Insurance Types For Business To Help You Understand What Each Insurance Type Is And What It Covers, We Put Together A Comprehensive.

Insurance Types For Business. Get Back To Business Fast.

SELAMAT MEMBACA!

Different types of business insurance.

Get recommendations on the types of insurance your business needs.

We're backed by more than 200 years of experience.

We've made it our business to figure out the best way to have your back.

Here are some insurance types that a business must have in place as soon as possible.

Types of business insurance your operation needs.

Below is a list of the different types of insurances for a business you'll need.

Moore started talking about different types of insurance for businesses.

Business insurance coverage protects businesses from losses due to events that may occur during the normal course of business.

Companies evaluate their insurance needs based on potential risks, which can vary depending on the type of environment in which the company operates.

Business property insurance will cover the cost to repair or rebuild your company's physical structures if you sustain damage from fire, hail, theft, wind, smoke or this insurance generally covers buildings, not other types of property such as vehicles in a commercial fleet.

Vehicles are covered under a.

A business property insurance policy pays for damages to your business property resulting from a covered loss.

Schedule a consultation with a business insurance professional to review your.

Business insurance, it's important to think about the covers you might need.

Employers' liability cover is a legal requirement for most businesses with staff, public small businesses can require many of the same types of insurance as larger businesses but it all depends on the setup of your business.

Get back to business fast.

Choose your industry to get started.

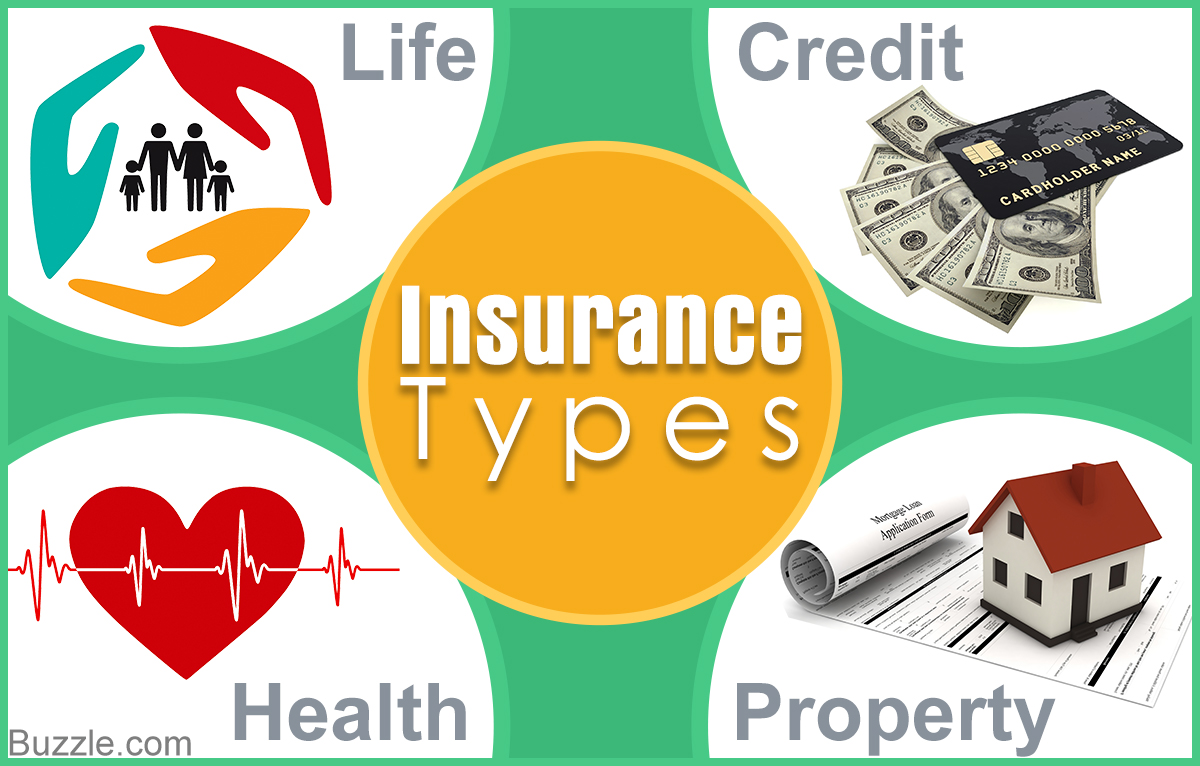

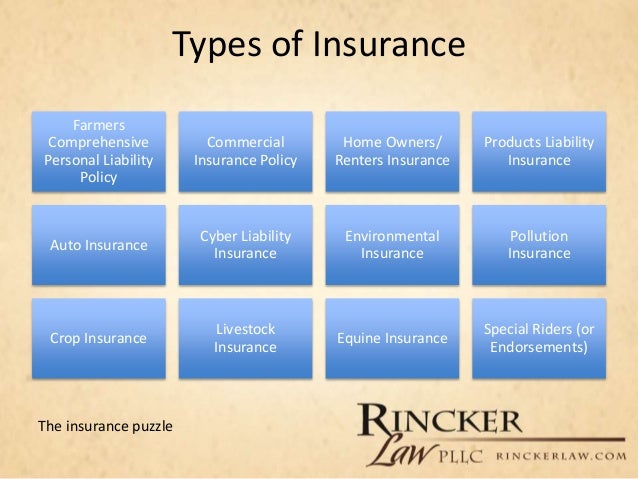

7 types of insurance are;

7 major types of business insurance.

Additional insurance coverage available for your business.

There are several major types of business insurance.

For example, workers compensation insurance is required for any business with employees.

Rules for workers compensation differ by state but are designed to help businesses pay compensation should an employee be injured or suffer a disease related to their.

There are different types of business insurance, and the types you may need depend on your business and what you do.

Before you choose an insurance policy, you'll need to evaluate your insurance needs.

Business interruption or loss of profits insurance covers you if your business suffers from damage to property by fire or other insured dangers.

And as each policy is different, it's important to know what's.

It's difficult even if you're familiar with business insurance.

It's near impossible if you don't know which options are available.

If you fall in the second category, don't lose your hat just yet.

Insurance companies that offer business insurance will often offer packages that bundle different types of insurance policies together.

The type of insurance products that are best for you really depends on your business.

Consider the following types of insurance when comparing policies

Since every business is unique, each business will have different insurance needs.

In this article, we'll cover the most common types of business insurance that nearly every business needs.

Here are the business insurance types you might need due to the business type that you have:

Business interruption insurance pays close to what you normally would have earned.

The premiums, especially when part of a complete insurance package, are low.

Login to add to your reading list.

Here's what you should know about the different types and how much business insurance you may require.

Why do i need insurance for my business?

Disasters don't just happen to other businesses.

The type of your business, the size, the assets, and corporate structure will.

Choosing the right types of business insurance can be overwhelming.

Explore affordable insurance options designed for growing businesses right from quickbooks.

Business insurance requirements vary from state to state, and names for individual coverages aren't always consistent among insurance companies.

For instance, one insurer might refer to coverage for the accidental.

The policy provides both defense and damages if you, your employees or your products or services cause or are alleged to have caused bodily injury or property damage to a third party.

Separate policies under business insurance type cover a specific risk.

Commercial insurance companies provide specific insurance coverage to tangible and intangible business assets, fire hazards, group mediclaim, etc.

Get a free quote, it's quick and easy!

To help you understand what each insurance type is and what it covers, we put together a comprehensive.

The type of business you run determines the type of coverage you may need — the requirements vary by state.

A few types of policies are common for many businesses, but before you assume it's a requirement, you should consult with a lawyer or insurance agent for details about your specific.

It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

Mengusir Komedo Membandel - Bagian 2Ternyata Ini Beda Basil Dan Kemangi!!Ternyata Tahan Kentut Bikin KeracunanIni Cara Benar Cegah Hipersomnia5 Khasiat Buah Tin, Sudah Teruji Klinis!!Ini Manfaat Seledri Bagi KesehatanIni Efek Buruk Overdosis Minum KopiTernyata Tertawa Itu DukaPentingnya Makan Setelah OlahragaTernyata Menikmati Alam Bebas Ada ManfaatnyaInsurance is a means of protection from financial loss. Insurance Types For Business. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

Different types of business insurance.

Get recommendations on the types of insurance your business needs.

We're backed by more than 200 years of experience.

We've made it our business to figure out the best way to have your back.

Here are some insurance types that a business must have in place as soon as possible.

Types of business insurance your operation needs.

Below is a list of the different types of insurances for a business you'll need.

Moore started talking about different types of insurance for businesses.

Business insurance coverage protects businesses from losses due to events that may occur during the normal course of business.

Companies evaluate their insurance needs based on potential risks, which can vary depending on the type of environment in which the company operates.

Business property insurance will cover the cost to repair or rebuild your company's physical structures if you sustain damage from fire, hail, theft, wind, smoke or this insurance generally covers buildings, not other types of property such as vehicles in a commercial fleet.

Vehicles are covered under a.

A business property insurance policy pays for damages to your business property resulting from a covered loss.

Schedule a consultation with a business insurance professional to review your.

Business insurance, it's important to think about the covers you might need.

Employers' liability cover is a legal requirement for most businesses with staff, public small businesses can require many of the same types of insurance as larger businesses but it all depends on the setup of your business.

Get back to business fast.

Choose your industry to get started.

7 types of insurance are;

7 major types of business insurance.

Additional insurance coverage available for your business.

There are several major types of business insurance.

For example, workers compensation insurance is required for any business with employees.

Rules for workers compensation differ by state but are designed to help businesses pay compensation should an employee be injured or suffer a disease related to their.

There are different types of business insurance, and the types you may need depend on your business and what you do.

Before you choose an insurance policy, you'll need to evaluate your insurance needs.

Business interruption or loss of profits insurance covers you if your business suffers from damage to property by fire or other insured dangers.

And as each policy is different, it's important to know what's.

It's difficult even if you're familiar with business insurance.

It's near impossible if you don't know which options are available.

If you fall in the second category, don't lose your hat just yet.

Insurance companies that offer business insurance will often offer packages that bundle different types of insurance policies together.

The type of insurance products that are best for you really depends on your business.

Consider the following types of insurance when comparing policies

Since every business is unique, each business will have different insurance needs.

In this article, we'll cover the most common types of business insurance that nearly every business needs.

Here are the business insurance types you might need due to the business type that you have:

Business interruption insurance pays close to what you normally would have earned.

The premiums, especially when part of a complete insurance package, are low.

Login to add to your reading list.

Here's what you should know about the different types and how much business insurance you may require.

Why do i need insurance for my business?

Disasters don't just happen to other businesses.

The type of your business, the size, the assets, and corporate structure will.

Choosing the right types of business insurance can be overwhelming.

Explore affordable insurance options designed for growing businesses right from quickbooks.

Business insurance requirements vary from state to state, and names for individual coverages aren't always consistent among insurance companies.

For instance, one insurer might refer to coverage for the accidental.

The policy provides both defense and damages if you, your employees or your products or services cause or are alleged to have caused bodily injury or property damage to a third party.

Separate policies under business insurance type cover a specific risk.

Commercial insurance companies provide specific insurance coverage to tangible and intangible business assets, fire hazards, group mediclaim, etc.

Get a free quote, it's quick and easy!

To help you understand what each insurance type is and what it covers, we put together a comprehensive.

The type of business you run determines the type of coverage you may need — the requirements vary by state.

A few types of policies are common for many businesses, but before you assume it's a requirement, you should consult with a lawyer or insurance agent for details about your specific.

It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

Insurance is a means of protection from financial loss. Insurance Types For Business. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.Sejarah Gudeg JogyakartaBir Pletok, Bir Halal BetawiTernyata Jajanan Pasar Ini Punya Arti RomantisStop Merendam Teh Celup Terlalu Lama!Resep Stawberry Cheese Thumbprint Cookies3 Cara Pengawetan CabaiTernyata Bayam Adalah Sahabat WanitaWaspada, Ini 5 Beda Daging Babi Dan Sapi!!Tips Memilih Beras BerkualitasCegah Alot, Ini Cara Benar Olah Cumi-Cumi

Comments

Post a Comment