Insurance Types Different Types Of Insurance For Companies And Businesses.

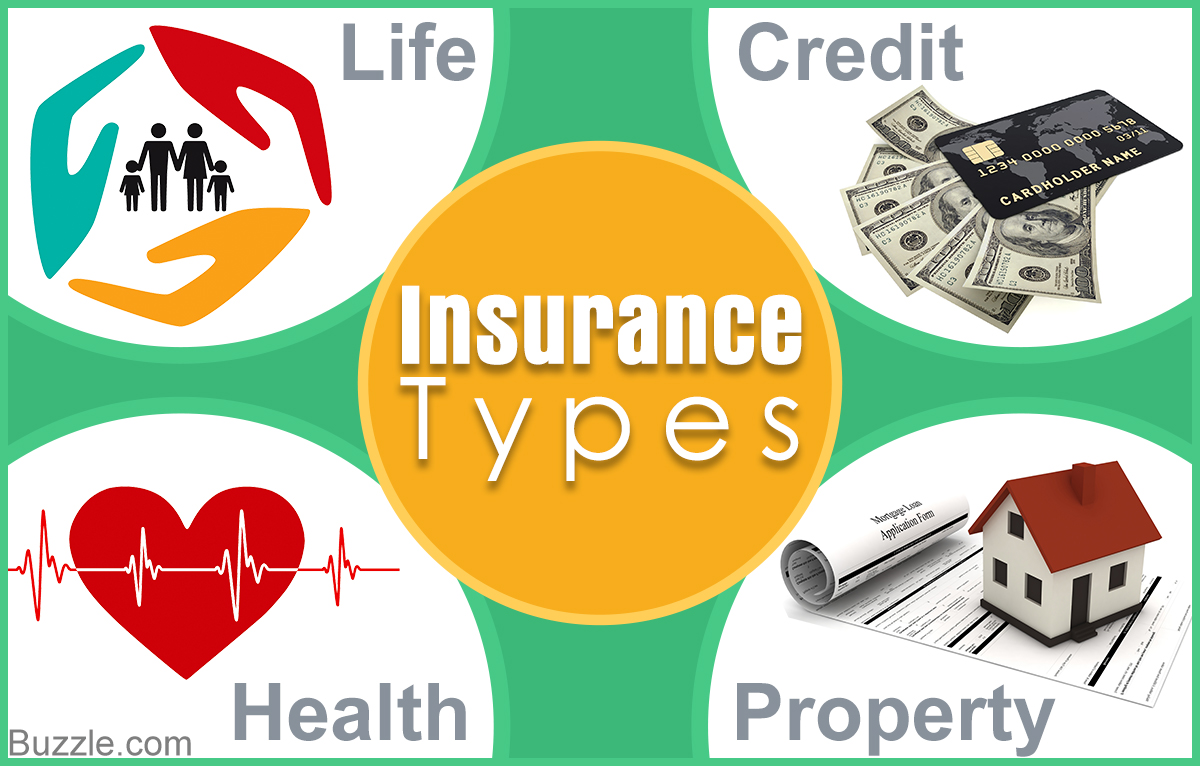

Insurance Types. Types Of Insurance Can Be Classified According To The Perils Insured Or By The Type Of Insurance Program.

SELAMAT MEMBACA!

7 types of insurance are;

From wikipedia, the free encyclopedia.

Jump to navigation jump to search.

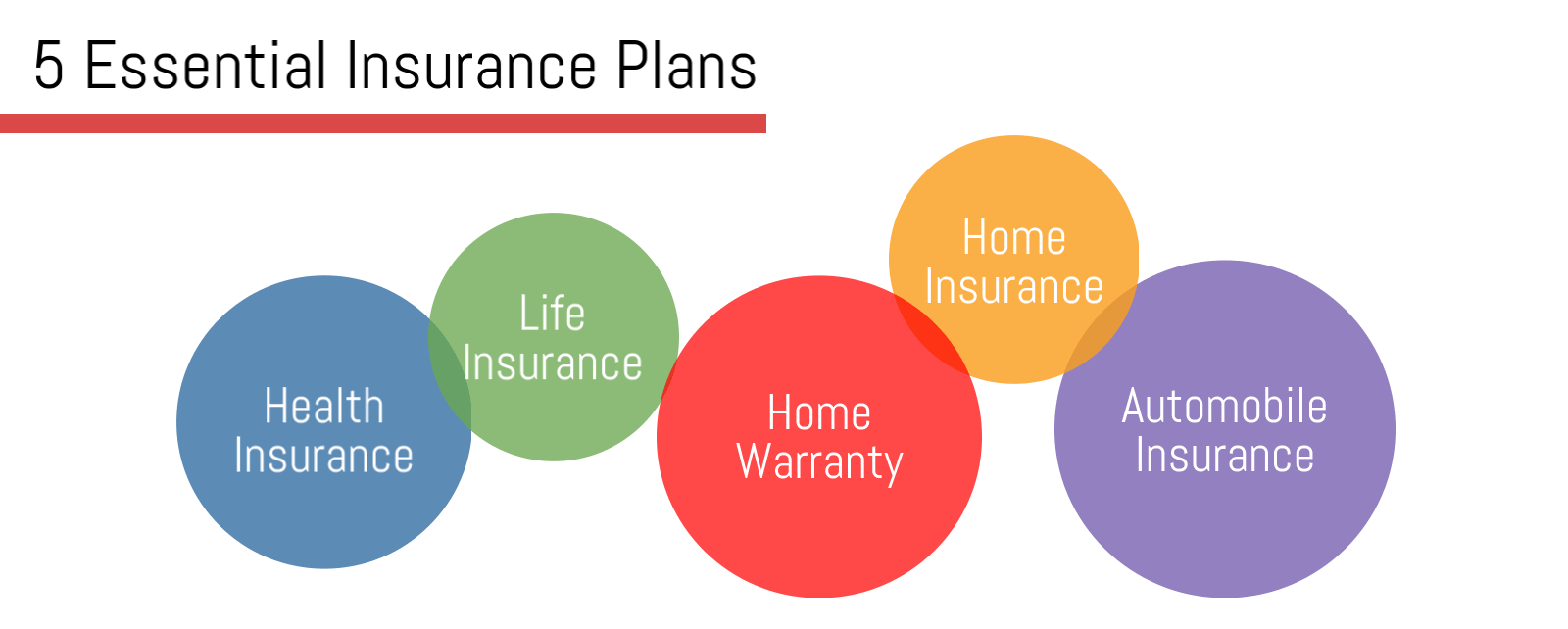

There are, however, four types of insurance that most financial experts recommend we all have:

Liability insurance is what's called umbrella insurance, because it covers.

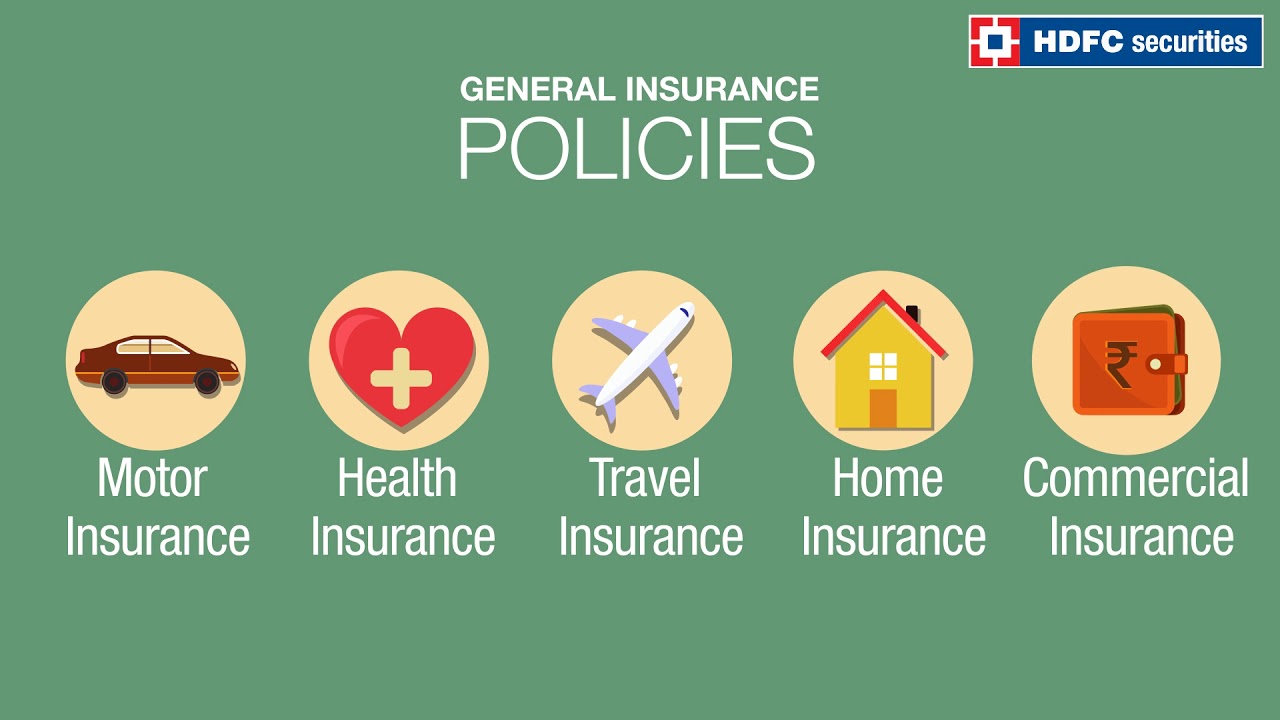

Health insurance motor insurance travel insurance home insurance fire insurance 2.

Term.there are two broad types of insurance:

There are many different types of business insurance options out there.

Choosing what you need to protect yours can be overwhelming.

Disability insurance is the only type of insurance that will pay a benefit to you if you are ill or auto, property, health, disability, and life insurance are the top types of insurance that help you protect.

If company vehicles will be used, those vehicles should be fully insured to protect.

It's unlikely that you'll need every insurance product on the market, even if you could afford them all.

Insurance covers different types of risks.

Life insurance (or) life assurance.

The types of insurance company corporate structures.

Many types of insurance policies are available to families and organizations that do not wish to retain.

This findlaw article gives an overview of some of the most common types of.

The concept of insurance discussing the topic:

Features, types, and significance or importance of insurance.

These types of insurance policies are mostly for shorter durations i.e.

Not more than some of the common types of general insurance are property insurance, liability insurance, legal expenses.

In this video i explain what is insurance, the general principles, and types of life, fire and marine insurance.

While thorough coverage is important, it's also possible that you can have too much coverage.

Understanding the types of life insurance policies doesn't have to be complicated.

Get the facts and learn the key differences before choosing a policy.

There is also a primary distinction between private and social insurance.

This type of insurance envisions the payment of insurance compensation for the loss or death of their occupational ability to work as a result of damage to the life and health of the insured person in the.

*recreational vehicle insurance covers those types of vehicles and the liability on motorized rv's.

Buying life insurance shouldn't be complicated.

Make sense of all the types of life insurance available and find out what's right for you and your family.

Common insurance types include property, auto, health, and life insurance.

The main types of insurance.

When you buy personal insurance for yourself, it liability coverage is one of the fundamental types of insurance, and you'll own a lot of it when you run a business.

Learn about the different types of insurance.

Find out about coverage options.

Two types of insurance are commonly found in the market;

They are insurance of property and life insurance.

Learn about the different ways to protect what's important to you.

Learn what you need to know about health, auto, life, home and other insurance for washington state consumers from the office of the insurance commissioner.

4 Titik Akupresur Agar Tidurmu NyenyakHindari Makanan Dan Minuman Ini Kala Perut KosongPD Hancur Gegara Bau Badan, Ini Solusinya!!Melawan Pikun Dengan ApelTernyata Jangan Sering Mandikan BayiCara Benar Memasak SayuranGawat! Minum Air Dingin Picu Kanker!Cegah Celaka, Waspada Bahaya Sindrom HipersomniaIni Cara Benar Cegah HipersomniaSaatnya Minum Teh Daun Mint!!Insurance companies create insurance policies by grouping risks according to many other types of insurance are also issued. Insurance Types. Group health insurance plans are usually offered by.

A detailed guide about different types of insurance policies in india.

Even when you think that you are financially secure, a sudden or unforeseen expenditure can significantly hamper this security.

Insurance in india refers to the market for insurance in india which covers both the public and private sector organisations.

It is listed in the constitution of india in the seventh schedule as a union list subject, meaning it can only be legislated by the central government only.

In india life insurance is the most availed form along with health and accident based plans.

Therefore, choosing the best insurance companies in india for your insurance needs is as important as getting an insurance policy.

However, people's needs of types of insurance are mostly restricted to life insurance and general insurance of health and vehicles.

Posted on may 7th, 2021 in insurance.

Different types of health insurance plans available in india include:

Offers coverage to only an individual.

Indian insurance refers to the indian insurance market which covers both public and private sector organizations.

Specialized types of insurance such as fire insurance, flood insurance, earthquake insurance, home insurance, inland sea insurance, or boiler insurance may include this.

In india, insurance is broadly categorized into three categories:

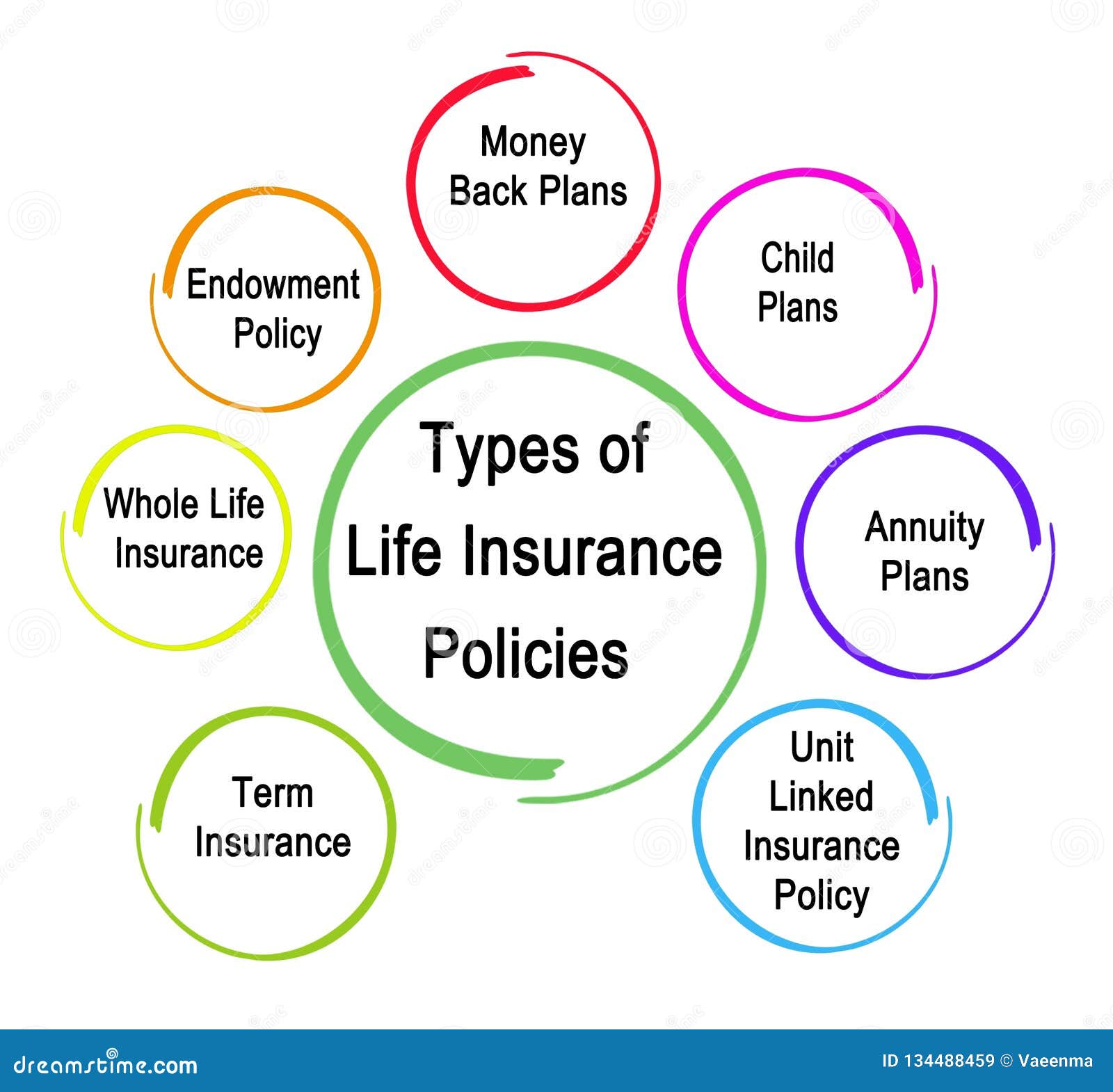

Types of life insurance policies in india.

The life insurance contract provides elements of protection investment.

Insurance is an old concept in india but today it's becoming very common and important for every person who is either a businessman, or a person holds this policy helps the insured person to get the amount of insurance after the age of 60 years the age of retirement in india.

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

Let's have a look what those are also what these insurances offer their policyholder.

What are general insurance types?

Who does not know about life insurance policies in india?

There are many types of insurances such as life insurance, health insurance, motor insurance etc.

Click here to know the details of each type of a complete list of all the different types of insurances available in india.

Sneha banerjee / september 20, 2019april 10, 2020.

Or maybe you need to know the different types of life insurance policies available in the market to make a wise choice!

This type of life insurance gives you maximum coverage with minimum premium.

You can also widen up the coverage by buying additional riders.

Read ahead to know more about government health insurance schemes in india.

What type of car insurance covers your car if it is stolen?:

Most comprehensive coverage policies will cover you if your car is stolen.

Life insurance can be termed as a contract between an insurance policyholder and an insurance company, where the insurer promises to pay a sum of money in exchange for a premium, upon the death of an insured person or after a set period.

Know about different types of insurance, insurance companies in india and tax benefits.

Insurance is a mutual agreement between the insured and insurer to protect against financial losses.

This type of home insurance covers you and your family.

A compensation is given in case of permanent disablement or death of the insured it is not just the house, that you have insured, but also the contents inside the house on which you would have spent a lot of time and money deserve.

Insurance planning / personal finance.

Once upon a time ulips were star investment products when these were launched for the first time in india.

The markets were bullish & investors churned out huge profits from their investments.

7 types of insurance are;

Can be insured under this insurance, too.

It is a type of risk management, which is primarily used to hedge against the risk of a possible or uncertain loss.

An entity or body which provides there are 57 insurance companies in india, and out of that figure 24 are life insurance companies.

This type of life insurance policy provides permanent life insurance.

Whole life policy offers a savings component (also known as cash value) to apply online for best credit cards in india, life insurance plans, secured loans and unsecured loans, visit www.mymoneymantra.com, the leading.

Types in insurance in india.

Term insurance or term plan.

Basic type and covered for a specific period.

Life insurance is the most popular type of insurance in india.

With life insurance policies, only when a policyholder dies or the policy matures does a policyholder receive the insurance amount.

Term life insurance is one of the various types of insurance in india and operates in a manner that is similar to the way it operates in the west.

As per life insurance should anything happen to the insured person, a certain sum of money will be given to his/her family.

Many types of insurance are available in the world but we explain most important or trending insurance types.

When you take any types of insurance so before signature you can read all term & condition in the company.

You know, all insurance company receives a contract that is called the.

The exponential upsurge of quality healthcare expenses has made it compulsory for everyone to be covered with a health insurance.

A term insurance plan provides comprehensive coverage to the family of the insured against any type of eventualities.

Moreover, it takes care of the liabilities of the family and helps them to maintain a good lifestyle even in the absence of the insured. Insurance Types. Future generali india life insurance.Ikan Tongkol Bikin Gatal? Ini Penjelasannya3 Jenis Daging Bahan Bakso Terbaik9 Jenis-Jenis Kurma TerfavoritBir Pletok, Bir Halal BetawiResep Ayam Suwir Pedas Ala CeritaKulinerKhao Neeo, Ketan Mangga Ala ThailandPetis, Awalnya Adalah Upeti Untuk Raja5 Cara Tepat Simpan Telur5 Trik Matangkan ManggaSegarnya Carica, Buah Dataran Tinggi Penuh Khasiat

Comments

Post a Comment