Insurance Types Life Discover The Different Kinds Of Life Insurance And Why You Need The Right Kind When You're Building Wealth With Ibc.learn More Here.

Insurance Types Life. Make Sure That Your Loved Ones Will Be Provided For If The Worst Should Happen By Choosing A Life Insurance Policy That Helps Them Financially.

SELAMAT MEMBACA!

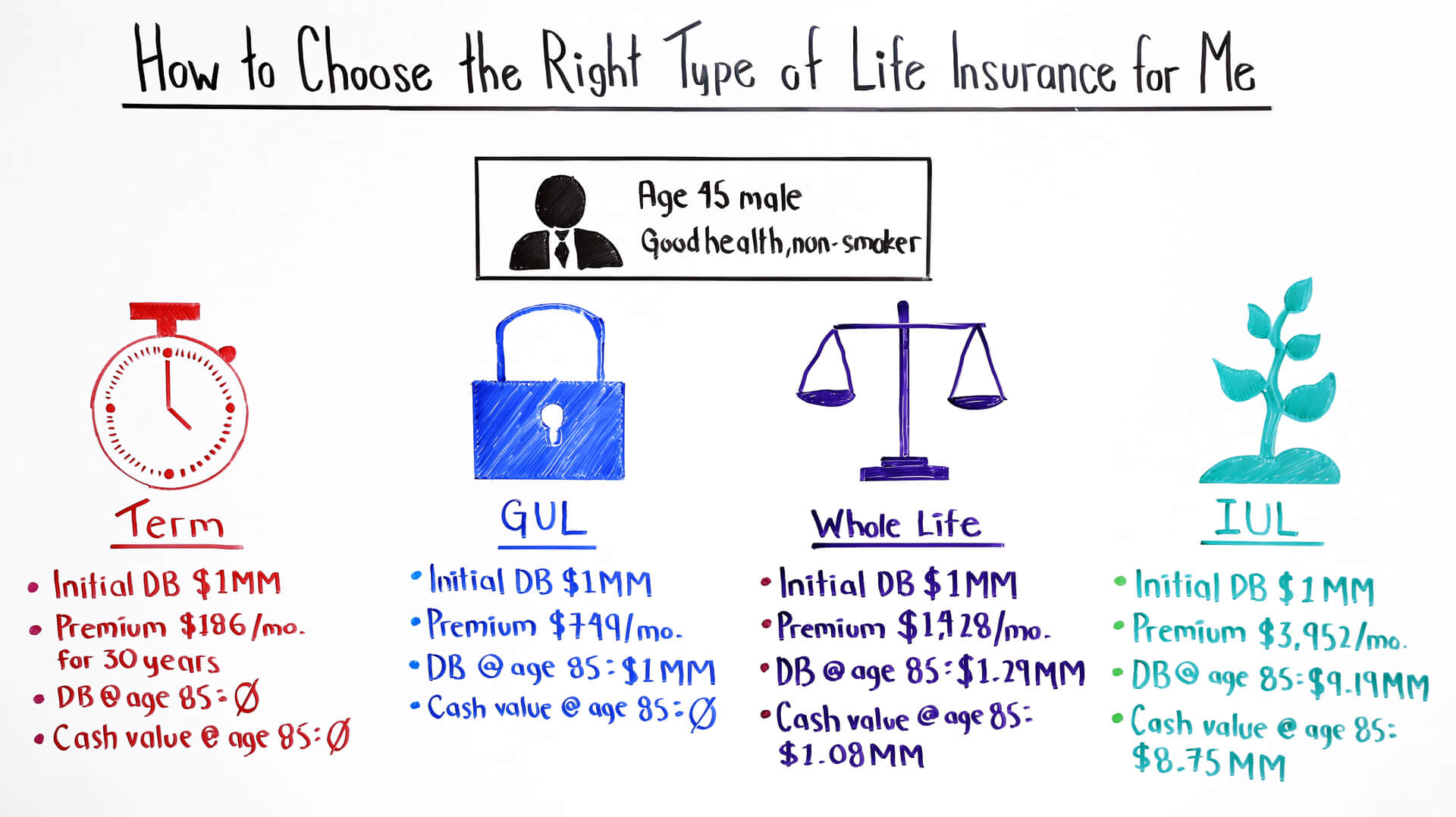

When you're shopping for life insurance, one of your first decisions will be what type of life insurance to buy.

That depends on a variety of factors, including how long you want the policy to last, how much you want to pay and whether you want to use the policy as an.

Understanding the types of life insurance policies doesn't have to be complicated.

Get the facts and learn the key differences before choosing a policy.

Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer.

Buying life insurance shouldn't be complicated.

Make sense of all the types of life insurance available and find out what's right for you and your family.

While term and whole life insurance are the broadest types of life insurance, other types of policies expand on permanent insurance the many types of life insurance available can be overwhelming.

Variable life insurance is also a form of permanent life insurance coverage.

These types of life insurance policies offer a death benefit, as well as a cash component.

On top of that, many life insurance companies sell multiple types and sizes of policies, and some specialize in meeting specific needs, such as policies for people with chronic health conditions.

Life insurance has different options that protect you and your future.

Learn the differences of life insurance from protective life!

Term life insurance provides a death benefit only, said robert e.

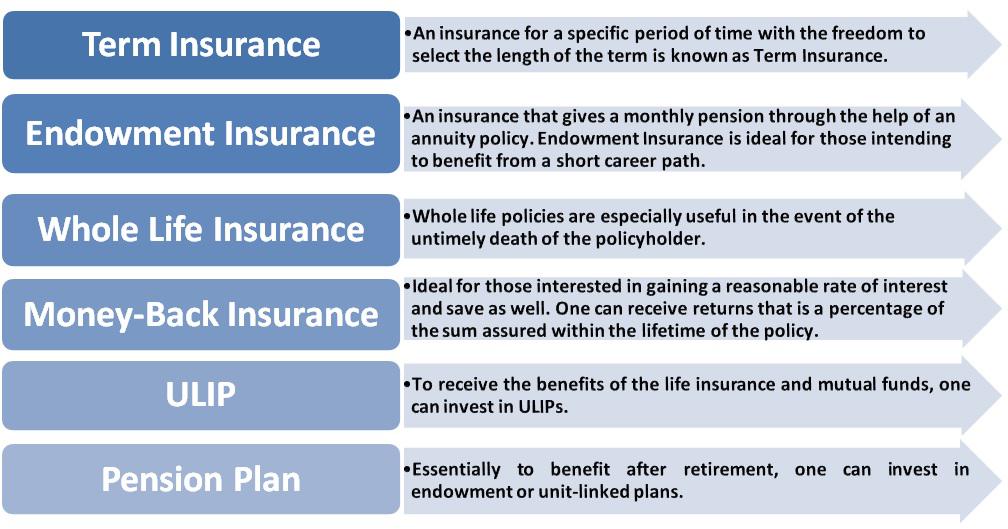

There are numerous types of life insurance, all of which fall under two main types, term life, and permanent life insurance.

Let's figure out what type of life insurance is best for your family's needs.

The most common are term, whole life and universal life cons:

Whole life insurance premiums are higher than other policy types because the policies last for.

Types of life insurance, there is a staggering array of options out there.

The two main types of life insurance.

When you buy life insurance , you sign a contract with an insurance company.

The company has to provide your family or other beneficiaries with a certain.

Learn about the different types of life insurance coverage to help you narrow your policy options.

Permanent life insurance products include whole life, universal life, variable life, and combination life.

There are many types of life insurance options available for you and your family.

An abr allows the insured to access a portion of the life.

Whole life insurance is a type of permanent life insurance, and it will last for your entire life.

Final expense and burial insurance are both types of whole life insurance policies that focus on people.

With this kind type of whole life some types of whole life policies allow you to pay premiums for shorter periods of time, such as 20.

Discover the different kinds of life insurance and why you need the right kind when you're building wealth with ibc.learn more here.

Understand the different types of life insurance so you can find the right cover today.

Here, you're buying a policy that pays a stated, fixed amount on your death, and part of your premium.

Permanent life insurance encompasses several types of policies, such as whole life insurance and universal life insurance.

While all forms of permanent life insurance generally follow the same.

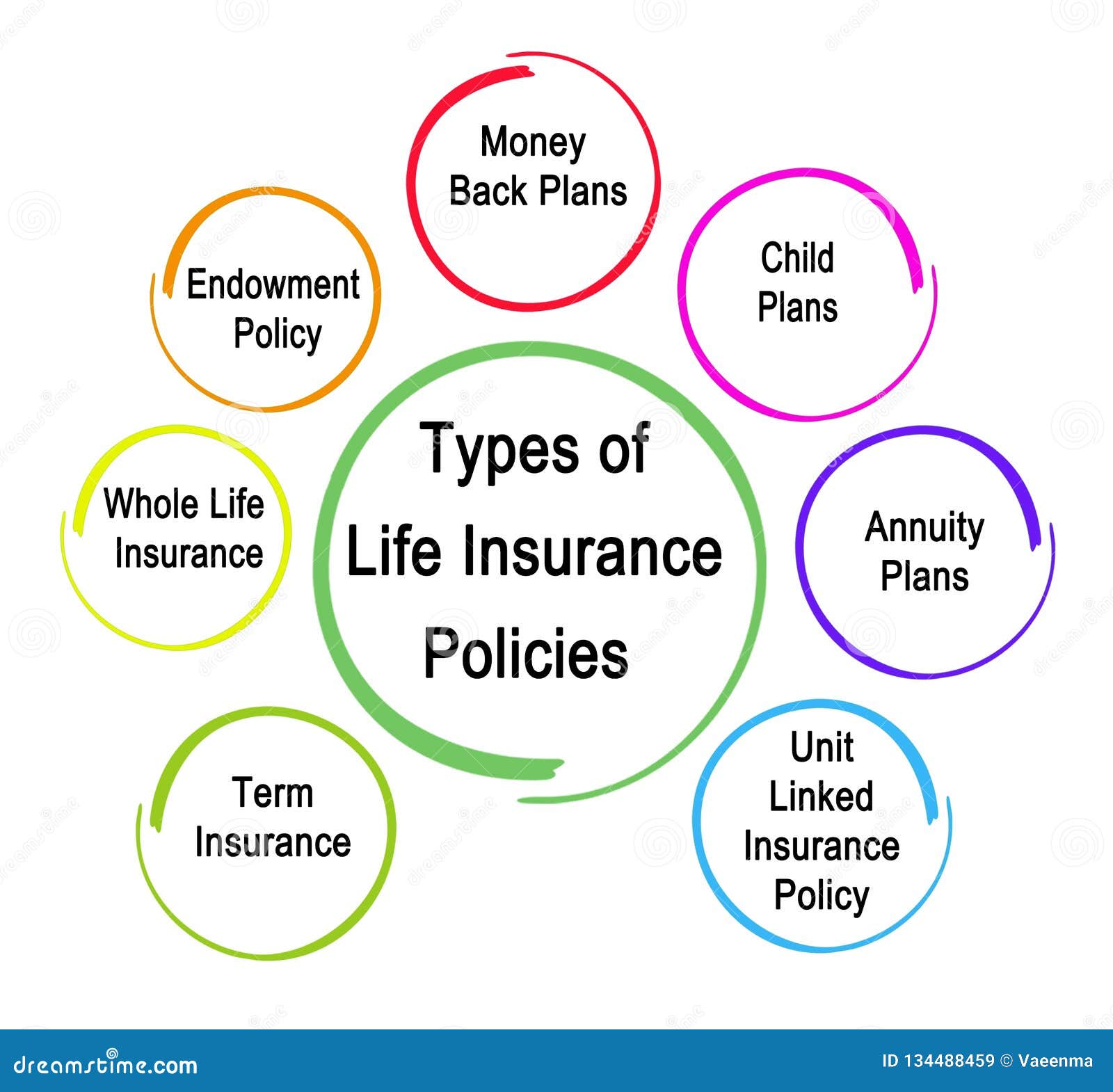

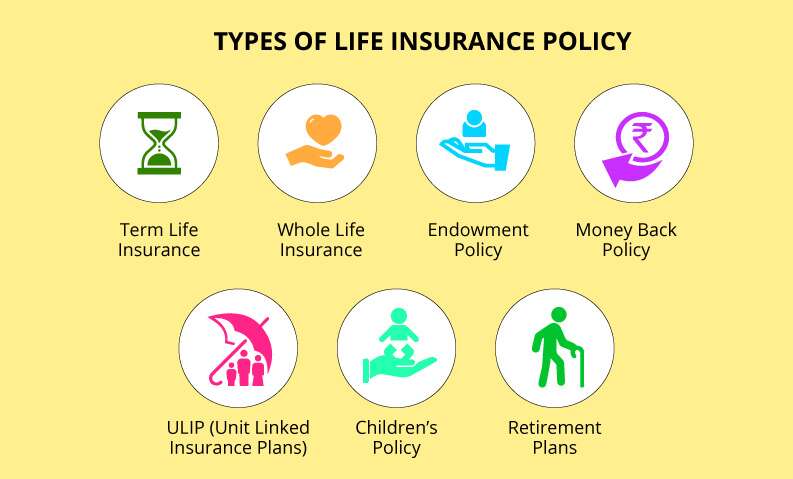

There are 8 types of life types of life insurance.

An individual today has an array of options to choose from when it comes to financial planning.

Ternyata Tahan Kentut Bikin KeracunanCegah Celaka, Waspada Bahaya Sindrom HipersomniaAwas!! Ini Bahaya Pewarna Kimia Pada MakananAwas!! Nasi Yang Dipanaskan Ulang Bisa Jadi `Racun`Sehat Sekejap Dengan Es BatuTernyata Madu Atasi InsomniaObat Hebat, Si Sisik NagaSegala Penyakit, Rebusan Ciplukan Obatnya4 Titik Akupresur Agar Tidurmu Nyenyak5 Manfaat Meredam Kaki Di Air EsTypes of life insurance policies explained. Insurance Types Life. Make sure that your loved ones will be provided for if the worst should happen by choosing a life insurance policy that helps them financially.

Check out our life insurance chart to understand the plans and what life insurance you may need.

What do you want the insurance to cover?

The four major types of life insurance policies are term, whole life, universal life, and variable universal life.

There are two types of whole life insurance policies offered through aig direct:

Understanding the types of life insurance policies doesn't have to be complicated.

Get the facts and learn the key differences before choosing a policy.

There are many types of life insurance policies that can help protect your family, and they all fall into two main categories:

The offers that appear on this site are from companies that compensate us.

This compensation may impact how and where products appear on this site, including, for example, the.

Although the number of types of life insurance products can be overwhelming for many people seeking coverage, having a selection of many products to choose from that can respond to different needs should be worth the unintended confusion.

Types of life insurance coverage:

If you're like most americans who are completely lost and confused by insurance industry jargon and don't know where to start when it comes to life insurance you've come to the right place.

Learn about and compare the different types of life insurance policies and coverage options offered by allstate and see which ones could best fit your life.

Insure.com is a part of the insurance.com family.

The products and services that appear in the advertisement section of this website on this page are.

There are many different kinds of life insurance.

What type of life insurance should you get?

Permanent life insurance never expires, and it accrues a cash value over time in addition to offering a disclosure:

This post is brought to you by the personal finance insider team.

Permanent life insurance is a type of coverage that provides insurance for the life of the policyholder with a payout guaranteed upon the death of the insured.

Whole life insurance is the most common life insurance product.

And as long as premiums are paid, the policy stays in force.

Make sure that your loved ones will be provided for if the worst should happen by choosing a life insurance term life insurance is a life cover policy that runs for a specified amount of time, or 'term'.

Term life and whole life insurance explained with chart and infographics in pdf.

This is a crucial question when you want to choose the best life insurance products for your needs and budget.

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

Learn about different types of life insurance and how to choose the policy that fits your needs and budget.

Take the guesswork out of choosing a policy.

All types of life insurance policies pay a specified amount of money if something happens to you.

Life insurance comes in many shapes and sizes, but there are two basic types of life insurance policies:

Term or temporary life insurance and permanent life the type of life insurance product that suits you best depends on your personal, family, physical and financial circumstances.

Understand the different types of life insurance so you can find the right cover today.

Which flavor is right for you?

This article outlines the 10 common types of life insurance, from term to voluntary life insurance.

Learn about term, whole life, universal life, and more.

Understand the two different types of life insurance.

We explain the difference between term understanding the different types of life insurance policies is an intimidating task, that's what you second is to compare quotes on several different products and coverage amounts with our quote.

So, how many different types of life insurance are there in today's marketplace?

This can make things very confusing for people that are trying to compare contracts.

Term life insurance is one of the primary forms of life insurance and is going to be what people think of as the most straightforward type of life policy.

A guaranteed issue life insurance policy is any form of life insurance product that doesn't require you to answer health questions for approval.

It ceases to operate only when the insured you can read more under the top subject, types of annuities.

Having taken you through this short journey into the world of life insurance.

A life insurance policy is a contract with an insurance company.

You need life insurance, but which type is best?

Learn about the different types of life insurance coverage to help you narrow your policy options.

Life insurance types fall into two main buckets:

Term insurance is the simplest form of life insurance available in the market.

A pure protection plan, a term 4.

Unit linked insurance plans (ulips) combining insurance and investment in a single product, ulips offer life protection as well as the opportunity for capital.

This post will help you make sense of all of your life life insurance is sometimes thought of as a singular product.

9 different types of life insurance explained in detail.

Learn about whole & term life insurance.

Whole life insurance is a type of permanent life insurance that is intended to stay in force throughout the whole life of the insured, or until the policy pays out.

Which type of life insurance is best for you?

Still, have questions about a specific scenario or product type? Insurance Types Life. Not sure which one is the best?Resep Ayam Kecap Ala CeritaKuliner9 Jenis-Jenis Kurma TerfavoritResep Selai Nanas HomemadeTernyata Kue Apem Bukan Kue Asli IndonesiaBakwan Jamur Tiram Gurih Dan NikmatBir Pletok, Bir Halal BetawiSegarnya Carica, Buah Dataran Tinggi Penuh KhasiatKhao Neeo, Ketan Mangga Ala ThailandAmpas Kopi Jangan Buang! Ini ManfaatnyaResep Kreasi Potato Wedges Anti Gagal

Comments

Post a Comment