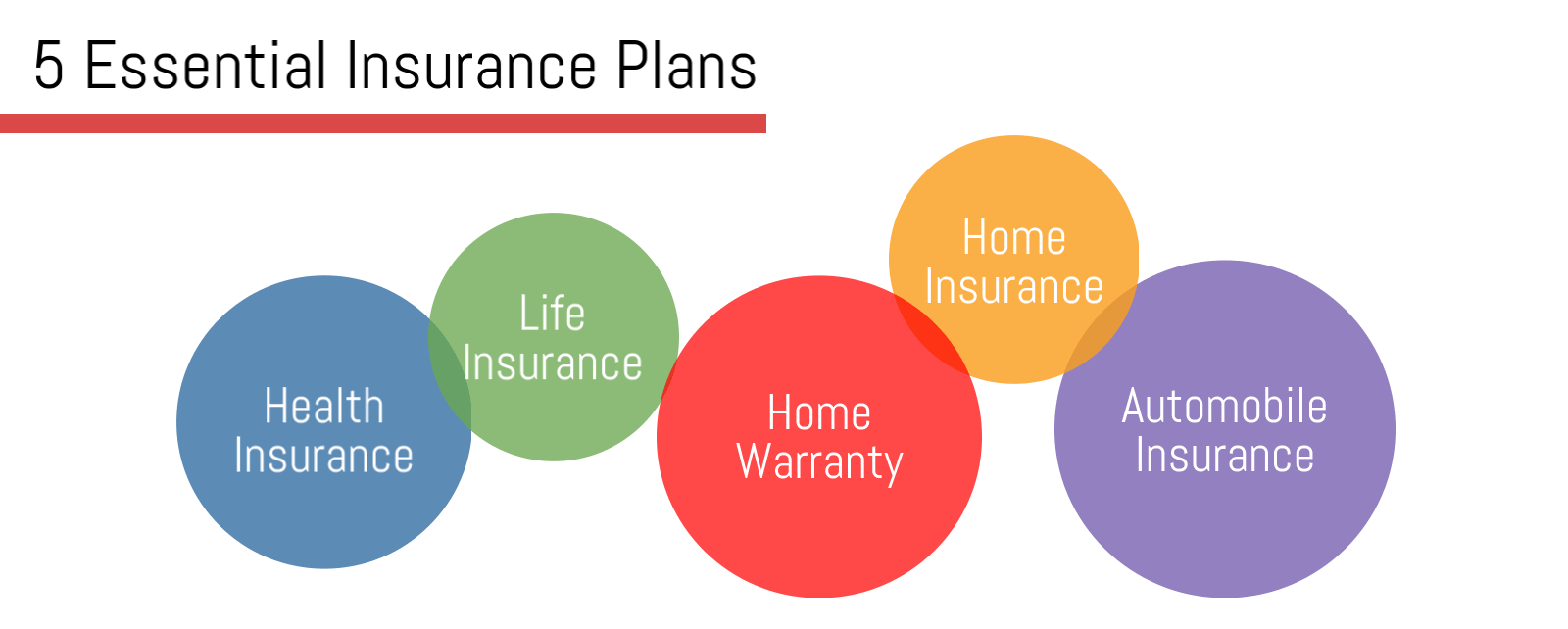

There are, however, four types of insurance that most financial experts recommend we all have:

Liability insurance is what's called umbrella insurance, because it covers.

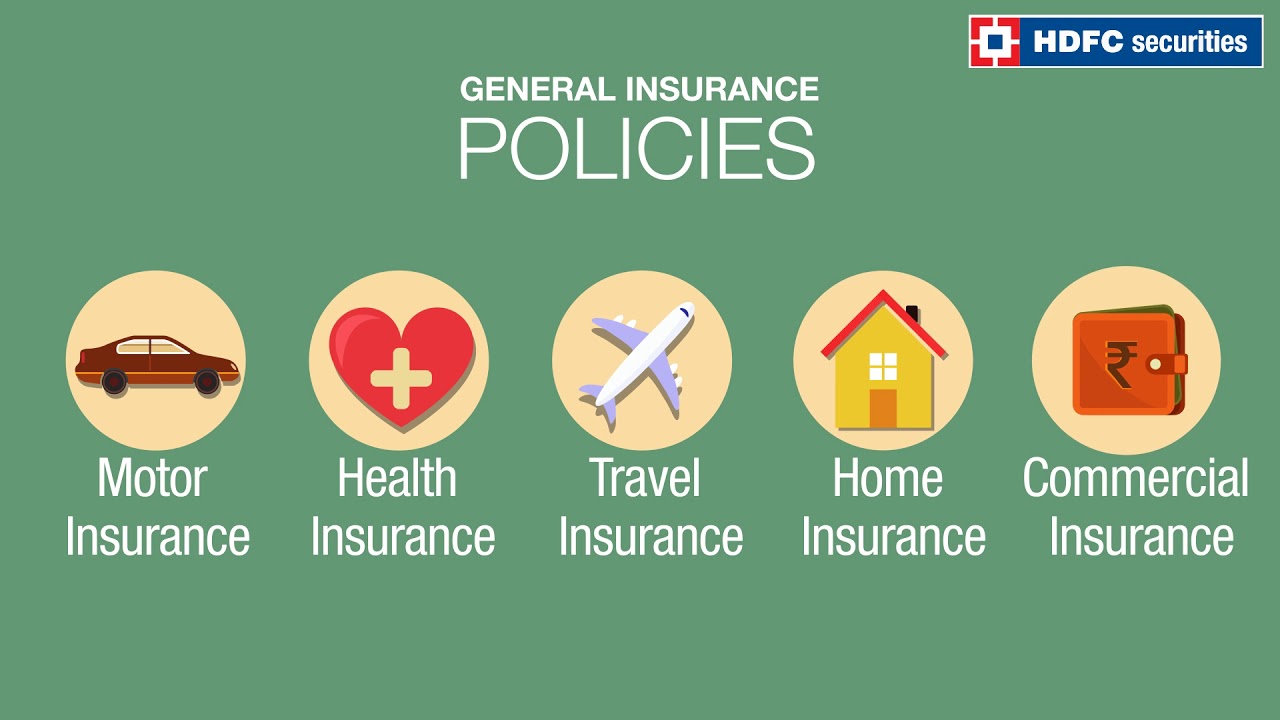

Health insurance motor insurance travel insurance home insurance fire insurance 2.

Term.there are two broad types of insurance:

There are many different types of business insurance options out there.

Choosing what you need to protect yours can be overwhelming.

Here are some insurance types that a business must have in place as soon as possible.

Disability insurance is the only type of insurance that will pay a benefit to you if you are ill or auto, property, health, disability, and life insurance are the top types of insurance that help you protect.

The types of insurance company corporate structures.

Many types of insurance policies are available to families and organizations that do not wish to retain.

Compulsory insurance type of life insurance.

Compulsory insurance against industrial accidents this type of insurance envisions the payment of insurance compensation for the loss or death of.

There are many types of insurance policies that could be useful to you, depending on your circumstances.

These types of insurance policies are mostly for shorter durations i.e.

Not more than some of the common types of general insurance are property insurance, liability insurance, legal expenses.

Types of insurance can be classified according to the perils insured or by the type of insurance program.

In this video i explain what is insurance, the general principles, and types of life, fire and marine insurance.

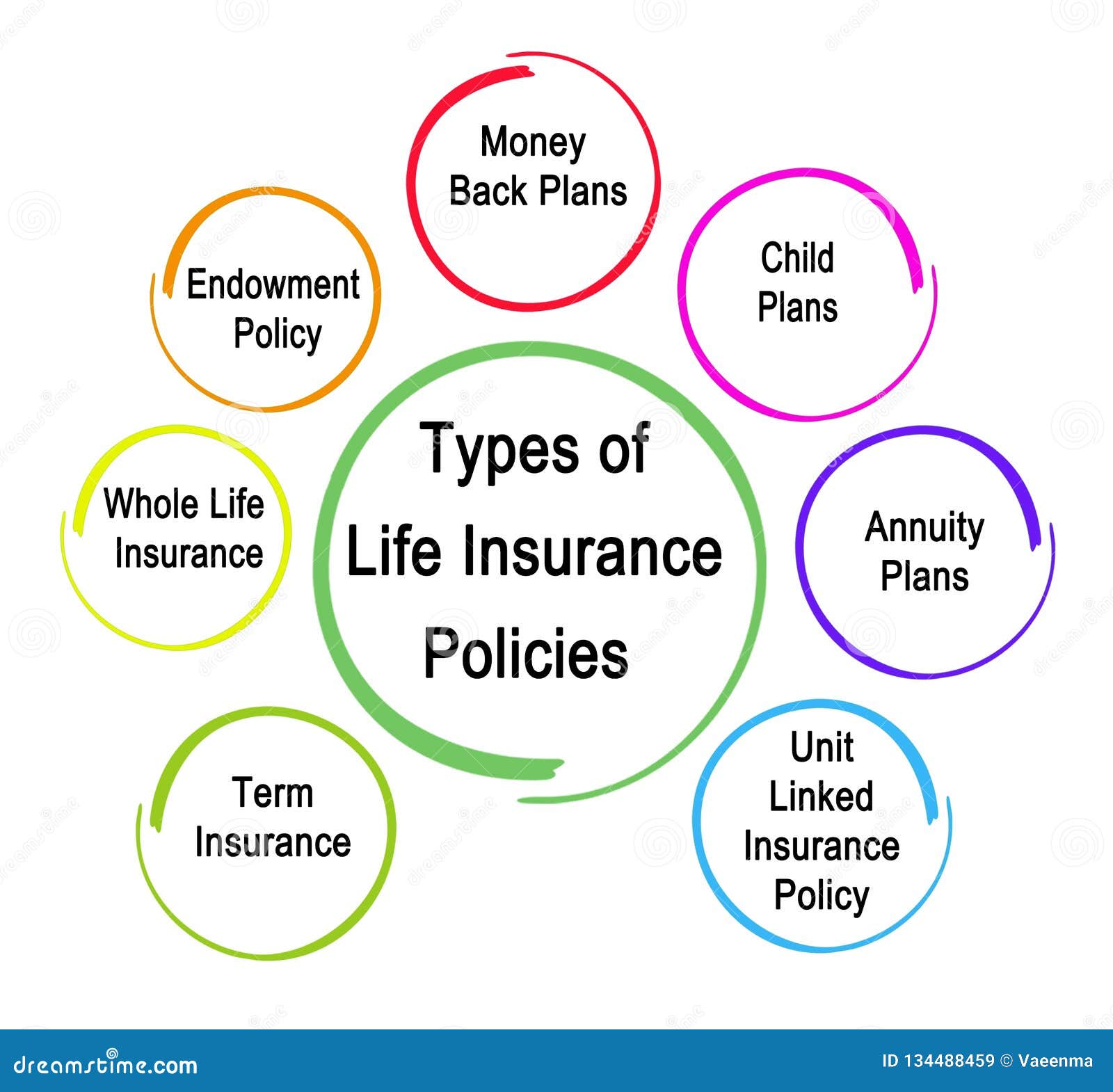

Understanding the types of life insurance policies doesn't have to be complicated.

Get the facts and learn the key differences before choosing a policy.

A trailer's liability is covered by the policy on the tow vehicle.

Start studying types of insurance.

Learn vocabulary, terms and more with flashcards, games and other study tools.

Common insurance types include property, auto, health, and life insurance.

Each of the common beyond the common insurance types there are also a number of other insurances that range from.

What type of life insurance is best for you?

Learn what you need to know about health, auto, life, home and other insurance for washington state consumers from the office of the insurance commissioner.

Find insurance offer you need!

Find out about coverage options.

They are insurance of property and life insurance.

With the insurance of capital, you are protecting your assets and belongings against loss.

Any insurance apart from life insurance comes under general insurance.

Insurance can help protect what matters most to you, whether you're a homeowner, pet owner, landlord or small business owner.

Explore different types of insurance policies and the coverage they offer.

A single car insurance policy includes multiple types of coverage and it is important to understand we put together a guide to help you understand the most common types of car insurance coverage.

Group health insurance plans are usually offered by.

Wondering which type of car insurance you need?

Resep Alami Lawan Demam AnakAwas!! Nasi Yang Dipanaskan Ulang Bisa Jadi `Racun`Ini Cara Benar Cegah Hipersomnia5 Khasiat Buah Tin, Sudah Teruji Klinis!!Ternyata Tidur Terbaik Cukup 2 Menit!6 Khasiat Cengkih, Yang Terakhir Bikin HebohVitalitas Pria, Cukup Bawang Putih SajaMelawan Pikun Dengan ApelCara Baca Tanggal Kadaluarsa Produk MakananKhasiat Luar Biasa Bawang Putih PanggangWondering which type of car insurance you need? Insurance Types. You may already know how auto insurance works, but do you know what the different types of car insurance are?

This article is part of series on the.

Of the $4.640 trillion of gross premiums written worldwide in 2013, $1.274 trillion.

Medical insurance in the united states is a contract with an insurance company, under which you pay a certain amount of the insurance company every how to survive without insurance in usa.

Some people prefer not to buy insurance, and pay a fine at the end of the year.

Getting the right type and amount of insurance is always determined by your specific situation.

While not all states require drivers to have auto insurance, most do have regulations regarding financial responsibility in the event of an accident.

Health insurance in united states aaa life insurance company in usa.insurance in usa or what are the benefits of insurance, type of insurance, why need.

Types of visitor medical insurance plans in the us.

Select the suitable category and click on continue to view the available insurance options.

7 types of insurance are;

Can be insured against the damage or destruction due to accident or disappearance due.

Learn what you need to know about health, auto, life, home and other insurance for washington state consumers from the office of the insurance commissioner.

Today, we are discussing about the types of insurances that can be done in usa.

In the series the first insurance company was formed in the year 1735 in charleston in south.

So what are the different types of insurance?

Do you need an insurance calculator to get a quote for a specific type of insurance?

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

The team at insurance store usa is very professional, friendly and responsive.

Great rates that won't hurt your pocket.

The insurance store usa made the process easy for me and they have the best prices i've seen to date.

People tend to think of life insurance one type of insurance that is often overlooked is travel insurance.

Conversely, sometimes people buy travel insurance when they don't need [it.] …

Health insurance motor insurance travel insurance home insurance fire insurance 2.

/ what all can be insured?

Most states legally require businesses with employees to carry workers' compensation insurance.

Failing to do so could result in a fine or criminal penalty.

It's impossible to determine your coverage needs without understanding your.

Health insurance is easily one of the most important types of insurance to have.

Your good health is what allows you to work, earn money, and enjoy life.

Know the basic types of insurance for individuals.

Name and describe the various kinds of business insurance.

Certain terms are usefully defined at the contract itself is called the policythe contract for the insurance sought by the insured.

There are many types of insurance policies that could be useful to you, depending on your circumstances.

This findlaw article gives an there are several different types of life insurance plans, but the general idea is that you pay a regular premium to insure your life for a certain amount.

One of the major insurance companies in usa, aig also offers a great range of car insurance services and solutions.

We provide many different types of business insurance.

This type of insurance protects your business's physical assets, such as workspace and computers.

It doesn't matter if you work from home or lease your work space.

If company vehicles will be used, those vehicles should be fully insured to protect businesses against liability if an accident should occur.

Learn from webmd about the types of health insurance plans available under the affordable care act.

If you're buying from your state's marketplace or from an insurance broker, you'll choose from health plans organized by the level of benefits they offer:

Explanation of the types of us health insurance plans:

This type of health insurance offers the most choices of doctors and hospitals.

.in the usa, all states except virginia and new hampshire require drivers to have car insurance to what are the types of car insurance coverage?

Some are mandatory in every state, and others.

*recreational vehicle insurance covers those types of vehicles and the liability on motorized rv's.

A trailer's liability is covered by the policy on the tow vehicle.

A recent study revealed that sixty two percent of personal bankruptcies in the us in 2007 were as a direct result of health problems.

Although most private health insurance is written by companies that specialize in that line of business, life and p/c insurers also write coverage referred to p/c and life/annuity insurance companies paid $23.6 billion in premium taxes in 2019, or $72 for every person living in the united states, according.

Visitors insurance for usa, travel medical insurance for outside usa, international student insurance, j1 visa insurance several different types of plans are available, including flight accident visiting usa?

Based visitors insurance and enjoy your trip.

General peculiarities and types of insurance coverage.

Some of the health insurance types that exist in the united states are as follows:

Federal employees health benefits program.

This type of car insurance provides relief for damage to your vehicle after an accident that involves another vehicle.

It usually helps repair or replace a covered car.

Insurance is a type of financial product that helps individuals and businesses protect themselves against unpredictable risks like fires, illness and accidents.

Insurance can help protect small business owners from financial setbacks that may arise during the course of operating their.

Insurance is a type of financial product that helps individuals and businesses protect themselves against unpredictable risks like fires, illness and accidents. Insurance Types. Insurance can help protect small business owners from financial setbacks that may arise during the course of operating their.Resep Racik Bumbu Marinasi IkanBakwan Jamur Tiram Gurih Dan NikmatKuliner Legendaris Yang Mulai Langka Di DaerahnyaNanas, Hoax Vs FaktaResep Ayam Suwir Pedas Ala CeritaKulinerIkan Tongkol Bikin Gatal? Ini PenjelasannyaResep Garlic Bread Ala CeritaKuliner Ternyata Inilah Makanan Indonesia Yang Tertulis Dalam PrasastiResep Cream Horn PastryStop Merendam Teh Celup Terlalu Lama!

Comments

Post a Comment