Insurance Types In Canada The Infographic Below Shows All The Key Players And Their Size, Reflecting Their Assets Under Management (aum) Based On Life And Wealth Segments Of The.

Insurance Types In Canada. For International Experience Canada , You Must Have Health Insurance For The Entire Time You Are In Canada.

SELAMAT MEMBACA!

Financial consumer agency of canada.

In it you will learn

It covers you for a specific period.

It supplements your provincial health care coverage and may or may not provide extended dental summary there are two basic types of life insurance in canada dictated by how life insurance premiums are paid.

Insurance in canada is an important part of your expenses, but it can be hard to decide what types of insurance you need right now.

As for all types of insurance, your policy will have specific details on what is and isn't covered.

This is also something you'll have to agree to when you buy your coverage.

However choosing from the different types of life insurance in canada isn t like.

The following 5 types of car insurance coverage should be studied to choose the.

Vtc is used for the type of coverage varies, depending on the insurance carrier and plan type.

What are the different types of life insurance policies available in canada?

Search canada's lowest insurance rates.

No matter what kind of insurance you need, we've got you covered.

Insurance is an assured and secure way to protect yourself and your family against risk.

As a newcomer, based on the experiences in your home country, you may have a fair idea of certain types of insurance.

Familiarizing yourself with insurance options in canada is an essential part of financial.

Whatever type of home insurance policy you get, we'll help walk you through each with tips and tricks so you can select the best coverage to suit your needs.

What are the different types of home insurance?

Click to learn more about each type of home insurance available in canada.

Life insurance premiums, like all forms of insurance, are based on the concept of risk.

That's all about types of life insurance in canada.

Life insurance can help you and your family prepare for the future.

The displayed data on insurances by type shows results of the statista global consumer survey conducted in canada in 2020.

This type of home insurance policy provides coverage against perils that are specifically mentioned in the policy document.

Is home insurance mandatory in canada.

For international experience canada , you must have health insurance for the entire time you are in canada.

If your insurance policy is valid for less time than your expected stay in canada, you may be issued a work permit that expires at the same time as your insurance.

The two main types of life insurance in canada are term insurance and permanent insurance.

Travel insurance for canada is a must.

Find out where you can get it, and read about recommended canadian travel insurance policies and providers.

Do you have health insurance for canada?

In canada as elsewhere, insurance is an important way to make sure you're covered if you run into trouble.

In british columbia, on the other hand, both types of damage are covered by a public insurance corporation.

Car insurance tends to cost more than life insurance, because of the longer payment period and multiple claim opportunities.

Save time and money with loans canada.

Research and compare lenders before you apply.

The life insurance landscape in canada is quite unique.

We offer different types of life insurance and we can help you find the solution that's right for you.

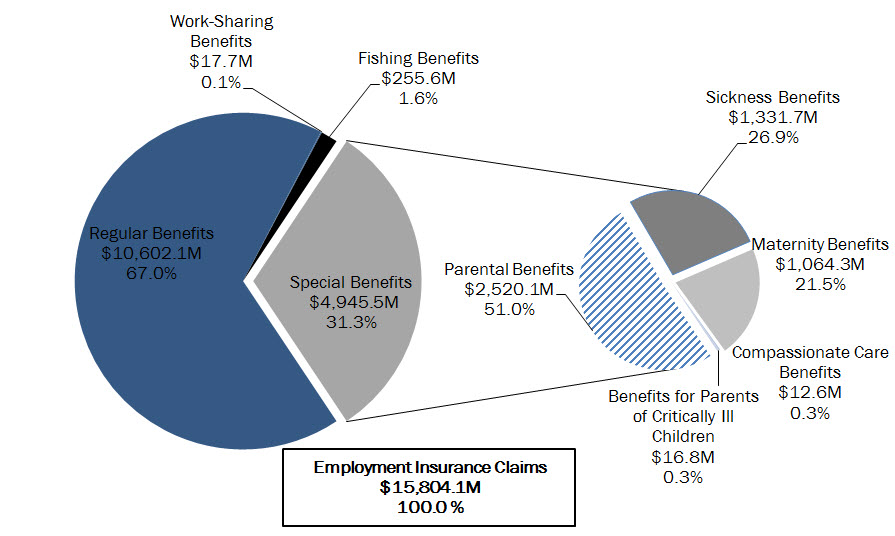

Canada's employment insurance program has a number of types of benefits available to those who are unable to work for different reasons.

Insurance & reinsurance laws and regulations 2021.

You will pay out of pocket for these plans and they can become quite expensive.

This type of vehicle insurance doesn't include damages caused due to collisions or faults in the vehicle.

Where you live in canada, the type of vehicle you drive or own, and driver history are just a few of the different factors that can affect either the amount of coverage.

The rules and regulations for medical insurance in canada vary from one province to another.

Some of these provinces provide health insurance coverage to international students as well.

This is a list of canadian insurance companies.

Canadian association of blue cross plans.

Insurtech is a touchstone for the digital transformation of insurance in canada.

Ternyata Jangan Sering Mandikan BayiTips Jitu Deteksi Madu Palsu (Bagian 2)Fakta Salah Kafein KopiHindari Makanan Dan Minuman Ini Kala Perut KosongTernyata Cewek Curhat Artinya SayangIni Efek Buruk Overdosis Minum KopiTernyata Merokok + Kopi Menyebabkan KematianCegah Celaka, Waspada Bahaya Sindrom HipersomniaMengusir Komedo Membandel - Bagian 2Awas!! Ini Bahaya Pewarna Kimia Pada MakananIntact financial is canada's largest provider of home, auto, and business insurance. Insurance Types In Canada. Formerly ing canada, intact financial offers a variety of coverage plans from brokers across canada.

Business insurance can protect you against loss or damage to physical property or the loss of your business's ability to operate and generate income.

No matter whether your business is small, or large, there are 6 types of business insurances in canada that you must have in your portfolio:

Coverage can be provided against various types of risks and you can choose insurance depending upon the coverage you want.

Winning the insurance business canada award for best brokerage under 10 people puts us in a unique position amongst our peers.

Each and every day, we work with top insurance companies to develop.

When you insure your business in canada, you really start off with commercial general liability insurance, and you build coverages on top of that.

Commercial general liability insurance is the most basic type of insurance, and it really covers your business against.

The business car insurance policy provides protection for one�s fleet of work vehicles and drivers.

This type of insurance includes third party liability although big banks such as toronto dominion and the canadian imperial bank of commerce, together with financial services providers in canada.

There are ample business insurance providers in canada, which can make choosing feel there are a few different types of business insurance in canada.

Business insurance (or commercial insurance) protects business owners of all sizes from potential losses as to canada's top financial institutions.

Why do you need business insurance?

There are many types of available business insurance coverages and the more you have, the more it will cost.

A major loss to one organization may be a trivial loss to another.

When selecting coverage, deductibles and policy limits, there are many factors to consider.

Key types of business coverage.

It covers you for a specific period.

It supplements your provincial health care coverage and may or may not provide extended but do you know what type of life insurance is right for you.

There are different types of term life insurance policies including 10 year term 20 year.

Not having proper coverage can result in a devastating lawsuit or liability claim.

Learn more about the different types of insurance for companies and how to choose the right protection for your business.

Intact insurance offers business insurance that meets the needs of companies and professionals.

We insure businesses of all sizes across a wide range of industries in canada.

Business liability insurance coverage protects companies from lawsuits and claims in the event their customers, third parties, or there are tens of thousands of licensed insurance advisors in canada alone that can all sell you the same policy.

The life insurance landscape in canada is quite unique.

Need insurance for your business in canada?

We'll provide you with quotes from canada's top business insurance providers.

Speak to a surex advisor about the different types of liability coverage policies and choose the one that is right for you and your business.

Canada receives a large number these immigrants can either be professionals, aspiring business persons.

5 main types of insurance available.

Insuring more expensive property, including the value of your home, means your premium will be higher.

Canada's employment insurance program has a number of types of benefits available to those who are unable to work for different reasons.

Business insurance products and solutions for businesses across multiple industries and sizes.

Learn more about business insurance solutions from travelers canada.

There are many types of insurance, but personal insurance is a contract that provides a binding guarantee that compensation will be paid in case of an injury, illness or death.

Canada life has been paying claims for 150 years.

Work with one of our trusted advisors to help build a plan for you.

In short, insurance helps protect you against risks.

Much like home insurance, there are policies to protect business buildings and their contents from theft, fire and some forms of natural disaster.

This is a list of canadian insurance companies.

Canadian association of blue cross plans.

This section presents information about the business of insurance in canada for a better understanding and appreciation of the industry overall.

Information related to a functional area such as claims or distribution is posted in the corresponding section.

When you are insuring your personal or commercial aircraft, you want peace of mind.

Learn what types of insurance you might need for your small business and compare quotes from top u.s.

Business insurance is a necessity to protect your small business from the unexpected.

This is definitely a requirement that.

Some of the different types of insurance policies available:

Over the past 17 years he has.

The two main types of life insurance in canada are term insurance and permanent insurance.

As the names imply, term insurance covers the policy holder for a given period only, while permanent insurance covers the policy holder for life.

As the names imply, term insurance covers the policy holder for a given period only, while permanent insurance covers the policy holder for life. Insurance Types In Canada. There are a few options within each category, as explained.Khao Neeo, Ketan Mangga Ala ThailandTernyata Asal Mula Soto Bukan Menggunakan DagingNikmat Kulit Ayam, Bikin SengsaraTernyata Kue Apem Bukan Kue Asli IndonesiaAmpas Kopi Jangan Buang! Ini ManfaatnyaBakwan Jamur Tiram Gurih Dan NikmatTips Memilih Beras BerkualitasResep Nikmat Gurih Bakso LeleKuliner Jangkrik Viral Di JepangResep Stawberry Cheese Thumbprint Cookies

Comments

Post a Comment