Insurance Types In India Posted On May 7th, 2021 In Insurance.

Insurance Types In India. Allows Your Entire Family To Get Coverage Under A Single Plan, Which Usually Covers Husband, Wife, Two Children.

SELAMAT MEMBACA!

A detailed guide about different types of insurance policies in india.

Even when you think that you are financially secure, a sudden or unforeseen expenditure can significantly hamper this security.

Insurance in india refers to the market for insurance in india which covers both the public and private sector organisations.

It is listed in the constitution of india in the seventh schedule as a union list subject, meaning it can only be legislated by the central government only.

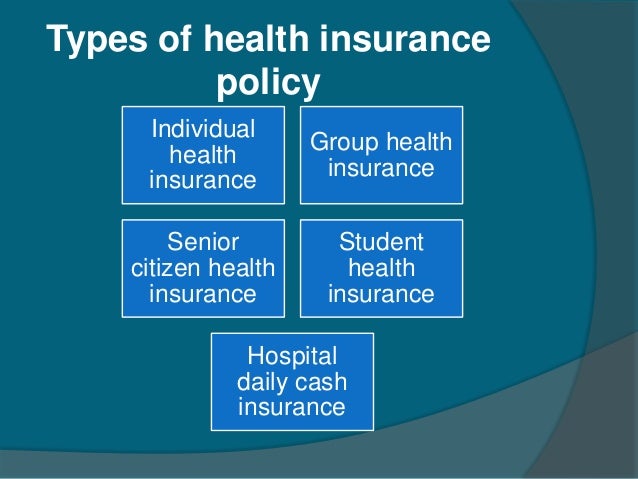

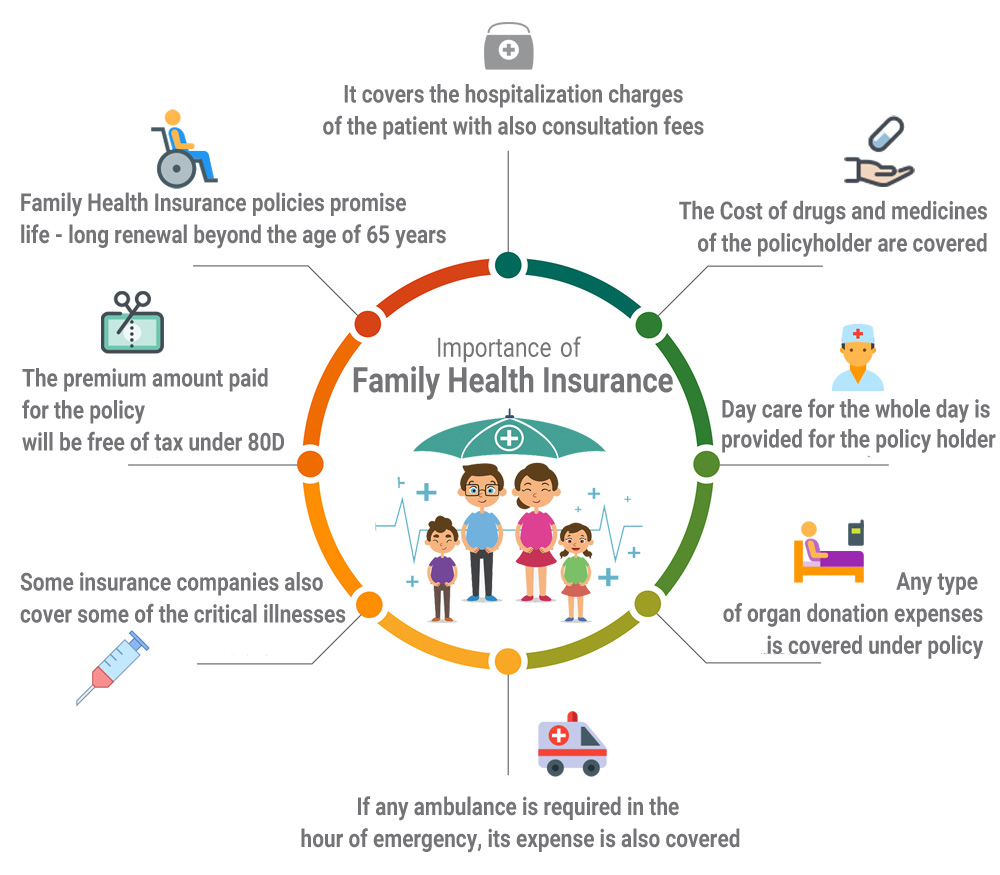

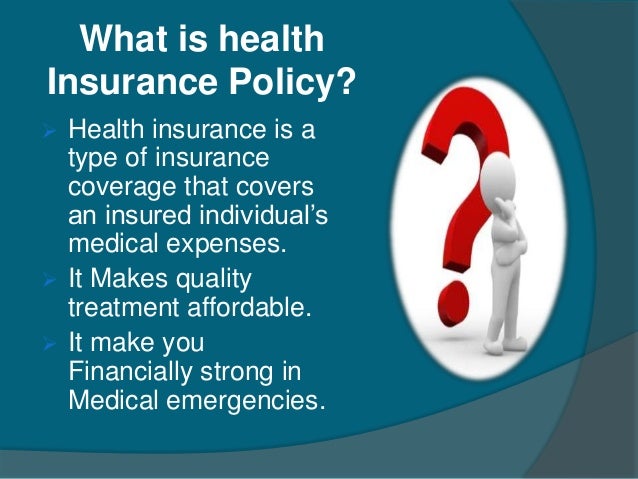

Different types of health insurance plans available in india include:

Offers coverage to only an individual.

Allows your entire family to get coverage under a single plan, which usually covers husband, wife, two children.

Different insurance types in india.

Posted on may 7th, 2021 in insurance.

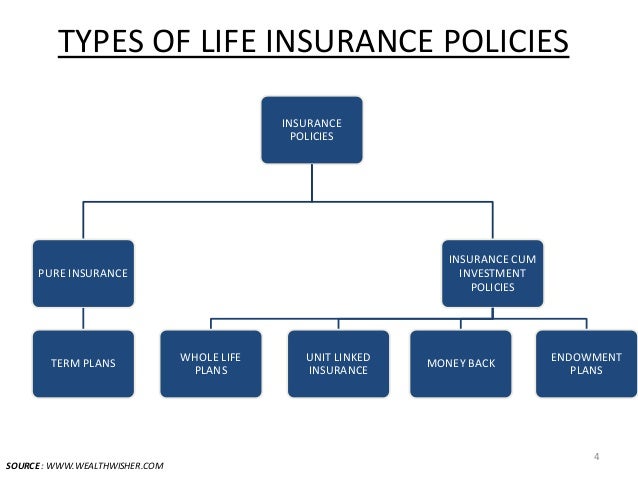

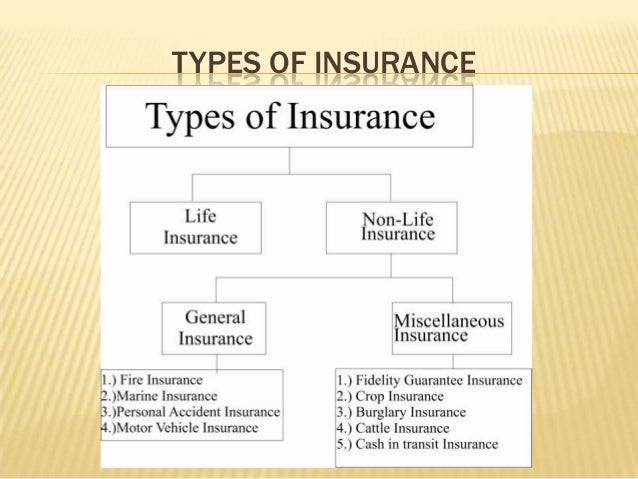

In india, insurance is broadly categorized into three categories:

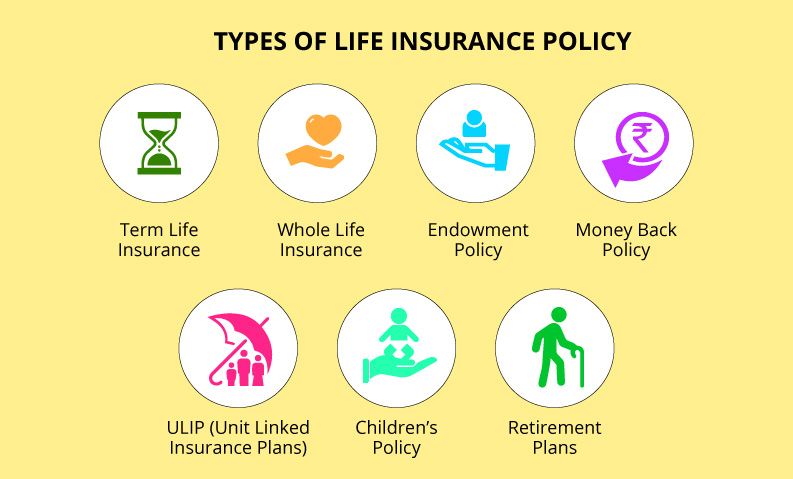

Child plan retirement plan investment plan savings plan protection plan.

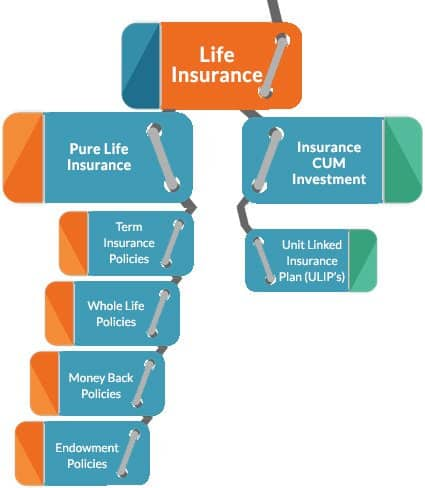

Know more about types of life insurance policies in india.

Indian insurance refers to the indian insurance market which covers both public and private sector organizations.

Overview of insurance plans in india.

Therefore, choosing the best insurance companies in india for your insurance needs is as important as getting an insurance policy.

However, people's needs of types of insurance are mostly restricted to life insurance and general insurance of health and vehicles.

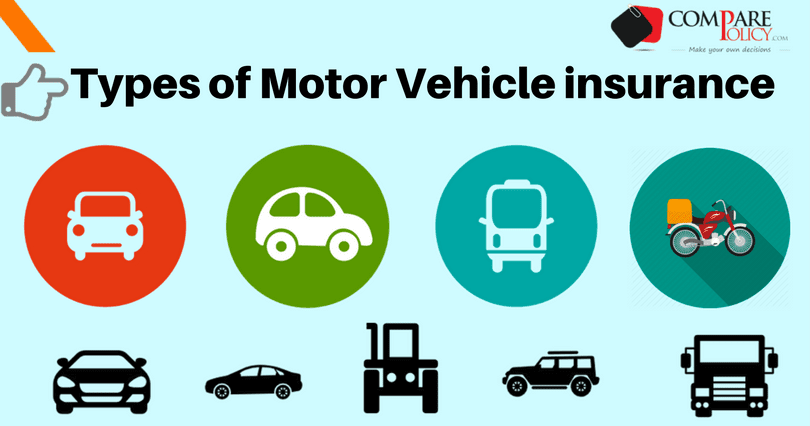

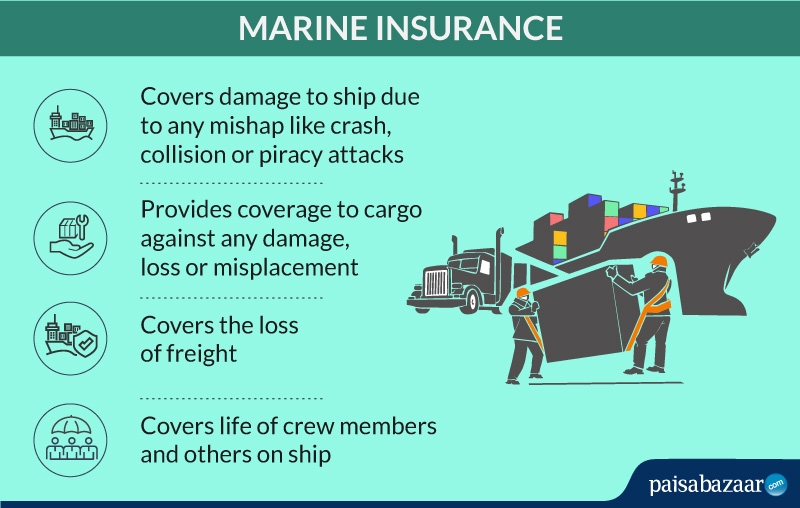

There are several numbers of general insurance types in india.

Let's have a look what those are also what these insurances offer their policyholder.

What are general insurance types?

Only a very few numbers of people are unfamiliar with.

Insurance planning / personal finance.

Types of life insurance policies in india.

The markets were bullish & investors churned out huge profits from their investments.

This type of life insurance gives you maximum coverage with minimum premium.

You can also widen up the coverage by buying additional riders.

Know about different types of insurance, insurance companies in india and tax benefits.

Insurance is a mutual agreement between the insured and insurer to protect against financial losses.

The legal contract between an insured and insurance company is known as an insurance policy.

Whole life policy offers a savings component (also known as cash value) to apply online for best credit cards in india, life insurance plans, secured loans and unsecured loans, visit www.mymoneymantra.com, the leading.

Read ahead to know more about government health insurance schemes in india.

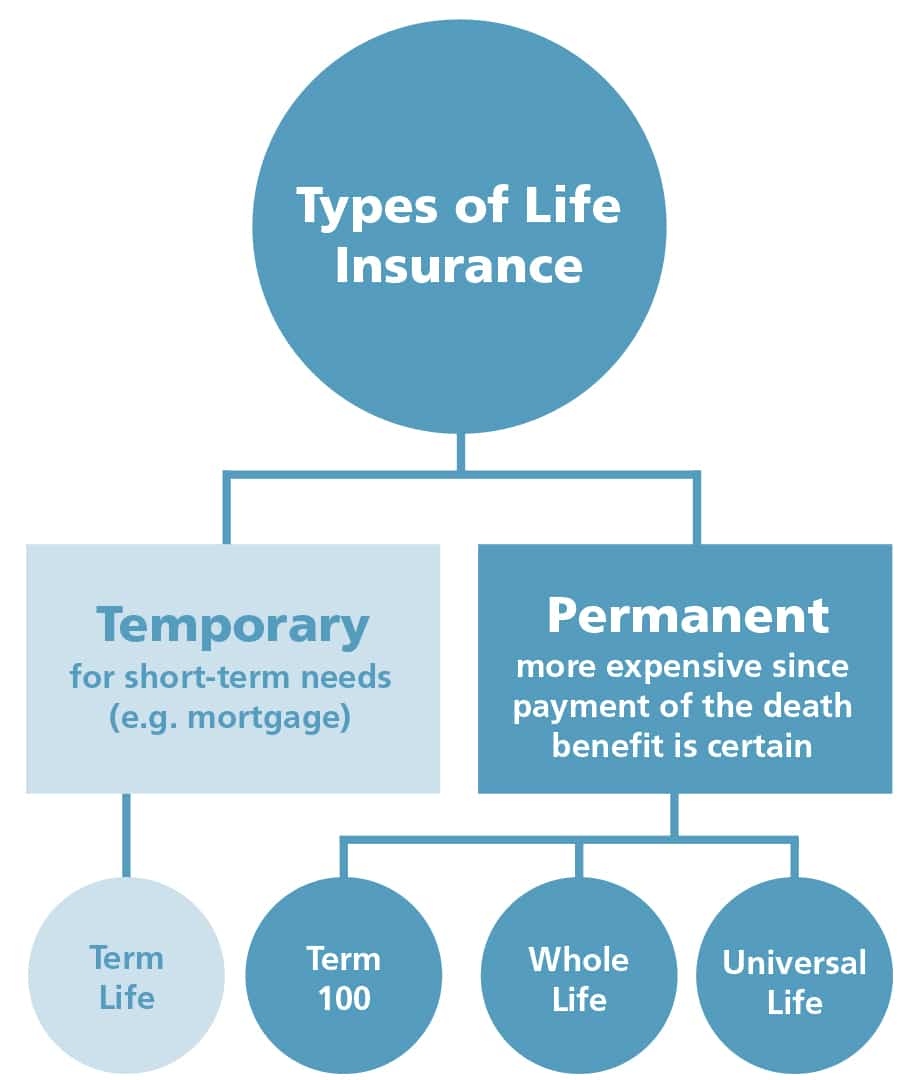

Life insurance can be termed as a contract between an insurance policyholder and an insurance company, where the insurer promises to pay a sum of money in exchange for a premium, upon the death of an insured person or after a set period.

The remaining life insurance companies are under the private there are varied types of life insurance policies offered by many insurance companies in india.

You can settle for the best policy as per your.

What type of car insurance covers your car if it is stolen?:

These types of policies usually protect you and your car against problems not caused by collisions, such as theft, vandalism, and breakdowns.

Best health insurance in india for individual.

Top up/super top up health insurance policy.

Life insurance is the most popular type of insurance in india.

This type of insurance applies to the life of an individual in case they die during the term of the policy.

With life insurance policies, only when a policyholder dies or the policy matures does a policyholder receive the insurance amount.

Insurance is very important for all because it gives assurance, if anything wrong happen to us!

Term insurance or term plan.

Basic type and covered for a specific period.

An entity or body which provides there are 57 insurance companies in india, and out of that figure 24 are life insurance companies.

33 others are general insurance companies which.

Different types of health insurance policies cover an array of diseases and ailments.

Pnb metlife india insurance co.

Indiafirst life insurance company ltd.

There are many types of life insurance plans, and the decision to buy a particular plan depends upon the optimal combination of needs and affordability of the customer.

The exponential upsurge of quality healthcare expenses has made it compulsory for everyone to be covered with a health insurance.

Many types of insurance are available in the world but we explain most important or trending insurance types.

When you take any types of insurance so before signature you can read all term & condition in the company.

This type of home insurance covers you and your family.

A compensation is given in case of permanent disablement or death of the insured it is not just the house, that you have insured, but also the contents inside the house on which you would have spent a lot of time and money deserve.

5 Olahan Jahe Bikin SehatCara Baca Tanggal Kadaluarsa Produk MakananSalah Pilih Sabun, Ini Risikonya!!!Melawan Pikun Dengan ApelTernyata Tertawa Itu Duka7 Makanan Sebabkan Sembelit8 Bahan Alami Detox Gawat! Minum Air Dingin Picu Kanker!Resep Alami Lawan Demam AnakTips Jitu Deteksi Madu Palsu (Bagian 2)This type of home insurance covers you and your family. Insurance Types In India. A compensation is given in case of permanent disablement or death of the insured it is not just the house, that you have insured, but also the contents inside the house on which you would have spent a lot of time and money deserve.

A detailed guide about different types of insurance policies in india.

Even when you think that you are financially secure, a sudden or unforeseen expenditure can significantly hamper this security.

Insurance in india refers to the market for insurance in india which covers both the public and private sector organisations.

It is listed in the constitution of india in the seventh schedule as a union list subject, meaning it can only be legislated by the central government only.

Different types of health insurance plans available in india include:

Offers coverage to only an individual.

Allows your entire family to get coverage under a single plan, which usually covers husband, wife, two children.

Different insurance types in india.

Posted on may 7th, 2021 in insurance.

In india, insurance is broadly categorized into three categories:

Child plan retirement plan investment plan savings plan protection plan.

Know more about types of life insurance policies in india.

Indian insurance refers to the indian insurance market which covers both public and private sector organizations.

Overview of insurance plans in india.

Therefore, choosing the best insurance companies in india for your insurance needs is as important as getting an insurance policy.

However, people's needs of types of insurance are mostly restricted to life insurance and general insurance of health and vehicles.

There are several numbers of general insurance types in india.

Let's have a look what those are also what these insurances offer their policyholder.

What are general insurance types?

Only a very few numbers of people are unfamiliar with.

Insurance planning / personal finance.

Types of life insurance policies in india.

The markets were bullish & investors churned out huge profits from their investments.

This type of life insurance gives you maximum coverage with minimum premium.

You can also widen up the coverage by buying additional riders.

![An Introduction - Indian General [Non-Life] Insurance ...](https://www.medindia.net/patients/insurance/images/insurance-Industry-India.jpg)

Know about different types of insurance, insurance companies in india and tax benefits.

Insurance is a mutual agreement between the insured and insurer to protect against financial losses.

The legal contract between an insured and insurance company is known as an insurance policy.

Whole life policy offers a savings component (also known as cash value) to apply online for best credit cards in india, life insurance plans, secured loans and unsecured loans, visit www.mymoneymantra.com, the leading.

Read ahead to know more about government health insurance schemes in india.

Life insurance can be termed as a contract between an insurance policyholder and an insurance company, where the insurer promises to pay a sum of money in exchange for a premium, upon the death of an insured person or after a set period.

The remaining life insurance companies are under the private there are varied types of life insurance policies offered by many insurance companies in india.

You can settle for the best policy as per your.

What type of car insurance covers your car if it is stolen?:

These types of policies usually protect you and your car against problems not caused by collisions, such as theft, vandalism, and breakdowns.

Best health insurance in india for individual.

Top up/super top up health insurance policy.

Life insurance is the most popular type of insurance in india.

This type of insurance applies to the life of an individual in case they die during the term of the policy.

With life insurance policies, only when a policyholder dies or the policy matures does a policyholder receive the insurance amount.

Insurance is very important for all because it gives assurance, if anything wrong happen to us!

Term insurance or term plan.

Basic type and covered for a specific period.

An entity or body which provides there are 57 insurance companies in india, and out of that figure 24 are life insurance companies.

33 others are general insurance companies which.

Different types of health insurance policies cover an array of diseases and ailments.

Pnb metlife india insurance co.

Indiafirst life insurance company ltd.

There are many types of life insurance plans, and the decision to buy a particular plan depends upon the optimal combination of needs and affordability of the customer.

The exponential upsurge of quality healthcare expenses has made it compulsory for everyone to be covered with a health insurance.

Many types of insurance are available in the world but we explain most important or trending insurance types.

When you take any types of insurance so before signature you can read all term & condition in the company.

This type of home insurance covers you and your family.

A compensation is given in case of permanent disablement or death of the insured it is not just the house, that you have insured, but also the contents inside the house on which you would have spent a lot of time and money deserve.

This type of home insurance covers you and your family. Insurance Types In India. A compensation is given in case of permanent disablement or death of the insured it is not just the house, that you have insured, but also the contents inside the house on which you would have spent a lot of time and money deserve.Susu Penyebab Jerawat???Sensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat RamadhanTernyata Jajanan Pasar Ini Punya Arti RomantisIni Beda Asinan Betawi & Asinan BogorFoto Di Rumah Makan PadangResep Ponzu, Cocolan Ala Jepang5 Makanan Pencegah Gangguan PendengaranBir Pletok, Bir Halal BetawiKuliner Legendaris Yang Mulai Langka Di DaerahnyaPetis, Awalnya Adalah Upeti Untuk Raja

Comments

Post a Comment