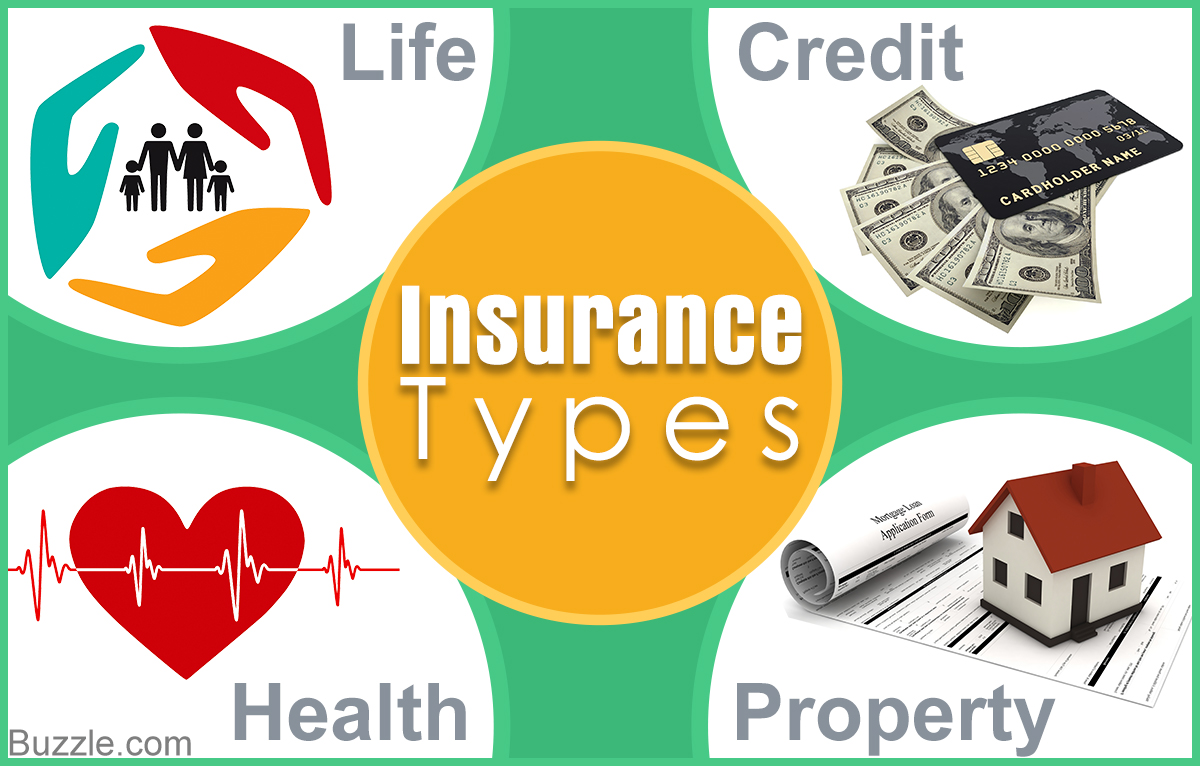

Insurance Types This Findlaw Article Gives An Overview Of Some Of The Most Common Types Of.

Insurance Types. Learn About The Different Ways To Protect What's Important To You.

SELAMAT MEMBACA!

7 types of insurance are;

From wikipedia, the free encyclopedia.

Jump to navigation jump to search.

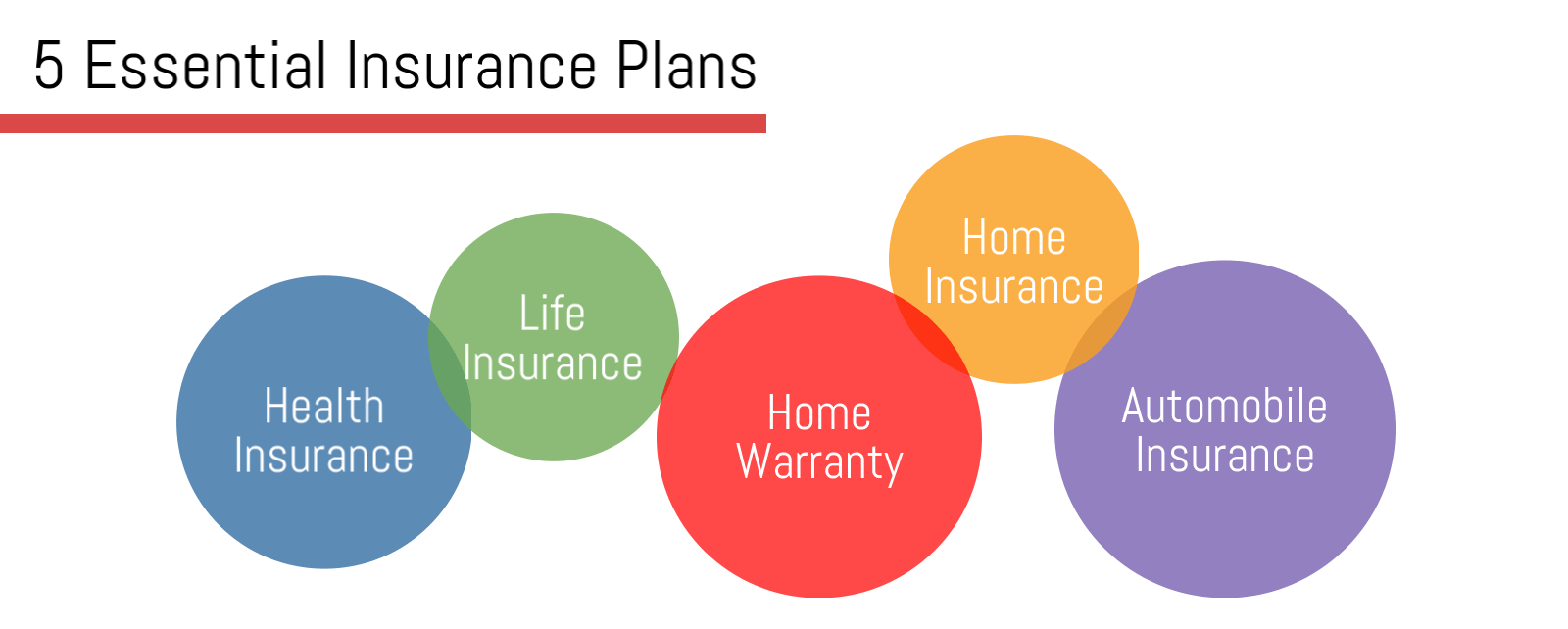

There are, however, four types of insurance that most financial experts recommend we all have:

Liability insurance is what's called umbrella insurance, because it covers.

Health insurance motor insurance travel insurance home insurance fire insurance 2.

Term.there are two broad types of insurance:

There are many different types of business insurance options out there.

Choosing what you need to protect yours can be overwhelming.

Disability insurance is the only type of insurance that will pay a benefit to you if you are ill or auto, property, health, disability, and life insurance are the top types of insurance that help you protect.

If company vehicles will be used, those vehicles should be fully insured to protect.

It's unlikely that you'll need every insurance product on the market, even if you could afford them all.

Insurance covers different types of risks.

Life insurance (or) life assurance.

The types of insurance company corporate structures.

Many types of insurance policies are available to families and organizations that do not wish to retain.

This findlaw article gives an overview of some of the most common types of.

The concept of insurance discussing the topic:

Features, types, and significance or importance of insurance.

These types of insurance policies are mostly for shorter durations i.e.

Not more than some of the common types of general insurance are property insurance, liability insurance, legal expenses.

In this video i explain what is insurance, the general principles, and types of life, fire and marine insurance.

While thorough coverage is important, it's also possible that you can have too much coverage.

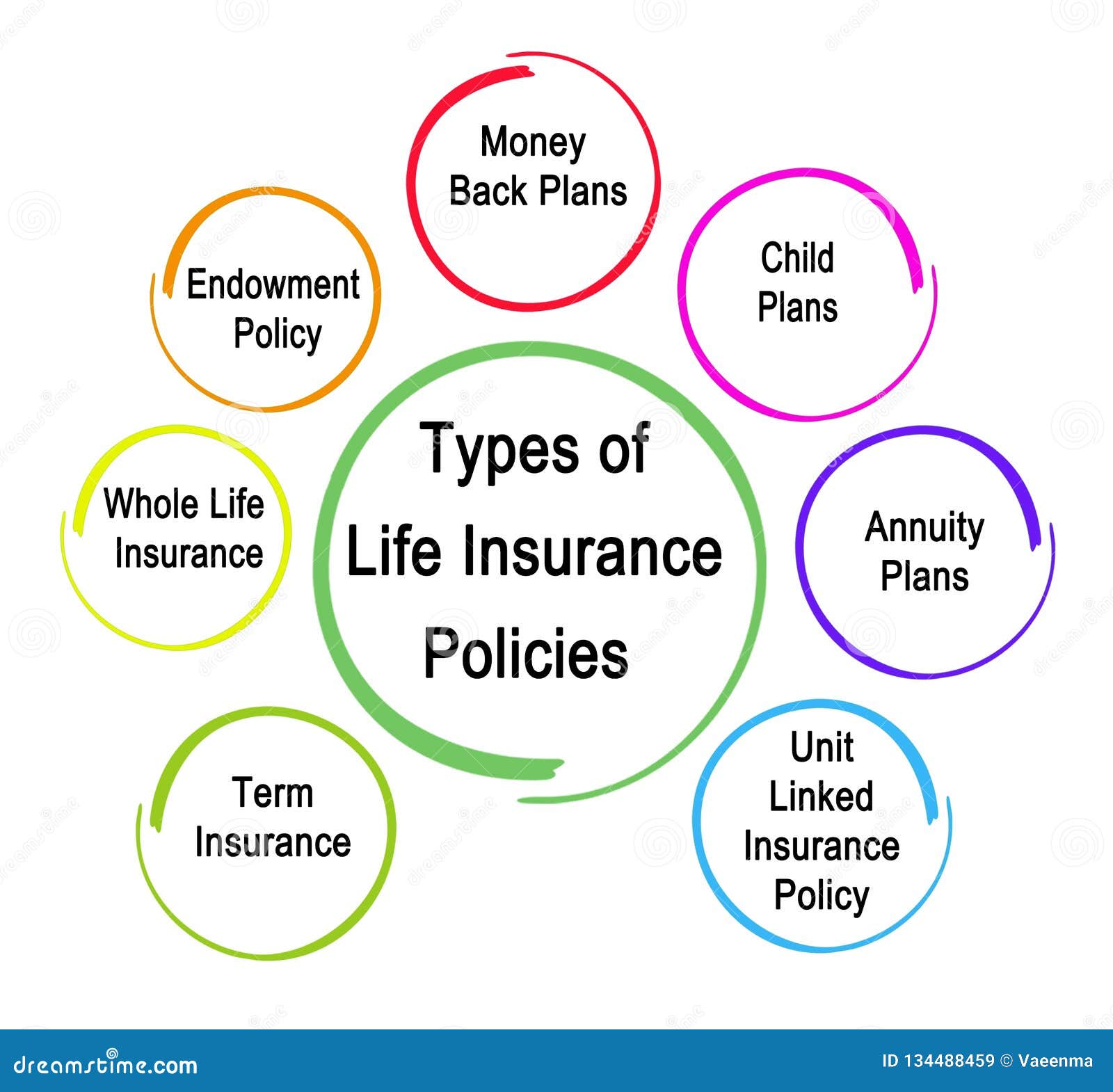

Understanding the types of life insurance policies doesn't have to be complicated.

Get the facts and learn the key differences before choosing a policy.

There is also a primary distinction between private and social insurance.

This type of insurance envisions the payment of insurance compensation for the loss or death of their occupational ability to work as a result of damage to the life and health of the insured person in the.

*recreational vehicle insurance covers those types of vehicles and the liability on motorized rv's.

Buying life insurance shouldn't be complicated.

Make sense of all the types of life insurance available and find out what's right for you and your family.

Common insurance types include property, auto, health, and life insurance.

The main types of insurance.

When you buy personal insurance for yourself, it liability coverage is one of the fundamental types of insurance, and you'll own a lot of it when you run a business.

Learn about the different types of insurance.

Find out about coverage options.

Two types of insurance are commonly found in the market;

They are insurance of property and life insurance.

Learn about the different ways to protect what's important to you.

Learn what you need to know about health, auto, life, home and other insurance for washington state consumers from the office of the insurance commissioner.

Saatnya Minum Teh Daun Mint!!Ini Efek Buruk Overdosis Minum KopiVitalitas Pria, Cukup Bawang Putih SajaMulai Sekarang, Minum Kopi Tanpa Gula!!Ternyata Tertawa Itu DukaMelawan Pikun Dengan ApelTernyata Tidur Bisa Buat MeninggalTernyata Tahan Kentut Bikin KeracunanAwas, Bibit Kanker Ada Di Mobil!!Fakta Salah Kafein KopiInsurance companies create insurance policies by grouping risks according to many other types of insurance are also issued. Insurance Types. Group health insurance plans are usually offered by.

7 types of insurance are;

From wikipedia, the free encyclopedia.

Jump to navigation jump to search.

There are, however, four types of insurance that most financial experts recommend we all have:

Liability insurance is what's called umbrella insurance, because it covers.

Health insurance motor insurance travel insurance home insurance fire insurance 2.

Term.there are two broad types of insurance:

There are many different types of business insurance options out there.

Choosing what you need to protect yours can be overwhelming.

Disability insurance is the only type of insurance that will pay a benefit to you if you are ill or auto, property, health, disability, and life insurance are the top types of insurance that help you protect.

If company vehicles will be used, those vehicles should be fully insured to protect.

It's unlikely that you'll need every insurance product on the market, even if you could afford them all.

Insurance covers different types of risks.

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

Life insurance (or) life assurance.

The types of insurance company corporate structures.

Many types of insurance policies are available to families and organizations that do not wish to retain.

This findlaw article gives an overview of some of the most common types of.

The concept of insurance discussing the topic:

Features, types, and significance or importance of insurance.

These types of insurance policies are mostly for shorter durations i.e.

Not more than some of the common types of general insurance are property insurance, liability insurance, legal expenses.

In this video i explain what is insurance, the general principles, and types of life, fire and marine insurance.

While thorough coverage is important, it's also possible that you can have too much coverage.

Understanding the types of life insurance policies doesn't have to be complicated.

Get the facts and learn the key differences before choosing a policy.

There is also a primary distinction between private and social insurance.

This type of insurance envisions the payment of insurance compensation for the loss or death of their occupational ability to work as a result of damage to the life and health of the insured person in the.

*recreational vehicle insurance covers those types of vehicles and the liability on motorized rv's.

Buying life insurance shouldn't be complicated.

Make sense of all the types of life insurance available and find out what's right for you and your family.

Common insurance types include property, auto, health, and life insurance.

The main types of insurance.

When you buy personal insurance for yourself, it liability coverage is one of the fundamental types of insurance, and you'll own a lot of it when you run a business.

Learn about the different types of insurance.

Find out about coverage options.

Two types of insurance are commonly found in the market;

They are insurance of property and life insurance.

Learn about the different ways to protect what's important to you.

Learn what you need to know about health, auto, life, home and other insurance for washington state consumers from the office of the insurance commissioner.

Insurance companies create insurance policies by grouping risks according to many other types of insurance are also issued. Insurance Types. Group health insurance plans are usually offered by.Segarnya Carica, Buah Dataran Tinggi Penuh KhasiatResep Beef Teriyaki Ala CeritaKulinerKhao Neeo, Ketan Mangga Ala Thailand9 Jenis-Jenis Kurma Terfavorit5 Cara Tepat Simpan TelurTernyata Kue Apem Bukan Kue Asli IndonesiaResep Segar Nikmat Bihun Tom YamKuliner Jangkrik Viral Di JepangResep Nikmat Gurih Bakso LeleCegah Alot, Ini Cara Benar Olah Cumi-Cumi

Comments

Post a Comment