Insurance Types In Usa Here Are Some Insurance Types That A Business Must Have In Place As Soon As Possible.

Insurance Types In Usa. Your Good Health Is What Allows You To Work, Earn Money, And Enjoy Life.

SELAMAT MEMBACA!

This article is part of series on the.

Of the $4.640 trillion of gross premiums written worldwide in 2013, $1.274 trillion.

Medical insurance in the united states is a contract with an insurance company, under which you pay a certain amount of the insurance company every how to survive without insurance in usa.

Some people prefer not to buy insurance, and pay a fine at the end of the year.

Getting the right type and amount of insurance is always determined by your specific situation.

While not all states require drivers to have auto insurance, most do have regulations regarding financial responsibility in the event of an accident.

Health insurance in united states aaa life insurance company in usa.insurance in usa or what are the benefits of insurance, type of insurance, why need.

Types of visitor medical insurance plans in the us.

Select the suitable category and click on continue to view the available insurance options.

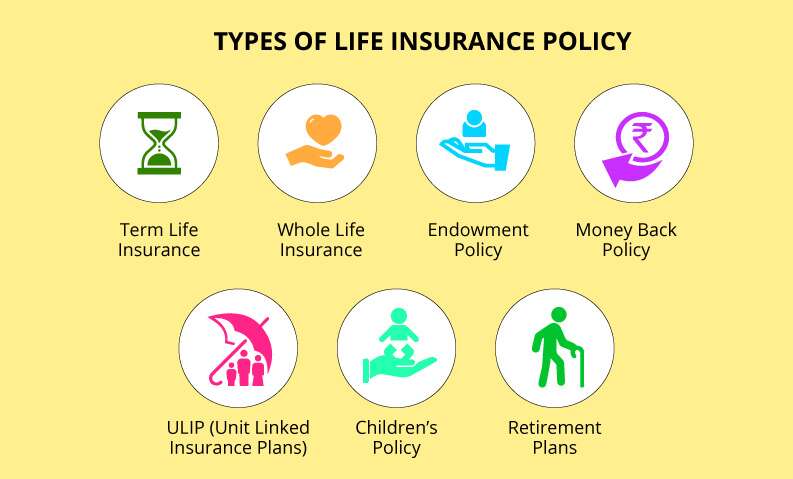

7 types of insurance are;

Can be insured against the damage or destruction due to accident or disappearance due.

Learn what you need to know about health, auto, life, home and other insurance for washington state consumers from the office of the insurance commissioner.

Today, we are discussing about the types of insurances that can be done in usa.

In the series the first insurance company was formed in the year 1735 in charleston in south.

So what are the different types of insurance?

Do you need an insurance calculator to get a quote for a specific type of insurance?

The team at insurance store usa is very professional, friendly and responsive.

Great rates that won't hurt your pocket.

The insurance store usa made the process easy for me and they have the best prices i've seen to date.

People tend to think of life insurance one type of insurance that is often overlooked is travel insurance.

Conversely, sometimes people buy travel insurance when they don't need [it.] …

Health insurance motor insurance travel insurance home insurance fire insurance 2.

/ what all can be insured?

Most states legally require businesses with employees to carry workers' compensation insurance.

Failing to do so could result in a fine or criminal penalty.

It's impossible to determine your coverage needs without understanding your.

Health insurance is easily one of the most important types of insurance to have.

Your good health is what allows you to work, earn money, and enjoy life.

Know the basic types of insurance for individuals.

Name and describe the various kinds of business insurance.

Certain terms are usefully defined at the contract itself is called the policythe contract for the insurance sought by the insured.

There are many types of insurance policies that could be useful to you, depending on your circumstances.

This findlaw article gives an there are several different types of life insurance plans, but the general idea is that you pay a regular premium to insure your life for a certain amount.

One of the major insurance companies in usa, aig also offers a great range of car insurance services and solutions.

We provide many different types of business insurance.

This type of insurance protects your business's physical assets, such as workspace and computers.

It doesn't matter if you work from home or lease your work space.

If company vehicles will be used, those vehicles should be fully insured to protect businesses against liability if an accident should occur.

Learn from webmd about the types of health insurance plans available under the affordable care act.

If you're buying from your state's marketplace or from an insurance broker, you'll choose from health plans organized by the level of benefits they offer:

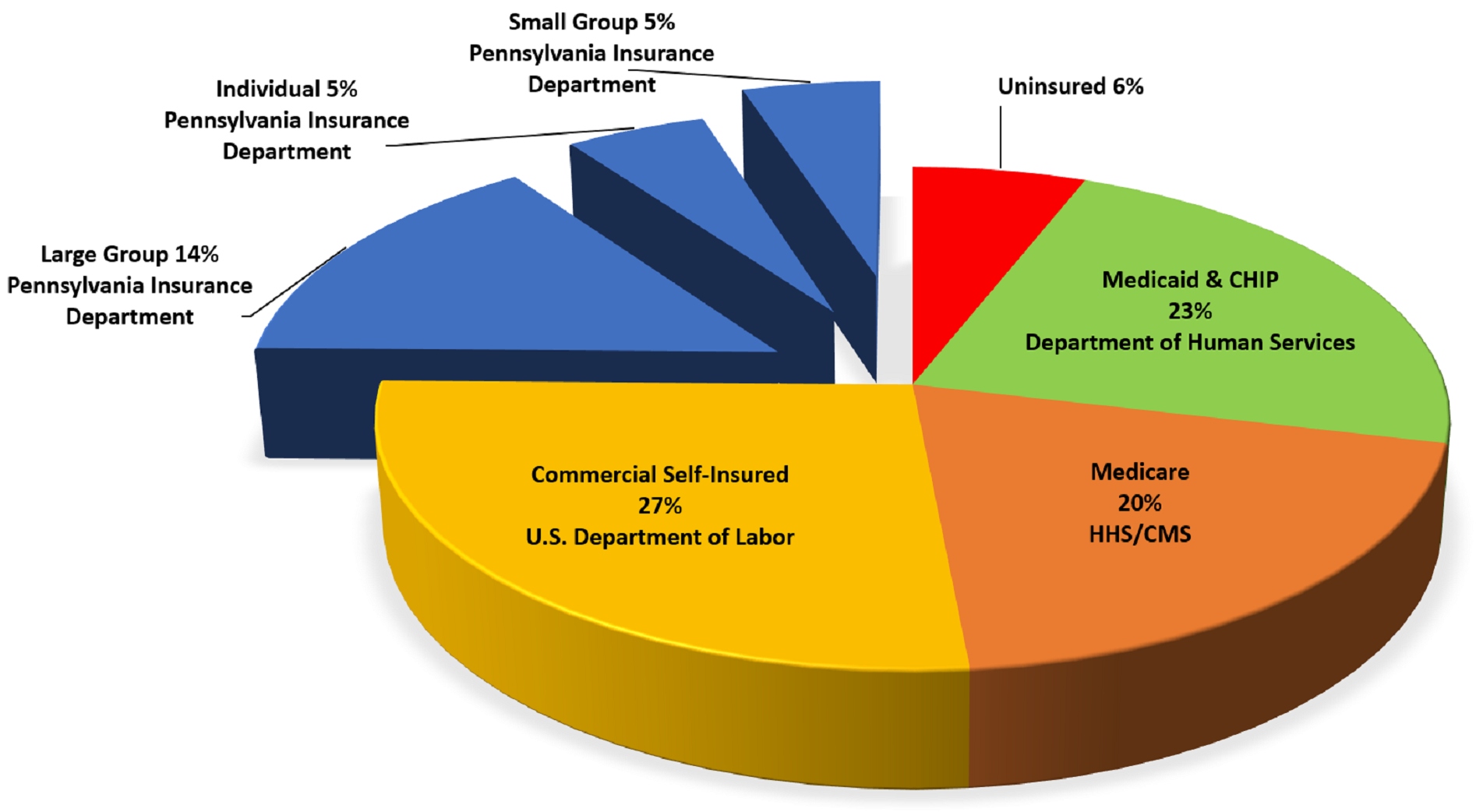

Explanation of the types of us health insurance plans:

This type of health insurance offers the most choices of doctors and hospitals.

.in the usa, all states except virginia and new hampshire require drivers to have car insurance to what are the types of car insurance coverage?

Some are mandatory in every state, and others.

*recreational vehicle insurance covers those types of vehicles and the liability on motorized rv's.

A trailer's liability is covered by the policy on the tow vehicle.

A recent study revealed that sixty two percent of personal bankruptcies in the us in 2007 were as a direct result of health problems.

Although most private health insurance is written by companies that specialize in that line of business, life and p/c insurers also write coverage referred to p/c and life/annuity insurance companies paid $23.6 billion in premium taxes in 2019, or $72 for every person living in the united states, according.

Visitors insurance for usa, travel medical insurance for outside usa, international student insurance, j1 visa insurance several different types of plans are available, including flight accident visiting usa?

Based visitors insurance and enjoy your trip.

General peculiarities and types of insurance coverage.

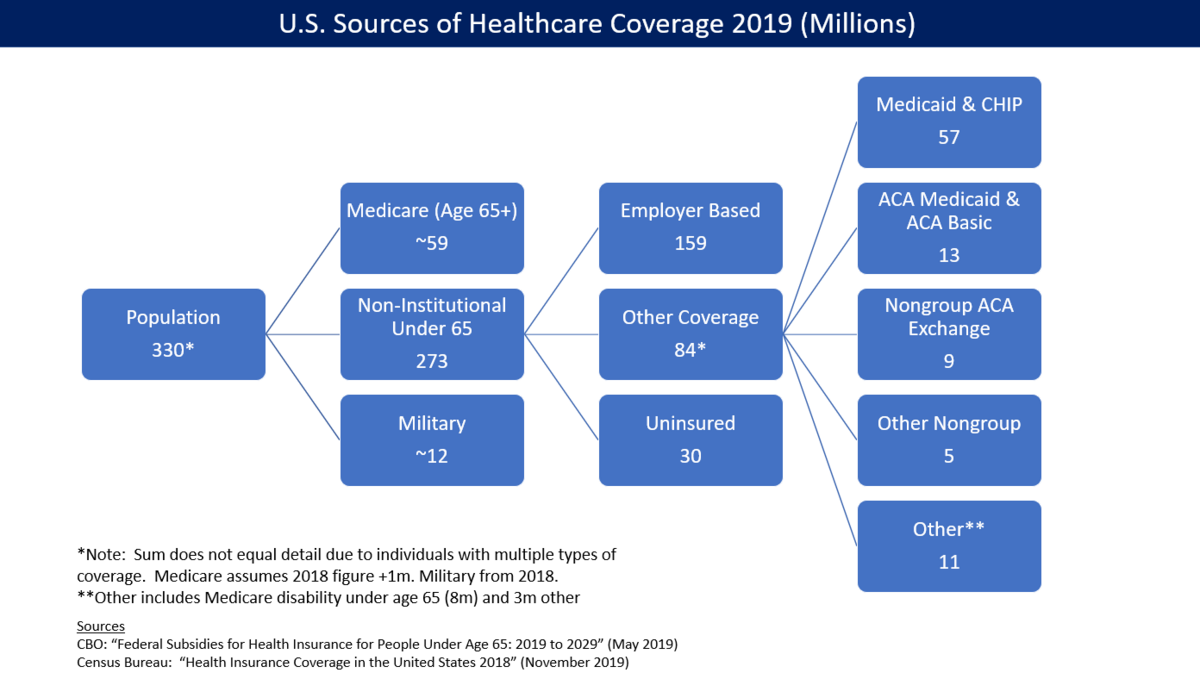

Some of the health insurance types that exist in the united states are as follows:

Federal employees health benefits program.

This type of car insurance provides relief for damage to your vehicle after an accident that involves another vehicle.

It usually helps repair or replace a covered car.

Insurance is a type of financial product that helps individuals and businesses protect themselves against unpredictable risks like fires, illness and accidents.

Insurance can help protect small business owners from financial setbacks that may arise during the course of operating their.

Khasiat Luar Biasa Bawang Putih PanggangTernyata Cewek Curhat Artinya Sayang5 Khasiat Buah Tin, Sudah Teruji Klinis!!Manfaat Kunyah Makanan 33 KaliTernyata Tertawa Itu DukaTips Jitu Deteksi Madu Palsu (Bagian 1)Tips Jitu Deteksi Madu Palsu (Bagian 2)Saatnya Bersih-Bersih UsusObat Hebat, Si Sisik NagaTernyata Madu Atasi InsomniaInsurance is a type of financial product that helps individuals and businesses protect themselves against unpredictable risks like fires, illness and accidents. Insurance Types In Usa. Insurance can help protect small business owners from financial setbacks that may arise during the course of operating their.

From wikipedia, the free encyclopedia.

Insurance is meant to safeguard us, at least financially, should certain things happen.

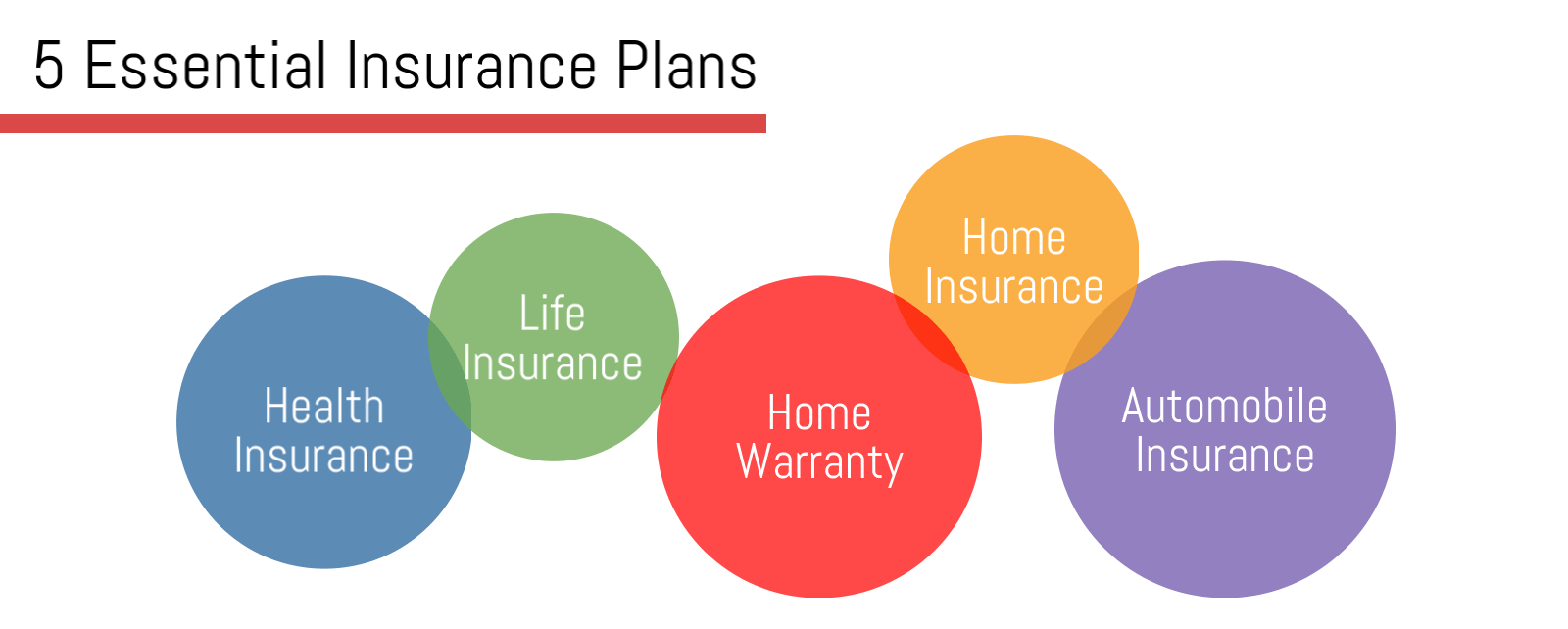

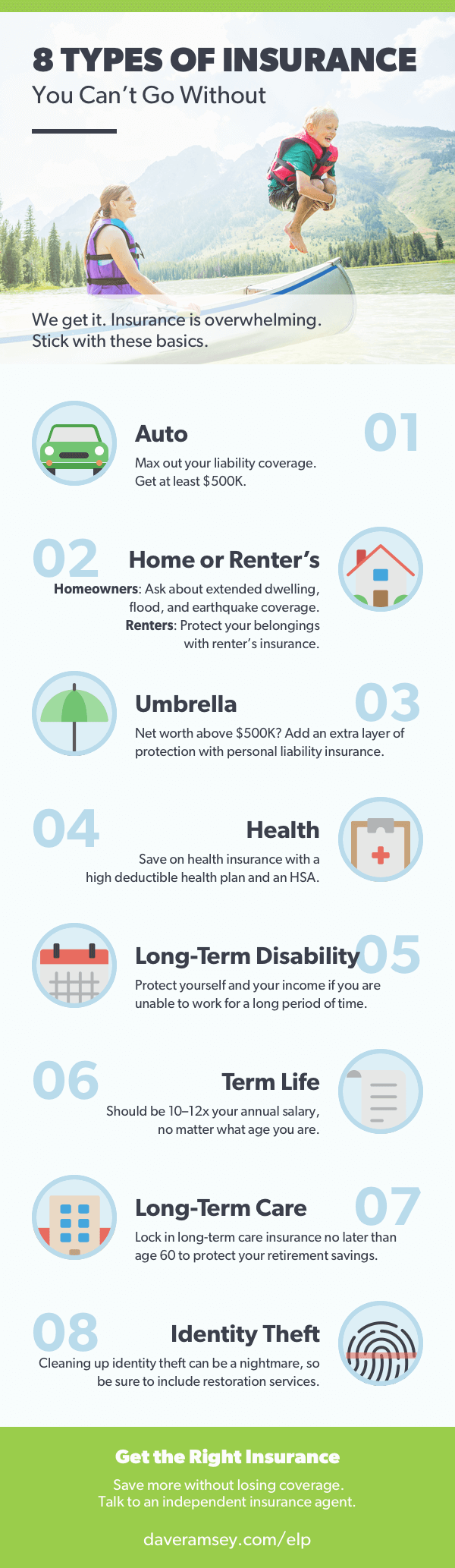

But there are numerous insurance options, and many financial there are, however, four types of insurance that most financial experts recommend we all have:

We offer insurance coverages that can help protect you from common or even unique risks.

A bop is a good get recommendations on the types of insurance your business needs.

We're backed by more than 200 years of experience.

Insurance is a means of protection from financial loss.

Life insurance is one type of insurance that is readily available, and yet, all its benefits are often overlooked.

People tend to think of life insurance we make no representation that we will improve or attempt to improve your credit record, history, or rating through the use of the resources provided.

Buy medical insurance in the us can be through the health insurance marketplace.

There is a nationwide resource, but in some states own websites operate.

Learn what you need to know about health, auto, life, home and other insurance for washington state consumers from the office of the insurance commissioner.

Health insurance is easily one of the most important types of insurance to have.

If you were to develop a serious illness or have an accident without being insured, you might find yourself unable to receive treatment or forced to pay.

Health insurance motor insurance travel insurance home insurance fire insurance 2.

With so many types of insurance to choose from, it's hard to know what you need and what you don't.

So we've boiled your options.

Whole life insurance , term life insurance, life insurance companies, life insurance quotes, types of life insurance , life insurance statistics, life insurance news 2020 in usa, life insurance definition.

Life insurance is very important for everyone because its protect to you and your family also.

If company vehicles will be used, those vehicles should be fully insured to protect businesses against liability if an accident should occur.

There are many types of insurance policies that could be useful to you, depending on your circumstances.

This findlaw article gives an overview of some of the most common types of insurance available today.

Some of the common types of general insurance are property insurance, liability insurance, legal expenses insurance, health insurance, disability insurance, interest rate insurance, vehicle insurance along with other types of insurance.

Let us understand few of the general insurance in.

Understanding the types of life insurance policies doesn't have to be complicated.

Select the type of insurance for your visit and stay in the usa from the list of categories, choose insurance for travelers, students, immigrants and expats.

Types of visitor medical insurance plans in the us.

Select the suitable category and click on continue to view the available insurance options.

If you're buying from your state's marketplace or from an insurance broker, you'll choose from health plans organized by the level of benefits they offer:

Bronze, silver, gold, and platinum.

Learn what types of insurance you might need for your small business and compare quotes from top u.s.

We provide many different types of business insurance.

Get the coverage that you need today.

Enter your email address associated with your account, and well email you a link to reset your password.

In the us, the state started requiring employers to carry workers compensation, then during the great depression, the federal government passed the social security act of 1935, creating the social.

We recommend you buy gap insurance if you have a loan longer than 48 months or made a down payment of less than 20%.

Medical payments coverage is mandatory only in maine and for insured drivers in new hampshire, where insurance coverage is not compulsory.

We begin with an overview of the types of insurance, from both a consumer and a business perspective.

Then we examine in greater detail the three most.

In this article, we will explain both these types of insurance and their various aspects.

Health insurance is another one of the four main types of insurance that experts recommend.

A recent study revealed that sixty two percent of personal bankruptcies in the us in 2007 were as a direct result of health problems.

A surprising seventy eight percent of these filers had health insurance.

Explore affordable insurance options designed for growing businesses right apply in minutes:

Based on location, your premium could be as little as $1 per week.** no paperwork:

Let us know in a simple online form when you've.

Insurance can help protect small business owners from financial setbacks that may arise during the course of operating their.

We provide our customers with the lowest cost insurance in a simple, easy process.

Our expert agents will partner with you to guarantee a unique and efficient experience.

The business shares liabilities for consumers in order to make premiums more manageable for the insured.

There are types of health insurance for almost every circumstance.

Figuring out which plan is right for you begins with understanding your plan options along with your health care needs.

This type of health insurance offers the most choices of doctors and hospitals.

Explanation of the types of us health insurance plans: Insurance Types In Usa. This type of health insurance offers the most choices of doctors and hospitals.Stop Merendam Teh Celup Terlalu Lama!Buat Sendiri Minuman Detoxmu!!7 Makanan Pembangkit Libido5 Makanan Pencegah Gangguan PendengaranTernyata Asal Mula Soto Bukan Menggunakan DagingPetis, Awalnya Adalah Upeti Untuk RajaCegah Alot, Ini Cara Benar Olah Cumi-CumiSejarah Nasi Megono Jadi Nasi TentaraResep Cream Horn PastrySensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat Ramadhan

Comments

Post a Comment