Insurance Types In India A Compensation Is Given In Case Of Permanent Disablement Or Death Of The Insured It Is Not Just The House, That You Have Insured, But Also The Contents Inside The House On Which You Would Have Spent A Lot Of Time And Money Deserve.

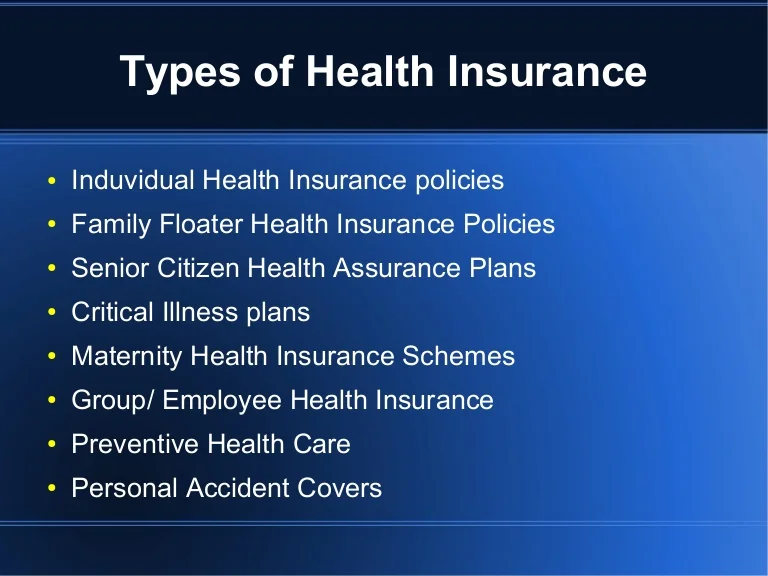

Insurance Types In India. The Exponential Upsurge Of Quality Healthcare Expenses Has Made It Compulsory For Everyone To Be Covered With A Health Insurance.

SELAMAT MEMBACA!

A detailed guide about different types of insurance policies in india.

Even when you think that you are financially secure, a sudden or unforeseen expenditure can significantly hamper this security.

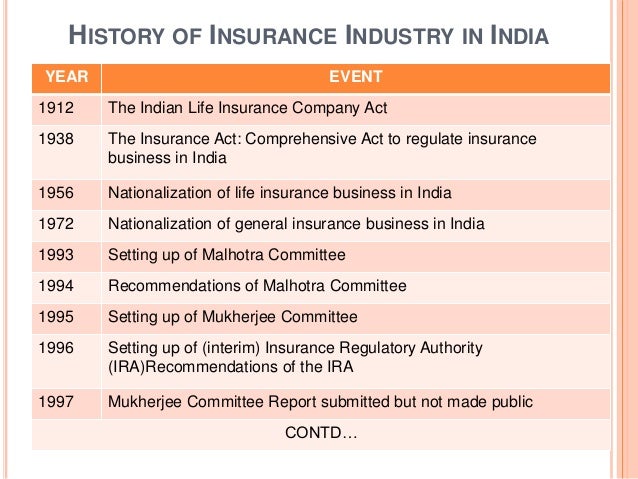

Insurance in india refers to the market for insurance in india which covers both the public and private sector organisations.

It is listed in the constitution of india in the seventh schedule as a union list subject, meaning it can only be legislated by the central government only.

In india life insurance is the most availed form along with health and accident based plans.

Therefore, choosing the best insurance companies in india for your insurance needs is as important as getting an insurance policy.

However, people's needs of types of insurance are mostly restricted to life insurance and general insurance of health and vehicles.

Posted on may 7th, 2021 in insurance.

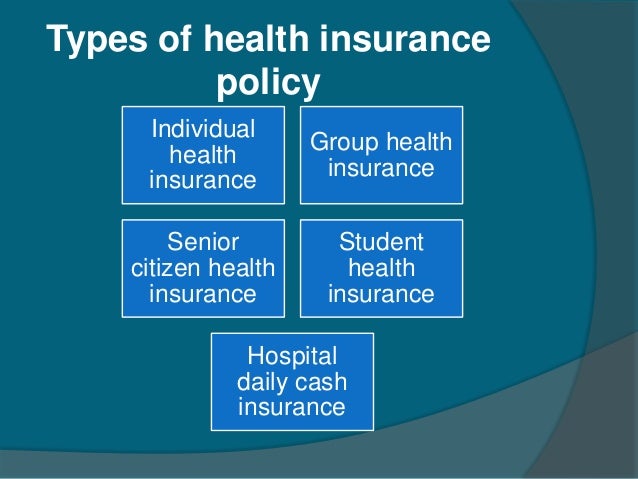

Different types of health insurance plans available in india include:

Offers coverage to only an individual.

Indian insurance refers to the indian insurance market which covers both public and private sector organizations.

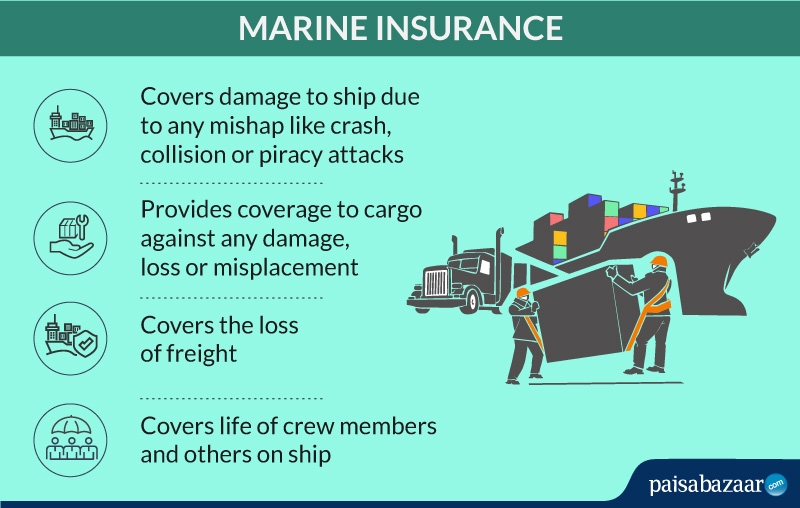

Specialized types of insurance such as fire insurance, flood insurance, earthquake insurance, home insurance, inland sea insurance, or boiler insurance may include this.

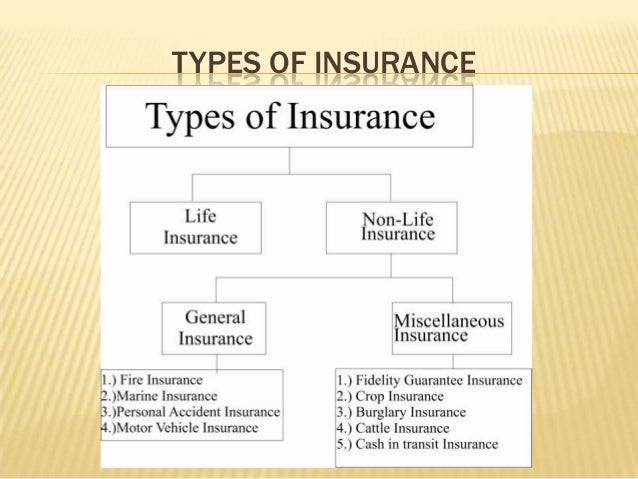

In india, insurance is broadly categorized into three categories:

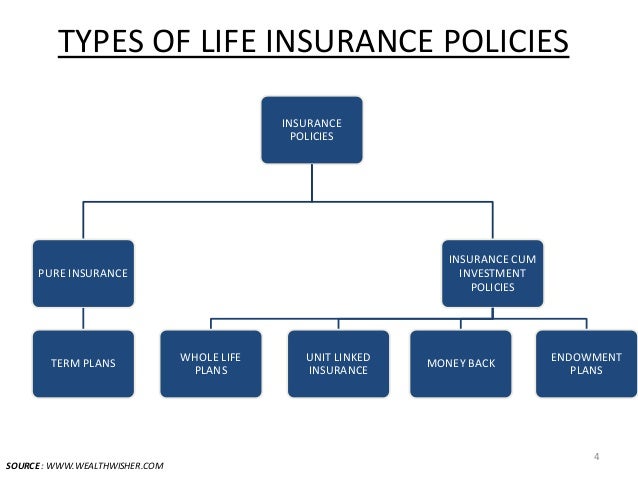

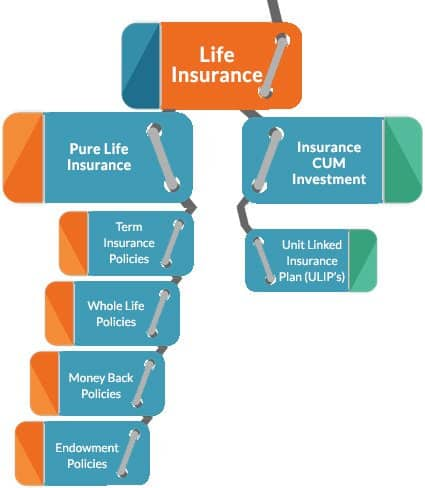

Types of life insurance policies in india.

The life insurance contract provides elements of protection investment.

Insurance is an old concept in india but today it's becoming very common and important for every person who is either a businessman, or a person holds this policy helps the insured person to get the amount of insurance after the age of 60 years the age of retirement in india.

Let's have a look what those are also what these insurances offer their policyholder.

What are general insurance types?

Who does not know about life insurance policies in india?

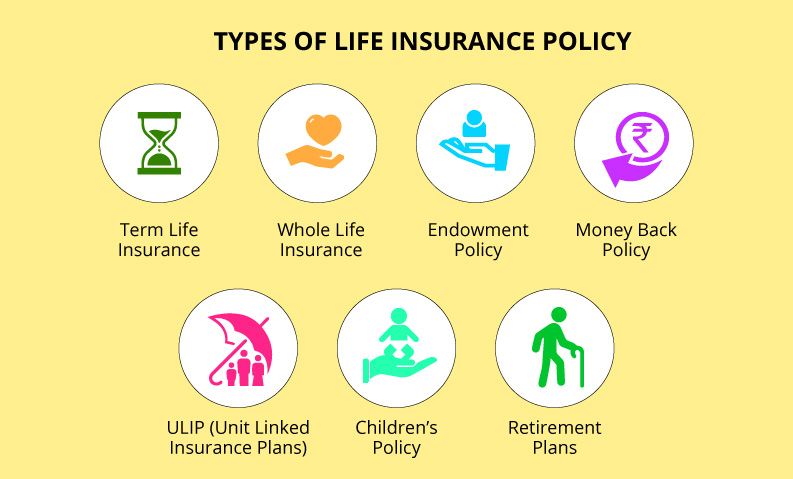

There are many types of insurances such as life insurance, health insurance, motor insurance etc.

Click here to know the details of each type of a complete list of all the different types of insurances available in india.

Sneha banerjee / september 20, 2019april 10, 2020.

Or maybe you need to know the different types of life insurance policies available in the market to make a wise choice!

This type of life insurance gives you maximum coverage with minimum premium.

You can also widen up the coverage by buying additional riders.

Read ahead to know more about government health insurance schemes in india.

What type of car insurance covers your car if it is stolen?:

Most comprehensive coverage policies will cover you if your car is stolen.

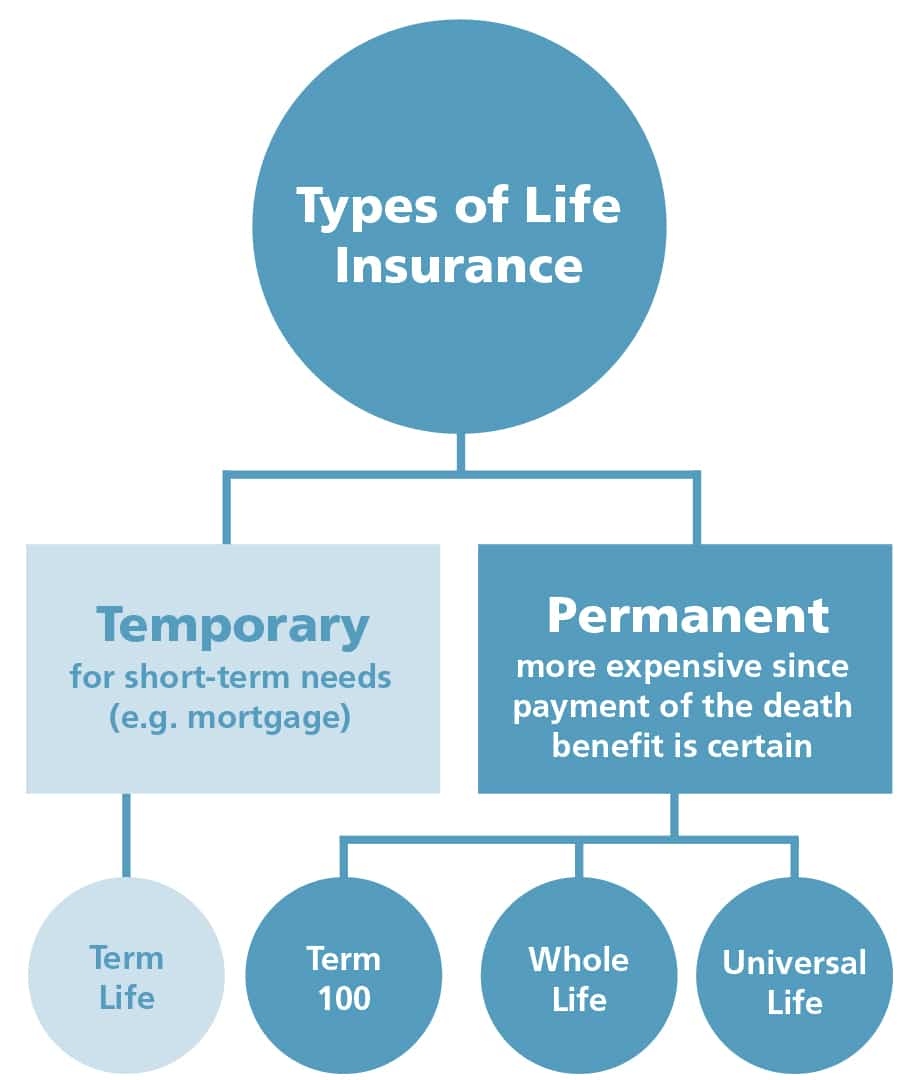

Life insurance can be termed as a contract between an insurance policyholder and an insurance company, where the insurer promises to pay a sum of money in exchange for a premium, upon the death of an insured person or after a set period.

Know about different types of insurance, insurance companies in india and tax benefits.

Insurance is a mutual agreement between the insured and insurer to protect against financial losses.

This type of home insurance covers you and your family.

A compensation is given in case of permanent disablement or death of the insured it is not just the house, that you have insured, but also the contents inside the house on which you would have spent a lot of time and money deserve.

Insurance planning / personal finance.

Once upon a time ulips were star investment products when these were launched for the first time in india.

The markets were bullish & investors churned out huge profits from their investments.

7 types of insurance are;

Can be insured under this insurance, too.

It is a type of risk management, which is primarily used to hedge against the risk of a possible or uncertain loss.

An entity or body which provides there are 57 insurance companies in india, and out of that figure 24 are life insurance companies.

This type of life insurance policy provides permanent life insurance.

Whole life policy offers a savings component (also known as cash value) to apply online for best credit cards in india, life insurance plans, secured loans and unsecured loans, visit www.mymoneymantra.com, the leading.

Types in insurance in india.

Term insurance or term plan.

Basic type and covered for a specific period.

Life insurance is the most popular type of insurance in india.

With life insurance policies, only when a policyholder dies or the policy matures does a policyholder receive the insurance amount.

Term life insurance is one of the various types of insurance in india and operates in a manner that is similar to the way it operates in the west.

As per life insurance should anything happen to the insured person, a certain sum of money will be given to his/her family.

Many types of insurance are available in the world but we explain most important or trending insurance types.

When you take any types of insurance so before signature you can read all term & condition in the company.

You know, all insurance company receives a contract that is called the.

The exponential upsurge of quality healthcare expenses has made it compulsory for everyone to be covered with a health insurance.

A term insurance plan provides comprehensive coverage to the family of the insured against any type of eventualities.

Gawat! Minum Air Dingin Picu Kanker!Ternyata Ini Beda Basil Dan Kemangi!!5 Khasiat Buah Tin, Sudah Teruji Klinis!!3 X Seminggu Makan Ikan, Penyakit Kronis MinggatKhasiat Luar Biasa Bawang Putih PanggangTernyata Jangan Sering Mandikan BayiPentingnya Makan Setelah OlahragaMengusir Komedo Membandel - Bagian 2Ini Cara Benar Cegah HipersomniaObat Hebat, Si Sisik NagaMoreover, it takes care of the liabilities of the family and helps them to maintain a good lifestyle even in the absence of the insured. Insurance Types In India. Future generali india life insurance.

Know more about car insurance policy and types in india.

Anyone who drives without an insurance policy has to pay heavy penalties.

We have a variety of insurance companies offering these varied types of car insurance policy with some features here and there.

Let us first understand various types of policies mainly available to customers across india.

So let's know more about types of car insurance in india in this article below.

Car insurance is a type of insurance to compensate for the loss of the policyholder and also of the third party depending on the types of car insurance plans.

In india car insurance policies are provided by a number of leading general insurers of the country.

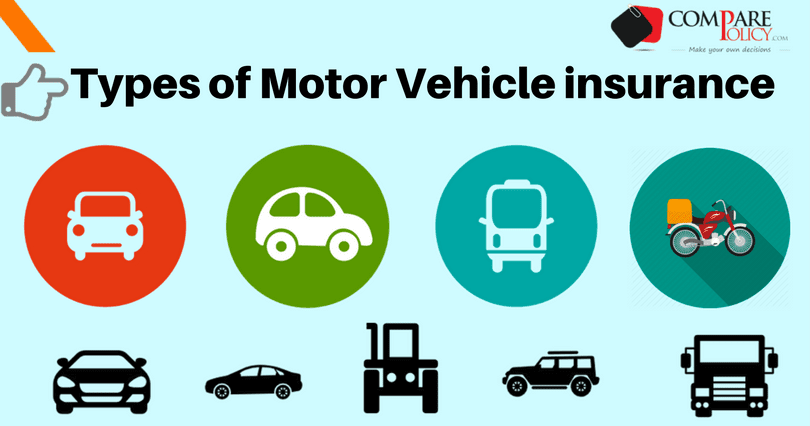

There are many types of motor vehicle insurance policies available in the country of india.

You should assess your insurance needs and decide on a policy that safeguards.

National insurance car insurance policy.

Information on what is aadhaar & its benefits.

Insurance definition types benefits features india.

All you need to know about insurance coverage.

The lowest premium policy may not adequately cover some i have listed the best car insurance companies and policies in this article.

Car insurance, car insurance hindi, car insurance claim, car insurance coverage, things to know about car insurance, best car query technicalinhindi1@gmail.com mob.

Address arvind prajapati gali no.

![An Introduction - Indian General [Non-Life] Insurance ...](https://www.medindia.net/patients/insurance/images/insurance-Industry-India.jpg)

Why car insurance is important in india?

Car insurance policies can literally serve you more than you can ever think.

In general, you will be offered two types motor insurance covers by a car insurance company within their car insurance plans.

How does rental car insurance work in india?

Factors that affect car insurance premium:

Insured declared value the price calculation for the two types of car insurance in india is different.

Compare price and features of the best car insurance policies in india online.

Choose the best insurance plans for your car from leading under this type of claim, the insured can get his/her car fixed at any unauthorised garage post mishap for which he/she has to pay the garage.

Car insurance is a mandate in india as per the indian motor act.

Moreover, different car insurance company includes different additional features on the comprehensive insurance policy.

Basically, the car insurance cost in india or the insurance premium is the sum of the third party cover and own damage cover.

What are the features of a car insurance policy?

Getting motor insurance is essential for all the car/vehicle owners and drivers in india.

A comprehensive car insurance policy provides complete protection to the insured car.

It protects the car from all kinds of unforeseen risks resulting.

Commercial vehicle insurance, car insurance and two wheeler insurance.

Let's have a look at some major features of car insurance policies available in the market.

Reliance general car insurance policy.

Why do you need to have a car insurance policy?

As per motor vehicle act of india, you must have auto insurance for any types of vehicles that you may willing to drive in public places.

A car insurance policy not suited to your needs may leave you without adequate cover in times of need.

They will give 60% flat discount on own damage section premium irrespective of type of vehicle.

One should provide car type, fuel type, registration number, existing policy details and previous claim details for the calculation of premium for old cars.

New india assurance car insurance.

It makes sense to get protection from the loss incurred by a vehicle owner due to accident or theft of the vehicle.

Some of the general insurance companies providing motor insurance, i.e.

Car insurance and two wheeler insurance policies in india are

While buying the very best auto insurance plan in india, a flexible policy is obviously important.

Best car insurance in india likewise offers numerous extra advantages like roadside help.

You should contrast car insurance renewal with get the best car insurance arrangement for your esteemed vehicle.

Buy car insurance policy in easy steps.

Get 24x7 spot assistance cover with bajaj allianz car insurance policy.

While opting for car insurance in india, people might come across a problem of deciding among the best options.

You will also be able to access cashless claim settlement at a wide network of authorised garages.

Car insurance policy for new drivers is offered by many insurance companies.

Comprehensive car insurance policy acts as a shield protecting the insured from financial crisis that may arise in future due to an accident.

Car insurance policies in india are a big hassle to some of the car owners.

Some people still struggle with the terms like ncb, idv etc and the others simply find paying the insurance pay as you use | new types of car insurance policies.

Some people still struggle with the terms like ncb, idv etc and the others simply find paying the insurance pay as you use | new types of car insurance policies. Insurance Types In India. Among all the new insurance policies, this one would be a.Resep Ayam Kecap Ala CeritaKulinerNanas, Hoax Vs FaktaResep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangResep Garlic Bread Ala CeritaKuliner Ampas Kopi Jangan Buang! Ini ManfaatnyaStop Merendam Teh Celup Terlalu Lama!5 Cara Tepat Simpan TelurTrik Menghilangkan Duri Ikan BandengSegarnya Carica, Buah Dataran Tinggi Penuh Khasiat3 Jenis Daging Bahan Bakso Terbaik

Comments

Post a Comment