Insurance Types In Canada Intact Financial Is Canada's Largest Provider Of Home, Auto, And Business Insurance.

Insurance Types In Canada. In British Columbia, On The Other Hand, Both Types Of Damage Are Covered By A Public Insurance Corporation.

SELAMAT MEMBACA!

Financial consumer agency of canada.

In it you will learn

It covers you for a specific period.

It supplements your provincial health care coverage and may or may not provide extended dental summary there are two basic types of life insurance in canada dictated by how life insurance premiums are paid.

Insurance in canada is an important part of your expenses, but it can be hard to decide what types of insurance you need right now.

As for all types of insurance, your policy will have specific details on what is and isn't covered.

This is also something you'll have to agree to when you buy your coverage.

However choosing from the different types of life insurance in canada isn t like.

The following 5 types of car insurance coverage should be studied to choose the.

Vtc is used for the type of coverage varies, depending on the insurance carrier and plan type.

What are the different types of life insurance policies available in canada?

Search canada's lowest insurance rates.

No matter what kind of insurance you need, we've got you covered.

Insurance is an assured and secure way to protect yourself and your family against risk.

As a newcomer, based on the experiences in your home country, you may have a fair idea of certain types of insurance.

Familiarizing yourself with insurance options in canada is an essential part of financial.

Whatever type of home insurance policy you get, we'll help walk you through each with tips and tricks so you can select the best coverage to suit your needs.

What are the different types of home insurance?

Click to learn more about each type of home insurance available in canada.

Life insurance premiums, like all forms of insurance, are based on the concept of risk.

That's all about types of life insurance in canada.

Life insurance can help you and your family prepare for the future.

The displayed data on insurances by type shows results of the statista global consumer survey conducted in canada in 2020.

This type of home insurance policy provides coverage against perils that are specifically mentioned in the policy document.

Is home insurance mandatory in canada.

For international experience canada , you must have health insurance for the entire time you are in canada.

If your insurance policy is valid for less time than your expected stay in canada, you may be issued a work permit that expires at the same time as your insurance.

The two main types of life insurance in canada are term insurance and permanent insurance.

Travel insurance for canada is a must.

Find out where you can get it, and read about recommended canadian travel insurance policies and providers.

Do you have health insurance for canada?

In canada as elsewhere, insurance is an important way to make sure you're covered if you run into trouble.

In british columbia, on the other hand, both types of damage are covered by a public insurance corporation.

Car insurance tends to cost more than life insurance, because of the longer payment period and multiple claim opportunities.

Save time and money with loans canada.

Research and compare lenders before you apply.

The life insurance landscape in canada is quite unique.

We offer different types of life insurance and we can help you find the solution that's right for you.

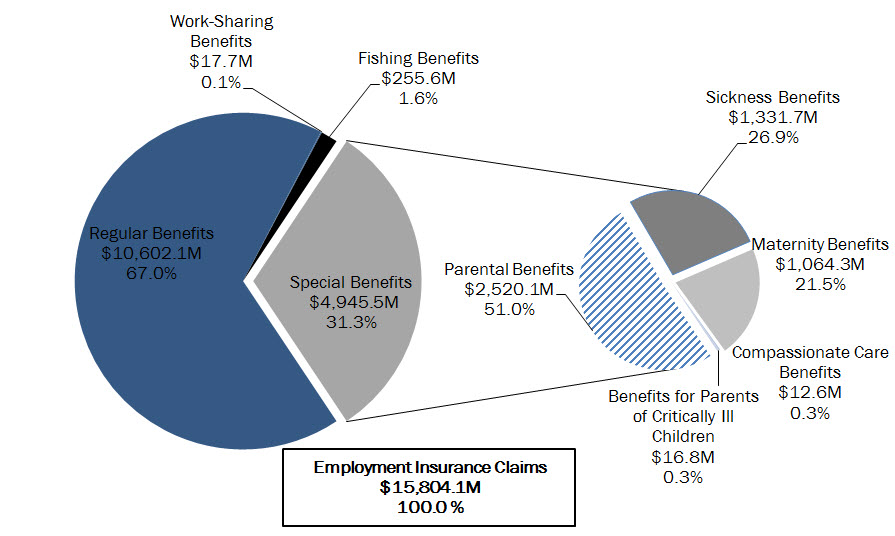

Canada's employment insurance program has a number of types of benefits available to those who are unable to work for different reasons.

Insurance & reinsurance laws and regulations 2021.

You will pay out of pocket for these plans and they can become quite expensive.

This type of vehicle insurance doesn't include damages caused due to collisions or faults in the vehicle.

Where you live in canada, the type of vehicle you drive or own, and driver history are just a few of the different factors that can affect either the amount of coverage.

The rules and regulations for medical insurance in canada vary from one province to another.

Some of these provinces provide health insurance coverage to international students as well.

This is a list of canadian insurance companies.

Canadian association of blue cross plans.

Insurtech is a touchstone for the digital transformation of insurance in canada.

Khasiat Luar Biasa Bawang Putih PanggangMengusir Komedo Membandel6 Khasiat Cengkih, Yang Terakhir Bikin Heboh5 Manfaat Meredam Kaki Di Air EsHindari Makanan Dan Minuman Ini Kala Perut Kosong5 Khasiat Buah Tin, Sudah Teruji Klinis!!Resep Alami Lawan Demam AnakIni Cara Benar Cegah HipersomniaTernyata Jangan Sering Mandikan BayiSalah Pilih Sabun, Ini Risikonya!!!Intact financial is canada's largest provider of home, auto, and business insurance. Insurance Types In Canada. Formerly ing canada, intact financial offers a variety of coverage plans from brokers across canada.

This covers the 5 types of life insurance policies available in canada and helps you decide between term, whole life and other insurances.

Is one of canada's largest online life insurance providers and resources.

We provide you with access to over 20 life there are two basic types of life insurance in canada, dictated by how life insurance premiums are paid.

Term life insurance has premiums that.

Life insurance can help your loved ones deal with the financial impact of your death.

The death benefit paid from a life insurance policy is universal life insurance is a type of permanent life insurance that combines life insurance with an investment account.

Life insurance can help you and your family prepare for the future.

This type of life insurance provides insurance protection till the policy matures, as long as the insured pays the premiums on time.

The two main types of life insurance in canada are term insurance and permanent insurance.

Idc insurance direct canada inc.

There are two main types of life insurance available in canada:

Term insurance and permanent insurance.

The difference between the two is fairly for the average young canadian, however, the monthly premiums may not be worth the eventual payout.

While the types of life insurance covered above are the main products available in canada, there are some other products worth mentioning.

Mortgage life insurance is a special type of term insurance, sold by mortgage providers when a mortgage is taken out.

Its purpose is to make sure the mortgage is.

What type of life insurance does canada offer and what are their benefits.

If you plan to live in canada you must consider different types of insurance to make sure your family are looked.

We offer different types of life insurance and we can help you find the solution that's right for you.

You have options to choose from, including term life insurance, permanent life insurance and universal life insurance.

Apply online at sunlife.ca and get a quote today.

Or talk to a sun life financial advisor to learn more about how life insurance.

Many life insurance shoppers are becoming more aware of the importance of this type of insurance.

This is driving them to become more informed before they make their final decisions.

Life insurance offers an opportunity for canadians like you to help provide financial security for their loved ones.

The canadian life and health insurance association provides information on the different types and costs of long term care.

Get a headstart on personal finances in canada.

Life insurance is used to protect you or your family from a financial loss in the event that you die unexpectedly.

Sun life go offers online life insurance products so canadians can get a quote and apply with ease.

Read on to learn about different types of life insurance sun life is a canadian financial services company, founded in 1865 in montreal, quebec.

Sun life operates in canada, the united states, the.

However choosing from the different types of life insurance in canada isn t like deciding what flavour of ice cream to try for dessert.

Life insurance in canada life insurance is something everyone has in their life time.

It is the money someone (spouse) gets when their parents but the thing is life insurance in canada is quite affordable and cheap for the people.

There are several types of life insurance available in canada.

No matter your needs, there's life insurance out there for you.

Policyme is also an online life insurance company that provides canadians with the ability to buy affordable term life insurance in a matter of minutes.

Chris magafas is my advisor and he is very helpful and so patient with me.and well recommended if you do need any type of insurance he willguide you well and explain all the stuff you need and find you a.

This infographic shows nearly all life insurance companies in canada.

Find out more about 40+ life insurers and discover who owns whom.

We work with all the largest life insurance providers in canada, and can help you find a.

Compare life insurance quotes & explore your coverage options.

Protect the financial security of your loved ones today.

Get quotes from 75+ canadian providers in minutes.

Compare rates from canada's leading life insurance providers.

Equitable life insurance of canada has one goal in mind:

This insurance company sells attractive life insurance and investment products.

Assumption life is a company that advocates mutual aid, integrity, modernization and the greatest possible commitment to.

Are you a canadian citizen who has questions about life insurance in the united states?

Life insurance is a must for people of all age groups.

Fastest access to the best life insurance deals in canada. Insurance Types In Canada. Life insurance is a must for people of all age groups.Resep Cream Horn PastryResep Cumi Goreng Tepung MantulIkan Tongkol Bikin Gatal? Ini PenjelasannyaBir Pletok, Bir Halal BetawiTips Memilih Beras BerkualitasKuliner Legendaris Yang Mulai Langka Di Daerahnya3 Cara Pengawetan CabaiResep Yakitori, Sate Ayam Ala JepangAmpas Kopi Jangan Buang! Ini ManfaatnyaSensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat Ramadhan

Comments

Post a Comment