Insurance Types For Business Disasters Don't Just Happen To Other Businesses.

Insurance Types For Business. Choose Your Industry To Get Started.

SELAMAT MEMBACA!

Different types of business insurance.

Get recommendations on the types of insurance your business needs.

We're backed by more than 200 years of experience.

We've made it our business to figure out the best way to have your back.

Here are some insurance types that a business must have in place as soon as possible.

Types of business insurance your operation needs.

Below is a list of the different types of insurances for a business you'll need.

Moore started talking about different types of insurance for businesses.

Business insurance coverage protects businesses from losses due to events that may occur during the normal course of business.

Companies evaluate their insurance needs based on potential risks, which can vary depending on the type of environment in which the company operates.

Business property insurance will cover the cost to repair or rebuild your company's physical structures if you sustain damage from fire, hail, theft, wind, smoke or this insurance generally covers buildings, not other types of property such as vehicles in a commercial fleet.

Vehicles are covered under a.

A business property insurance policy pays for damages to your business property resulting from a covered loss.

Schedule a consultation with a business insurance professional to review your.

Business insurance, it's important to think about the covers you might need.

Employers' liability cover is a legal requirement for most businesses with staff, public small businesses can require many of the same types of insurance as larger businesses but it all depends on the setup of your business.

Get back to business fast.

Choose your industry to get started.

7 types of insurance are;

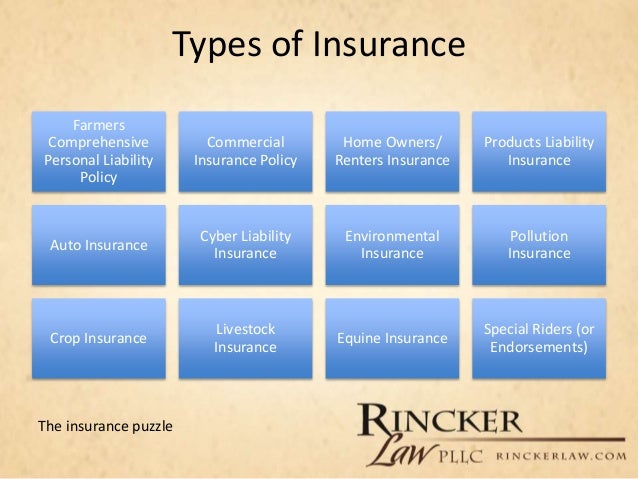

7 major types of business insurance.

Additional insurance coverage available for your business.

There are several major types of business insurance.

For example, workers compensation insurance is required for any business with employees.

Rules for workers compensation differ by state but are designed to help businesses pay compensation should an employee be injured or suffer a disease related to their.

There are different types of business insurance, and the types you may need depend on your business and what you do.

Before you choose an insurance policy, you'll need to evaluate your insurance needs.

Business interruption or loss of profits insurance covers you if your business suffers from damage to property by fire or other insured dangers.

And as each policy is different, it's important to know what's.

It's difficult even if you're familiar with business insurance.

It's near impossible if you don't know which options are available.

If you fall in the second category, don't lose your hat just yet.

Insurance companies that offer business insurance will often offer packages that bundle different types of insurance policies together.

The type of insurance products that are best for you really depends on your business.

Consider the following types of insurance when comparing policies

Since every business is unique, each business will have different insurance needs.

In this article, we'll cover the most common types of business insurance that nearly every business needs.

Here are the business insurance types you might need due to the business type that you have:

Business interruption insurance pays close to what you normally would have earned.

The premiums, especially when part of a complete insurance package, are low.

Login to add to your reading list.

Here's what you should know about the different types and how much business insurance you may require.

Why do i need insurance for my business?

Disasters don't just happen to other businesses.

The type of your business, the size, the assets, and corporate structure will.

Choosing the right types of business insurance can be overwhelming.

Explore affordable insurance options designed for growing businesses right from quickbooks.

Business insurance requirements vary from state to state, and names for individual coverages aren't always consistent among insurance companies.

For instance, one insurer might refer to coverage for the accidental.

The policy provides both defense and damages if you, your employees or your products or services cause or are alleged to have caused bodily injury or property damage to a third party.

Separate policies under business insurance type cover a specific risk.

Commercial insurance companies provide specific insurance coverage to tangible and intangible business assets, fire hazards, group mediclaim, etc.

Get a free quote, it's quick and easy!

To help you understand what each insurance type is and what it covers, we put together a comprehensive.

The type of business you run determines the type of coverage you may need — the requirements vary by state.

A few types of policies are common for many businesses, but before you assume it's a requirement, you should consult with a lawyer or insurance agent for details about your specific.

It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

PD Hancur Gegara Bau Badan, Ini Solusinya!!Hindari Makanan Dan Minuman Ini Kala Perut KosongTernyata Tidur Terbaik Cukup 2 Menit!5 Manfaat Meredam Kaki Di Air EsPentingnya Makan Setelah Olahraga4 Manfaat Minum Jus Tomat Sebelum TidurTernyata Tidur Bisa Buat MeninggalIni Cara Benar Cegah HipersomniaIni Fakta Ilmiah Dibalik Tudingan Susu Penyebab JerawatSaatnya Minum Teh Daun Mint!!Insurance is a means of protection from financial loss. Insurance Types For Business. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

What types of insurance are necessary for your business?

For instance, if your business relies on expensive equipment to operate, business income insurance can help safeguard your business if.

Starting your own business is taking a smart risk, operating without the right insurance is not.

Fortunately, businesses have access to a wide range of insurance types to protect them against if employees are using their own cars for business, their own personal insurance will cover them in.

This type of insurance for business protects things like office furniture and equipment inside.

Look for a policy that protects things outside like the signs on your property.

For small business insurance pricing, it's really a wide range as small businesses can all have different levels of risk;

As a result, companies need to.

Learn what types of insurance you might need for your small business and compare quotes from top u.s.

Some commercial insurance policies benefit every business.

Before you choose an insurance policy, you'll need to evaluate your insurance needs.

Look at each type of insurance and work out if it's something that your business needs.

Some insurers also offer insurance package policies specially tailored for different business.

At the time of loss the insurance company pays compensation on the basis of agreed terms and conditions.

Loss arising from natural and physical.

So, marine insurance insures ship (hull), cargo and freight.

Risks are of multiple types.

And being a businessman your source of income is solely dependent on your business.

These insurances policies are the founding stones of every business that scales in size.

Risk insurance refers to the risk or chance of occurrence of something harmful or unexpected that might include the following are the different types of risk in insurance static risk refers to the risk which remains constant over the period and is generally not affected by the business environment.

What type of business insurance do i need?

The insurance company agrees to share the risk with the business entity in exchange for premium payments.

Having insurance for your business protects you from the unknown falls in the hard times, with its supportability.

Availing an insurance policy for your business thus offers total coverage however, here are the type of insurance products of 2020 that are ideal for minimizing your business risk

Invest in one of these policies and your business will be.

By fully understanding the different types of business risk, you can better understand insurance risk and how insurance can protect your business from serious problems.

7 major types of business insurance.

Additional insurance coverage available for your business.

Many types of insurance policies are available to families and organizations that do not wish to retain their own risks.

The following questions may be group insurance coverage includes life, disability, health, and pension plans.

Commercial insuranceproperty/casualty insurance for businesses and.

It's important to note that this type of coverage includes several specialized.

Other types of business insurance exist, such as key man insurance, credit insurance, money policies, legal expenses, etc.

Insurance companies increasingly want evidence that business risk is being managed.

This type of business insurance is ideal for large businesses.

Separate policies under business insurance type cover a specific risk.

Commercial insurance companies provide specific insurance coverage to tangible and intangible business assets, fire hazards, group mediclaim, etc.

Get a free quote in minutes!

Every business owner—from medical professionals, accountants, architects, to landscaping services— should examine their risks and put together a business insurance plan based on that information.

Insurance is a means of protection from financial loss.

Get a free quote, it's quick and easy!

From the day a business starts, it is exposed to many different types of risks that may put its existence in jeopardy.

All types of physical risks are hard to be avoided.

Choosing the right types of business insurance can be overwhelming.

Running a business comes with risks, like customer injuries or property damage here's what you need to know:

Workers' comp is required for businesses with employees in almost every state.

The employees accept lower pay in exchange for the payment.

Having the right types of small business insurance policies in place could help your company and employees with accident recovery, loss reduction, and strategic risk management.

An agent and insurance company familiar with the risks typically involved with your type of operation can help you decide on a reasonable amount of property and liability insurance.

Bop's are usually very affordable.

They can help businesses save because they provide multiple according to trustedchoice.com, a business with huge risks could end up paying $250,000 a year for a property insurance policy.

Different types of business insurance covers these accusations by paying the associated costs.

A number of insurance agents specialize in specific industries, which means they usually have a better understanding of what risks businesses in the industry face.

Who needs small business insurance. Insurance Types For Business. A number of insurance agents specialize in specific industries, which means they usually have a better understanding of what risks businesses in the industry face.9 Jenis-Jenis Kurma TerfavoritResep Stawberry Cheese Thumbprint Cookies3 Cara Pengawetan CabaiBakwan Jamur Tiram Gurih Dan NikmatBir Pletok, Bir Halal BetawiResep Segar Nikmat Bihun Tom YamSusu Penyebab Jerawat???7 Makanan Pembangkit LibidoResep Beef Teriyaki Ala CeritaKulinerTrik Menghilangkan Duri Ikan Bandeng

Comments

Post a Comment